The Financials Unshackled Weekender | Issue 61 (15th Sep 2025) - UK Banks @ Barclays Global FS Conference and Much Much More

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Issue 61 | ‘The Financials Unshackled Weekender (15th Sep 2025)’ - your weekly pack for critique and curation of key banking developments.

The main focus of this week’s note is on takeaways from the UK banks’ fireside chats at the Barclays Global Financial Services Conference in NY last week together with a sprinkling of select snippets on other important news developments.

To unshackle your understanding of the last week's banking developments please read on to explore critiques, curated insights, your calendar for the week ahead, and to finish with some light entertainment!

🔎 The Critique 🔎

🇬🇧 UK Banks - Fireside Chats at Barclays NY Conference 🇬🇧

What Happened?: Barclays held its annual Global Financial Services Conference in NY last week. Four of the UK banks (LLOY, BARC, NWG, HSBA) broadcast fireside chats that their senior executives held with the Barclays analysts. Transcripts available for LLOY here, BARC here, and NWG here - and a webcast replay link for the HSBA session is available here.

Key Detail & Perspectives: Key themes and some select company-specific highlights are set out below. Inevitably there is a lot of repetition from what we learned on recent earnings calls so I have tried to pluck out incremental points of interest only in the company-specific notes. It’s a slightly differently styled ‘Critique’ piece this time in which I just overlay perspectives in places.

Key UK themes:

UK macro conditions uninspiring but not unsupportive: Consistent message from all to the effect that the UK macro “…is pretty uninspiring…but…not unsupportive…” (to paraphrase the LLOY CFO). Growth unremarkable and inflation somewhat sticky (though the latter is not unhelpful in an official rates context) but unemployment is low and the executives said ‘all the right things’ about the UK government’s commitment to growth.

Additional bank taxes are a bad idea: Unsurprisingly, there was clear and firm resistance to the idea that bank taxes could be jacked up in the upcoming (26th November) Budget. Executives made the valid points that UK banks already pay a disproportionate level of taxes relative to other sectors and jurisdictions and that higher taxes would be damaging in an economic growth context (and, hence, inconsistent with the government’s growth agenda).

Evolution in regulatory landscape is welcome: The Leeds Reforms and the points made in the Chancellor’s recent Mansion House Speech have been welcomed. Indeed, Pam Kaur, HSBA CFO noted that it is the first time in her career that she has seen UK regulators pursue growth as an objective (commenting that this is the norm in growth-oriented markets like Singapore and Hong Kong), which gives some grounds for optimism. However, it was also observed that the competitiveness gap with the US needs to narrow.

Confidence in delivery of FY25 financial targets / medium-term targets: All conveyed confidence in their ability to achieve stated financial targets and medium-term targets.

Loan growth holding up well: Not a major focus of every conversation but the broad theme was that UK loan growth continues to hold up well despite lacklustre economic growth.

Strong revenue momentum: Significant emphasis on the importance of the structural hedge income in a wider revenue growth momentum context - with high confidence in the continued strong contribution from hedge income over the coming years.

Cost reduction remains a key focus: Not a major talking point across the sessions but, where it did come up, it was clear that management teams remain ruthlessly focused on driving further efficiencies and meeting cost targets - with AI-related initiatives constructive in this vein too (as well as supportive in a customer service proposition enhancement context).

Asset quality is robust: Again, not a major talking point this time round but, where it did come up, we heard the same messages that were relayed in recent earnings updates, i.e., credit quality is very strong and the environment remains benign.

Clear commitment to shareholder distributions / openness to M&A: Management’s understanding of the importance of shareholder distributions was repeated and, while all remain open to inorganic acquisition opportunities, the bar to complete a deal is very high.

Company-specific select highlights:

LLOY CFO (14:00 BST, 8th Sep):

Motor Finance: Recent Supreme Court judgment welcomed and eliminates some significant risk. There are a significantly narrower range of potential outcomes than were built into LLOY’s original probability-weighted scenario. Still awaiting the outcome of the FCA Consultation clearly and the provision stays where it is but Chalmers commented that LLOY is comforted by the FCA’s estimate that most individuals will probably receive less than £950 per agreement.

