The Financials Unshackled Weekender | Issue 63 (29th Sep 2025) - Revolut's Ambitions and Much More

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Issue 63 | ‘The Financials Unshackled Weekender (29th Sep 2025)’ - your weekly pack for critique and curation of key banking developments.

The main focus of this week’s note is on Revolut’s ambitions following its announcement and a spate of media coverage as it opened its new global headquarters in Canary Wharf on Tuesday. The note also includes a sprinkling of select snippets on other important news developments.

To unshackle your understanding of the last week’s banking developments please read on to explore critiques, curated insights, your calendar for the week ahead, and to finish with some light entertainment!

🔎 The Critique 🔎

🇬🇧 Revolut’s global banking ambitions 🇬🇧

What Happened?: Revolut opened its new global HQ in London’s Canary Wharf on Tuesday 23rd September and noted it has earmarked $13bn for global expansion plans - to launch in 30 new countries in a bid to reach 100 million users by 2030 (up from 65 million currently) - with £3bn of the funds dedicated to UK expansionary initiatives, to include the cost of a further 1,000 hires.

Key Detail: CEO Nik Storonsky and other company representatives engaged intensively with the media following the announcement and here is a wrap of the key details we learned (perspectives follow below).

Top priority is securing UK banking licence: Storonsky was very clear that obtaining its full banking licence in the UK is the key priority, with the FT (here) quoting Storonsky as follows: “The number one priority is actually rolling out our UK bank here. We have 11 million customers in the UK”. Storonsky made it clear that the UK, as Revolut’s home market, is a key plank in the context of the company’s global growth ambitions, commenting: “From our roots here in the UK, we’ve grown to serve over 65 million customers globally, and today’s opening of our new Global HQ in London is the launchpad for our future. This HQ will be central to driving our growth towards our next milestone of 100 million customers. To power that journey from our home market, we are investing £3 billion in the UK over the next five years. This commitment will not only create 1,000 new jobs but will also fuel the innovation from our London hub that will help us deliver on our global ambitions.” (extracted from Treasury’s press release here). Sid Jajodia, Revolut’s Chief Banking Officer and US CEO, reportedly commented to the Business Post on Tuesday (see here) that the company is still aiming to launch the UK bank in 2025, noting that Revolut is “actively working with the regulator to launch the bank this year. That’s our ambition – that we’re going to launch the bank this year”.

Weighing a dual listing in NY and London: The Sunday Times reported this weekend here that sources have informed the newspaper that a potential dual listing, to the extent that the firm eventually seeks to float, is being “widely discussed”, with Chair Martin Gilbert reportedly open-minded in a listing venue selection context. The newspaper also reported that Storonsky has apparently said “If I get a better product from the UK, I will list in the UK”.

Global bank focus: Notably, Storonsky also remarked that “Our mission has always been to simplify money for our customers, and our vision to become the world’s first truly global bank is the ultimate expression of that” (extracted from Treasury’s press release) and acknowledged that mistakes were made in Revolut’s early overseas expansion efforts, with the FT quoting him as follows: “When we started international expansion many years ago, we tried to short-cut our banking licences and apply for lighter licences, e-money licences, FX licences, payment licences…and it was a worse product.”. Financials Unshackled Issue 60 of 7th September here covered a FT article of 2nd September here which reported that Revolut has approached advisers in relation to the potential acquisition of a US bank to expedite its growth in that market - indeed, the FT reported on Tuesday that Storonsky noted that the company has refreshed its approach to overseas expansion efforts: “We made a conscious decision: whenever we…decide to go to a country, we either get the bank licence or just buy a bank”. Reuters reported later on Tuesday here and here that Sid Jajodia confirmed to the news agency that it is “actively looking” at whether to acquire a US bank and noted that “being a bank in every market we operate in is critical” - with an article in the Business Post on Tuesday here making the same point, noting Jajodia’s comments to that newspaper: “What I can say is – it is our ambition to be a bank in the US. We would love to get a banking licence soon, because it’s part of our objective to scale in the market. Whether we go de novo, or whether we do an acquisition, we’re still evaluating all the pathways.”. Bloomberg also reported here that Revolut is playing the long game in this respect with Jajodia commenting that Revolut’s aim to become one of the top three financial apps in every market it enters is “…not going to happen overnight - this is a multi year journey”.

Multiple growth forays: The media on Revolut this week also referenced its ambition to push into Africa starting with South Africa, that it may consider a licence application in Saudi Arabia, that it plans to submit a French banking licence application, that it will launch branches in Portugal, that it is in the process of obtaining further licences in Australia & New Zealand, that it is working to secure a licence in the Philippines and is considering applying for a licence in Peru (see Bloomberg here); its ambition to win a banking licence in Mexico in 2026, its preparations to launch in India, and the prospect of a co-branded card with the Audi Formula One team (see The Times here).