Revenue Growth: Will be driven by both NII and OOI growth. Chalmers talked through the NII growth drivers: i) asset and liability volume growth; ii) structural hedge income growth (currently yielding 2.2% but refinancing at close to 4%); iii) mortgage headwinds will be largely eliminated by FY26 (he later noted that front and back book margins should equalise in 2H26); and iv) deposit migration will be largely complete by back end of FY26. BAU and strategic investments expected to continue to remain supportive in an OOI growth context. All stands to reason in my view and the recent market volatility is supportive in terms of structural hedge income tailwinds.

Competitive Pressures: On a question regarding prospects for structural hedge income erosion owing to competition (this point around ‘givebacks’ came up on the NWG 1H25 earnings call and I wrote about it in Financials Unshackled Issue 55 here), Chalmers indicated that LLOY is not overly anxious given: i) all mainstream players have articulated profitability targets, which imposes a level of discipline; ii) some sizeable players don’t have large structural hedges (Nationwide Building Society springs to mind) which means relatively less revenue benefit / revenue pressures in those cases over the coming years; iii) the relatively longer weighted average life of LLOY’s structural hedge (c.3.5Y at end-1H25 - for context, this compares to a 3Y WAL for BARC’s structural hedge and a 2.5Y WAL for NWG’s product hedge at that same date); and iv) competitive pressures already exert pressure on asset margins, referencing the keen c.70bps average front book mortgage margins as a case in point.

BARC CEO & FD (17:45 BST, 8th Sep):

Bank Taxes: Some hard-hitting remarks made by Venkat on the potential for higher UK bank taxes, including: i) UK banks pay tax rates of c.48% versus c.28% in the US; ii) additional bank taxes would be damaging to the economy as a whole and damaging to the banking sector as a major employer; and iii) “we continue to be invested in the UK in a big way, we have choices, of course, as a multinational bank, this is a choice we make”. Venkat’s comments were widely reported in media but I didn’t see much attention paid to the last quoted remark. Without getting carried away I did see it as something of a warning shot. While BARC could theoretically re-domicile it would surely be fraught with operational and regulatory complexities and any such decision seems highly unlikely and one that would not be taken lightly - and only with a very long-term view. That being said, I think Venkat was basically saying here that it is an option (perhaps just a threat but I’d be surprised if contingency options haven’t been given some consideration in recent years). In an arguably somewhat related vein it was interesting to read a Bloomberg report earlier today here noting that UBS executives recently met with officials from the Trump administration to evaluate a potential strategy shift given more stringent proposed Swiss bank capital requirements - Bloomberg reported on this possibility before but it was the New York Post that broke this story on Saturday 13th September here noting that “UBS is ramping up its threats to leave Switzerland and set up shop in the US”. Given the widening competitiveness gap from a regcap perspective between the US and the UK, it could bring a possible move for BARC into focus were more things to ‘go wrong’ like higher taxes. It would be wise for policymakers to treat any such rumblings with a large pinch of salt but I will repeat my views that: i) any further increase in UK bank taxes would be entirely inconsistent with the government’s growth agenda; and ii) the Chancellor has already (in 2024) defended the reserves remuneration regime specifically, as I wrote in Financials Unshackled Issue 59 here. And, as an aside, at the rate things are going it is only a matter of time before a European bank ups sticks (it’s a lower risk that a UK bank does in my view) and where one goes others may follow. On a final note in the content of potential changes in UK bank taxes, it was worrying to read on Mortgage Introducer on Monday 8th September here that Louise Haigh, the former transport secretary who had been in the running for the Labour Deputy Leader role, reportedly recently wrote in New Statesman that “It is beyond comprehension that we have not already reformed our approach to the payment of interest on reserves held in the Bank of England reserves”.

US consumer in good shape; committed to retention of US Consumer Bank (USCB): The FD, Anna Cross, noted that performance of US consumer banking operations has been very resilient - pointing to very high cash deposit levels, robust real wage growth, and lower household debt levels than was historically the case. As an aside, it is noteworthy that Federal Reserve data on Monday 8th September showed that outstanding US consumer borrowing rose by $16bn in July, well above the median projection in a Bloomberg survey of economists for a $10.4bn rise - as reported by Bloomberg here. Cross also reminded us that delinquencies were down y/y (and q/q) in 2Q25. A strong defence was made by Venkat this time for remaining committed to the USCB (despite the fact that a US bank owner would carry a lower capital requirement owing to more onerous regcap rules in the UK) in response to a question from a member of the audience: i) diversification benefits - and facilitates the objective to reduce the proportionality of RWAs attributable to the Investment Bank (IB); ii) fulfils a very important need for corporate clients; iii) gives BARC access to the largest consumer market in the world; and iv) management expects the USCB to generate its FY26 target of >12% RoTE. It is also worth reminding readers that a question arose on the 1H25 Fixed Income Investor call on the strategic significance of USCB and the FD made some high conviction remarks on its centrality to the BARC business at that point: “…it's important to understand that we see this because it's a partnership business – it's not a direct-to-consumer business in the same way as our UK business is. We really see this as a business with 20 million customers, yes, of course, but it's actually 20 significant corporate clients. And we see ourselves as providing consumer credit to those largely IB clients. So that's really what's different about that part of the bank. So, you can see the nexus that it's got to the IB, but it's also important to just stress the amount of connectivity between the two cards businesses on either side of the Atlantic. So, we share modelling and capital approaches, and we also are able to use the capability that we have in the US to bring across to Barclays UK. You can see it increasingly running a partnership model – not just with Tesco, but with Amazon and with Avios. All of that capability and attitude comes from the US. So, there's quite a connectivity here…”. I would expect questions to keep coming on this - at least until BARC demonstrates it can generate a divisional >12% sustainable RoTE again.

Investment Bank Trends: Consistent with peer banks (plenty of media reports on BoA/Citi/JPM related positive commentary last week), Venkat called out a pick-up in activity in the IB in recent months, noting that management expects the higher level of volume activity to be sustained through 3Q and 4Q.

NWG CFO (14:00 BST, 9th Sep):

Loan Growth: On a question in relation to the “remarkably strong” loan growth that NWG has seen this year, CFO Katie Murray deftly issued a strong response, noting: i) NWG has grown its lending and deposits at c.2x average market growth rates over the last six years (to some other mainstream challenger banks’ points recently that the strong just keep getting stronger…); ii) product expansion initiatives in mortgages (FTB, BTL and family-backed products) have helped; iii) NWG was historically underrepresented in credit cards and has gone some way to address that (with the Sainsbury’s acquisition instrumental in this context); and iv) the focus on select sectors for growth in the commercial lending book has been constructive. Murray wrapped up noting that “We would expect it to continue”, which is somewhat reassuring.

Asset Quality: As a reminder, there was a question on the 1H25 earnings call around whether the historically indicated 25-30bps through-the-cycle CoR guidance would be recalibrated. The CFO indicated that management will reflect on this, indicating an openness to doing so. Given NWG is guiding to a sub-20bps CoR for FY25, the Barclays analyst raised the relevant question as to whether or not NWG is taking enough risk. Murray noted that NWG is not looking to add risk and that management does not believe that there is a need to change risk appetite in overall terms, but is comfortable tweaking risk in pockets of the book as it develops different products, etc. While some may see this as overly risk averse, given the ongoing uncertainties in a UK macro backdrop context, it seems sensible not to overly dial up risk at this particular point in time in my view. Additionally, I suspect that if NWG started printing RoTEs north of 20%, it could be seen as gluttony by the ‘powers that be’ increasing the risk of higher taxes in future Budgets.

Capital Targets: I noted in Financials Unshackled Issue 55 that “In relation to potential changes to the capital framework (i.e., potentially lower minimum capital requirements), the CFO gave a sense of more openness to reviewing the CET1 capital ratio target than the LLOY CFO did (though one suspects their philosophies are not too far removed when it comes to the crunch…).”. On the question as to whether it could be a realistic scenario that NWG runs with a CET1 capital ratio with a ‘12 handle’ (rather than the current wide 13-14% range), the CFO wouldn’t specify - but reaffirmed that “it's something we will continue to review. Won't commit to a date or a number today, but you can see there's many different factors in play.”. In my view this is a realistic possibility to the extent that the FPC’s review of the Capital Framework supports it - and my view is that it will given government’s intense push for competitiveness across industries.

HSBA CFO (14:45 BST, 9th Sep):

Delivery since the changes at the top - and outlook: On the question as to what progress HSBA has made since the new CEO appointment last year and what the outlook is from here, CFO Pam Kaur issued a confident response on how a strong start has been made to refocus the business and invest for growth: i) elevation of Hong Kong, UK, Wealth and CIB businesses, all of which are delivering well; ii) execution of simplification initiatives; and iii) cultural improvement. She also noted that management is very comfortable in the earnings outlook and that HSBA is being managed to a mid-teens RoTE, with all four business divisions at or above this level (2Q25 RoTE (excl. notable items) print of 17.7% - and an investor poll conducted during the session indicated that the majority expect RoTE will move modestly higher from this level despite a Bloomberg ‘Big Take’ piece from Sunday 7th September here which noted that analysts are beginning to “sour on HSBC’s stock”.

Low loan growth: Loan growth is low as customers are not making capex decisions given geopolitical uncertainties (lines are available to customers but utilisation levels are low) and given Hong Kong customer deleveraging. Corporate customers are engaging with the bank to understand how best to evolve their business models in the context of tariffs. Kaur expects that asset growth would pick up if there is more stability from a macro / global trade perspective.

Distributions / M&A: On the question of the sustainability of the c.$3bn of buybacks per quarter, Kaur was very clear that there is no target level of buybacks in mind and that the quantum of buybacks is a residual after HSBA deploys capital to: i) its dividend payout; and ii) growth, potentially including M&A. Like other executives, Kaur was very clear that there is a very high hurdle rate to cross when it comes to potential acquisitions. However, I felt she spoke quite a lot about potential acquisitions and one would be forgiven for speculating that something sizeable could be in the offing.

📌 The Curation 📌

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ Sector Snippets:

There was a significant media focus on Nikhil Rathi the FCA CEO’s comments to the Treasury Select Committee (TSC) in which he noted that the regulator will present proposals in early October for an industry-wide redress scheme in the context of the motor finance debacle (see this FT article from Tuesday 9th September, for example). The Times also reported on the matter here, noting Rathi’s remarks to the effect that some lenders have been uncooperative. While he wouldn’t namecheck the firms, he agreed to provide the names to the TSC Chair who will have the option to do that. The FCA CEO also noted that “a very significant proportion” of the 14.6 million discretionary commission arrangements (DCAs) (of c.30 million car loan agreements) spanning the 2007 through early 2021 period “probably breached the law when it came to disclosure”. Notably, the FCA recently noted that the cost of the scheme (including operational costs) is likely to be in the £9-18bn range and I opined in Financials Unshackled Issue 55 that the language used in the FCA’s press release in August indicates it expects that it will be at the lower end of that range - and possibly even below £9bn: “The FCA thinks it unlikely the cost of the scheme, including to run it, would be much lower than £9 billion. And it could be higher, up to £18 billion in some scenarios though the FCA doesn’t believe these are the most likely. A total cost midway in the range, as forecast by some analysts, is more plausible.” Doing some basic math, if all 14.6 million DCAs written during the aforesaid period were found to be eligible for compensation, and taking an average of £950 of compensation per agreement (note that the FCA has said that most individuals will probably receive less than £950 per agreement), it would mean £13.87bn of compensation costs (excluding the not insignificant administrative / operational costs). Now, clearly, not all DCAs will be eligible and it feels like the average compensation per customer is likely to be materially below £950 - but some parameters to play around with nonetheless. The banks likely, ‘behind the scenes’, remain fearful that the costs will end up towards the higher end of the FCA’s expected range (notably, the LLOY CFO made a sensible observation at the Barclays conference last week that it is unusual for the regulator to specify an expected cost range ahead of the conclusion of a consultation process). It will be very interesting to digest the proposals that the FCA presents in October and to hear what management teams have to say on them on the 3Q earnings calls.

The Bank of England (BoE) published its quarterly Mortgage Lenders and Administrators (MLAR) Statistics for 2Q25 on Tuesday 9th September here. Volume trends have previously been reported (gross mortgage advances -2.4% y/y) but the release is useful for more granular information.

Moneyfacts reported on Friday 12th September here that BTL mortgage rates have continued to fall, coming as a boost to landlord profitability - with the average 2Y/5Y fixed rate falling to 4.88%/5.21% at the start of September - with the 2Y rate -47bps y/y and the 5Y rate -12bps y/y. The FT covered the development here.

UK Finance published its latest Business Finance Review for 2Q25 on Thursday 11th September (press release here and full report here), which is well worth a read. The report finds that SME lending growth was +8% y/y in 2Q - down from the +14% y/y growth reported in 1Q25 and the slowest rate of growth since the start of 2024.

It’s well worth reading Jono Gillespie’s (CEO of Evlo; former CEO of NSF plc) article in CityAM on Tuesday 9th September here on the plight of those who cannot get on the credit ladder.

2️⃣ Company Snippets:

Bloomberg reported here on Thursday 11th September that the FirstRand CEO Mary Vilakazi has raised a question mark regarding the lender’s long-term commitment to the UK market (FirstRand owns Aldermore, which was integrated with MotoNovo in May 2019 following FirstRand’s take-private of Aldermore that completed in March 2018) within her comments in relation to the impending FCA-led motor finance redress scheme, with Vilakazi reportedly noting in a Bloomberg TV interview: “If we have to pay material amounts in the redress scheme, then we don’t have resources for lending and that puts us out of the market”. While one ought to take Vilakazi at her word, it is of course also possible that the comments are designed to exert indirect pressure on the regulator in the context of the design of the redress scheme’s parameters.

Well worth reading an interview with the CEO of OakNorth Rishi Khosla in The Sunday Times here (published online on Saturday 13th September). Khosla praises the UK government’s growth agenda but indicates that, if OakNorth were to ever IPO, it would likely be in the US as that’s where the business sees more long-term future growth opportunity given the size of the target addressable market. Well played by a clearly inspirational entrepreneur - avoiding a criticism of the UK market though one senses an element of diplomatic polish in the message.

NatWest Group (NWG) issued a RNS on Thursday 11th September noting that S&P has: i) upgraded the long-term issuer credit rating to 'A-' from 'BBB+'; ii) affirmed the A-2 Short-Term Issuer Credit Rating; and iii) upgraded all senior unsecured debt and regulatory capital instruments issued by NWG by one notch. The outlook remains Stable. A summary of S&P’s updated unsecured debt ratings can be found in a table in the RNS here. This is a highly welcome development that has undoubtedly pleased NWG’s fixed income investor base. Indeed, the question as to S&P’s strict ratings methodology (relative to Moody’s and Fitch) came up on a number of the UK banks’ 1H25 fixed income investor calls, including NWG’s. It seems as if the intensive work that NWG’s Head of Treasury Donal Quaid and his team have done as articulated in the following comments extracted from the 1H25 fixed income investor call transcript (on a question on S&P’s rating methodology) attests to: “…S&P are now the only rating agencies that do not have an A rating for NatWest Group. We've got Fitch at A+, we've got Moody's at A3, and S&P at BBB+. I'd obviously like to see S&P join the other two agencies with an A rating, which I personally think is more than deserved, given the balance sheet strength of the organisation and the consistent strong financial performance of the Group, both on a relative and on an absolute basis versus European peers. However, I think when you look at S&P ratings methodology for UK bank HoldCos, it's overly punitive versus others. That's reflected in the minus one notch applied for structural subordination. I think NatWest and peers are also penalised by S&P's views on the UK economy, which keeps the score lower than other European countries. Again, if that improved, our rating would likely go up one notch for stronger capital. So we'll continue to deliver on our strategy and continue to deliver strong results and emphasise the operating strength in discussions we have with all the agencies, particularly S&P.”.

Sky News reported here on Tuesday 9th September that KKR is on the verge of striking an agreement to acquire NewDay’s existing loan book as well as acquiring a stake in its lending platform alongside existing owners, CVC and Cinven.

3️⃣Shareholding Changes of Note:

Barclays (BARC): Taylor Wright (Global Co-Head of Investment Banking) sold 209,965 shares at a price of 367.9p per share on 9th September netting him gross proceeds of c.£770k.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ Sector Snippets:

Last week started off with a press release from Banking & Payments Federation Ireland (BPFI) here noting that AIB Group (AIBG), Bank of Ireland Group (BIRG), and PTSB have announced plans to launch Zippay, a new mobile payment service, in early 2026. This will be an in-app service offered through the banks’ existing mobile banking apps and delivered by the European paytech firm Nexi. This is both a defensive move (to challenge Revolut’s unique Irish market instant payments capability) and an offensive move (upping their game from a tech perspective) - but is essentially reactionary, albeit worth pursuing. It is, however, a welcome development but Revolut, which has become a household (and widely used) name in instant payments, will be hard to displace in my view. It neatly cuts through competition issues as it is not a joint venture amongst the three banks (like a past similar such initiative, Synch) and some other players have indicated their interest in signing up too. The development received an inordinate amount of press attention in what was a quiet week in Irish banking and Donal MacNamee’s comprehensive piece in the Business Post on Saturday 13th September here is well worth a read as is John McManus’ piece in The Irish Times on Wednesday 10th September here.

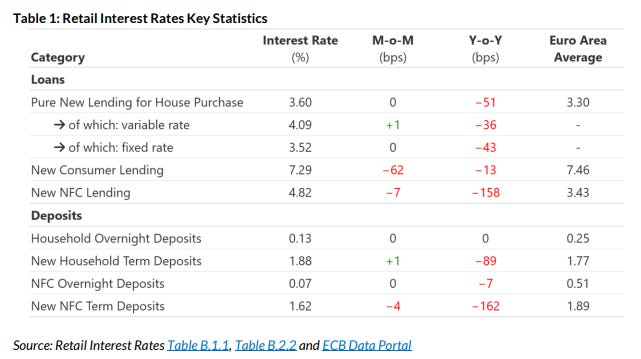

The Central Bank of Ireland (CBI) published its Retail Interest Rates update for July 2025 on Wednesday 10th September here and an excerpt from the release, neatly summarising key movements, is shown below.

One point to flesh out is that, while new household term deposit rates are above the euro area average (1.88% versus 1.77%) and new NFC term deposit rates are below the euro area average (1.62% versus 1.89%), it is important to remember that the relevance of this from a banking sector net interest margin (NIM) perspective is extremely limited for two key reasons: i) the percentage of deposit stock attributable to term deposits in the Irish market is very low compared to other jurisdictions (over 90% of the listed banks’ deposit funding is represented by current accounts and demand accounts, i.e., overnight product); and ii) deposit churn (or flow to term) has been minimal (talking about deposit beta as rates come down is absolutely and utterly pointless in my view - just look at the absolute quantities of flow to term) and is clearly slowing. On my calculations, AIB Group (AIBG) and Bank of Ireland Group (BIRG) paid in the region of just c.25bps of their entire stock of deposits in 1H25.

Banking & Payments Federation Ireland’s (BPFI) latest Housing Market Monitor for 2Q25 was published on Friday 12th September (press release here and report here). While the 15,149 of reported housing unit completions was +20% y/y it is still running at much too low a level given demand factors - and, far more worryingly, just 7,384 units were commenced in the first seven months of 2025. This will, in due course, put a brake on the Irish banks’ mortgage lending growth opportunities (of which there should be many) if it goes unresolved. It is an absolute shambles in my opinion - and the weekend papers are full of stories about dezoning and challenges with purpose-built student accommodation are testament to that as I see it. The Irish government seems utterly incapable of resolving the housing mess and there is a clear lack of courage amongst policymakers to take on the system (planning and judicial reviews the most pertinent issues from a residential development perspective). I guess anyone who shows a degree of abrasiveness in the public sector despite delivering in their role (the two are strongly linked in my view) runs the risk of ending up in the slaughterhouse as another story seemingly attests to. Indeed, it reminds me of the few hundred grand the Exchequer has saved by not installing the highly experienced Brendan McDonagh as Housing Czar with complete silence in relation to this supposed post since then. Big picture anyone?!

2️⃣ Company Snippets:

Moody’s moved on Thursday 11th September to upgrade all of AIB Group’s (AIBG) (and AIB plc and EBS) long-term ratings and assessments by one notch, with the move reflecting the bank’s “…reduced and contained asset risk, its strong capitalisation and significantly improved core profitability” while the upgrades also reflect the bank’s “…predominantly deposit based funding profile and high levels of liquid asset holdings…”. This seems a highly logical move given the strength of the bank on all of these counts and it is constructive in a wholesale funding costs context. The Moody’s press release can be accessed here.

Moody’s then moved on Friday 12th September to upgrade Bank of Ireland Group’s (BIRG) long-term deposit and senior unsecured debt ratings, reflecting “…its leading positioning as the only bancassurer in a concentrated Irish banking system, its strong and improved asset quality, strong capitalisation levels and significantly stronger core profitability and hence capital generation” - with Moody’s further noting that the bank’s “…large volume of stable deposits and high levels of liquidity are also key factors supporting its BCA upgrade”. Again, this seems a highly logical move given the strength of the bank on all of these counts and it is constructive in a wholesale funding costs context. The Moody’s press release can be accessed here. Separately, Business Post reported on Friday 12th September here that BIRG is expecting 260 employees to take voluntary redundancy in 2025.

The Business Post reported here on Wednesday 10th September that Bunq grew its customer numbers by 50% in 1H25 (note that Bunq owns Capitalflow in Ireland). While we don’t get detail of what the number of customers is, it is a welcome development to see more competition in the market.

3️⃣Shareholding Changes of Note:

AIB Group (AIBG): BlackRock now 10.00% (previously disclosed shareholding: 9.82%) following a transaction on 11th September.

AIBG: FIL now 3.08% (previously disclosed shareholding: 3.02%) following a transaction on 4th September.

Bank of Ireland Group (BIRG): Wellington now 3.01% (previously disclosed shareholding: 3.00%) following a transaction on 9th September.

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ Select Snippets:

Sharon Donnery, Member of the ECB Supervisory Board, set out her thoughts on simplification of supervision on Monday 8th September in a blog post here - highlighting various areas (SREP reform, SRTs, etc.) in which the ECB is already delivering in this vein, which is a timely communication that shows some pragmatism on the part of the ECB (indeed, Bloomberg picked up here on Monday 8th September on Donnery’s comments to the effect that the ECB is seeking to cut approval times for simple SRTs to just 10 working days from three months, which is a highly welcome development in my view). That being said, the issue, in my view, is that local regulators often top up ECB requirements with additional (and often unnecessary) regulations. Additionally, while some of the simplification initiatives outlined are helpful in terms of speeding up the annual SREP assessment process owing to prioritisation of pertinent issues, by way of example, it doesn’t seem that means any lesser regulatory burden for the banks - with Donnery noting that “These developments do not indicate a change in supervisory focus or a reduction in supervisory attention. Banks will still need to follow up on all measures, irrespective of whether these were communicated in their new SREP decision, in an operational act or through another channel.”. What’s more, another member of the ECB Supervisory Board Patrick Montagner argued in defence of the currently complex regulatory regime in a speech on Paris on Tuesday 9th September (transcript here), noting that “The current regulatory complexity stems from a pressing societal need. Certain criticisms notwithstanding, our fellow Europeans expect rules and protection.”. That is true but at what cost? - but when did the ECB last do a survey of what consumers want (I would also strongly argue that regulators’ care for consumers is evidently minimal in certain cases) - and we can’t aspire to the illusion of perfect safety to the detriment of competitiveness in my view. Indeed, all too often regulation just considers one side of the story as I see it (what about credit access, let alone the convenient shifting of truckloads of credit risk to the unregulated private credit space…).

Bloomberg reported on Monday here on how the ECB has scaled back the use of a controversial challenger model used to quantify risks in a leveraged lending context, which had projected loan losses fair in excess of the banks’ estimates.

It’s worth reading a Bloomberg report from Tuesday 9th September here on how the Bundesbank’s proposals to simplify the capital stacks of banks could lead to new CET1 capital demands on banks. This is because only CET1 would count toward the main capital requirements of banks while AT1 and Tier 2 would be used to meet their needs in resolution. Reuters further reported on Friday 12th September here that the Bundesbank’s latest proposals (published on Friday) in this vein - which also contemplate combining the CCyB and the SRB "into a single, releasable buffer" that could be "released during periods of stress". Bloomberg also reported here on Friday that Bundesbank President Joachim Nagel has argued that European authorities should be courageous in their efforts to reduce the regulatory burden on banks without undermining their resilience: “We should boldly move forward on this path…Simplification is feasible — according to the motto: as complex as necessary, as simple as possible”. Wise words - we’ll see where things end up.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ Bloomberg on stablecoins

Just to quickly flag an article on stablecoins that I thoroughly enjoyed digesting on my journey to the airport on Wednesday morning which featured in Bloomberg Businessweek on Monday 8th September here. The article focused on the risk that US savers could convert their bank accounts to stablecoins which could enormously impact US small community lenders. As the authors note: “Many savers might balk at the notion of converting their bank accounts to crypto. For others all it would take is a sleek app custom-built for seamless payments and some improvement on long-staid banking models.”. Early days but the article reminds readers of the rise of money market funds some 50 years ago, which drove substantial migration out of bank deposits into Treasury-backed vehicles. It has been well-documented that large US banks are (jointly) pursuing stablecoin initiatives and it was comforting to note that some smaller forward-thinking community lenders are taking defensive action too. But it gets me thinking, where are the UK and European banks in all of this? Indeed, an astute investor question sprung up at the end of the BARC CEO & FD’s fireside chat at the Barclays conference in NY last week on whether there is an opportunity for BARC to deliver more products to UK customers via blockchains - I felt the answer got short shrift but, to be fair (and rather unsurprisingly), BARC sems to be thinking deeply about this issue as its contribution to the debate around an EU Framework for Markets in Crypto-assets seems to attest to.

📆 The Calendar 📆

Look out for these in the week ahead:

🇬🇧 Mon 15th Sep (13:00 BST): S&P Global Ratings Webinar - Spotlight on the UK Banking System (register here)

🇬🇧 Tue 16th Sep (08:00 BST): NatWest Group (NWG) CEO Fireside Chat at BoA Financials CEO Conference (registration link available in Investor Relations section of NWG’s website)

🇬🇧 Tue 16th Sep (08:45 BST): Lloyds Banking Group (LLOY) CEO Fireside Chat at BoA Financials CEO Conference (registration link available in Investor Relations section of LLOY’s website)

🇮🇪 Tue 16th Sep (11:00 BST): Central Bank of Ireland (CBI) SME and Large Enterprise Credit and Deposits Q2 2025 (11:00 BST)

🇬🇧 Thu 18th Sep (12:00 BST): Bank of England (BoE) Monetary Policy Summary & Monetary Policy Committee (MPC) Minutes

🇬🇧 Fri 19th Sep (07:00 BST): Investec (INVP) 1H25 (for the six months to 30th September) Pre-Close Briefing

🍺 The Closer 🍺

The FT reported here on Wednesday 10th September that Starling Bank has appointed Morgan Stanley and Rothschild ahead of a potential secondary share sale that could value the bank at c.£3.5-4.0bn. This is reportedly to facilitate existing investors to sell down their holdings to “make way for fresh blood”. I just love that a wave of marketeer fintech social media commentators quickly concluded this means that Starling is now definitively worth £4bn! Now a deal may well be done already but I would doubt these commentators are privy to that if so. All I have to say is: i) growth in Starling’s core UK banking business has slowed to a pedestrian pace; ii) related to i), like other neobanks, Starling is struggling in a maturity transformation context; and iii) Engine is touted as the ‘next big thing’ but delivers annual revenues of <£10m, according to the latest filed financial statements. But I guess in private markets the marginal buyer at a price point is all that matters. You can read about my thoughts on Starling Bank in much more detail in Financials Unshackled Issue 49 here but I’m afraid to confess it will take a few minutes to digest so it won’t satisfy the social media algos that seem fixated on backslapping nonsense news stories or the scrollers who just want hot headlines!

Have a great week! 🍨

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.

Is there a possibility that Labour hike the Bank Levy instead of taxing interest on reserves?

It's cleaner, easier to explain to the populace and would be harder to circumvent (in my view at least). If enacted, I'd imagine this would impact NatWest, Lloyds and any other predominantly UK focused banks the most?