Irish mortgages, Zippay comments: The Business Post reported on Tuesday here on comments made by Béatrice Cossa-Dumurgier, CEO of Revolut’s new Western European hub, to the effect that the “heart of Revolut” in the region is in Ireland and noted that the firm does “not want to rush” the rollout of mortgage product in the country (“If it is pushed out, it will be pushed out…there is no hurry”) and will not push the product “very aggressively” when it does launch, acknowledging the product’s “complex” nature. The Sunday Times covered this here in some more detail and reported that sources familiar with the company’s Irish mortgage project “said the Irish product was ready and confidence was high after a good experience in Lithuania, but the company was wary of making a mistake by coming to market prematurely with a novel digital offering”. Separately, the Business Post reported this weekend here that Cossa-Dumurgier has said the “intention is there that at some point we will join” in a reference to Zippay, the mobile payment scheme that is due to be launched by the three listed Irish banks in 2026 - going on to note that “Whenever there is - either domestic, or pan-European, or across several geographies - a payments initiative, we want to participate in it…We just have a roadmap. So the intention is there, that at some point in time we will join.”.

Unshackled Perspectives:

A full UK banking licence seems inevitable - at some point: The UK, as Revolut’s chosen home location, is clearly a key market for Revolut and it is unsurprising to note that the firm’s top priority is on securing a full banking licence. Whether that will come this year remains to be seen and the fact that it has had a restricted licence (i.e., AWR) for more than 12 months is seen by some as a likely indication of lack of readiness be it from a governance and/or a risk management and/or a cultural standpoint, for example. That said, as I have written before, Revolut has been taking steps to ‘tidy itself up’ significantly in recent years - including the appointment of Martin Gilbert as Chair and Francesca Carlesi as UK CEO, with Carlesi noting last year that three key focus areas are: i) building trust; ii) broadening its product range; and iii) strengthening its security and safety capabilities (as reported in Financials Unshackled Issue 38 of 16th March here). For what it’s worth my prediction is that Revolut will get the licence in early 2026. Regardless of the precise timing, full regulatory authorisation seems inevitable at some point and will serve as a crucial validation point. It will affirm Revolut’s status as a mature, serious banking business in the UK and globally. This validation ought to be highly constructive from a customer acquisition perspective (particularly in the business segment) and for converting its existing user base into primary bank customers.

Dual listing certainly seems plausible: On the topic of an eventual listing, I suspect that, to the extent market conditions are supportive, Revolut could press ahead with IPO preparations once it has secured a full UK banking licence. It makes sense for the company to circulate the message that a dual listing is under consideration given that a potential London listing will likely continue to guarantee political warmth - and may exert soft pressure on the BoE to grant the full licence without undue delay. Treasury’s highly sensible move to establish a ‘transatlantic taskforce’ with the US Treasury Department which will, among other things, look at ways in which dual listings can be facilitated is likely helpful in this respect. But, to the extent that Revolut were to pick just one market, I suspect NY would be the clear favourite given the more growth-oriented mindset of the US investor base.

Revolut is maturing: Stepping back, and reflecting on Storonsky, Jajodia, and Cossa-Dumurgier’s comments in relation to banking licences and speed of travel - as well as various measures that Revolut has been taking from a governance, risk management, and cultural standpoint that Financials Unshackled has reported on over the last year or so - one senses a level of maturity and humility at a top management team level that was not evident just a few short years ago, coupled with clarity in relation to the direction of travel. More progress needs to be made for sure but to the extent that Revolut eventually wins the deep trust of regulators and customers and executes its core product rollouts seamlessly, I expect it will be highly disruptive in a banking industry context. Indeed, by way of an example, while some may scoff at the continued delays in the context of Revolut’s Irish mortgage product rollout, my view is that Cossa-Dumurgier’s comments to the effect that there is no hurry are spot on - it’s more important to get it right and I believe that the business has both the financial and intellectual horsepower as well as the innovative prowess (all to a greater extent than incumbent peers) to make that happen.

It is still - very -early days: But it is important to remember that Revolut is still just in its infancy - in both a deposit build and a maturity transformation context. I recently wrote in the Business Post on 16th June here on Revolut’s banking business specifically: “Revolut recorded its fourth consecutive year of profitability in 2024. It continued to grow rapidly, reaching 52.5 million retail customers by year-end — a 38 per cent increase on 2023. Deposits also rose sharply, up 48 per cent year-on-year to £22.5 billion. The figures imply average balances of just over £400 per account, including business customers– only about two per cent of average balances at Lloyds and NatWest, for example. In Ireland, Revolut is reported to have gathered close to €1 billion in deposits across more than three million accounts, pointing to even lower average balances per customer than in the UK. For context, AIB reported deposits of nearly €110 billion at the end of March. While Revolut has successfully developed a well-diversified business that generates substantial non-interest revenues, its lending operations remain limited. By the end of 2024, less than £1 billion of customer deposits had been recycled into loans. The bulk of its £790 million in gross interest income was derived from returns on liquid assets—such as central bank reserves, bank deposits, and treasury investments—rather than traditional lending. In essence, Revolut is largely placing deposits with other financial institutions and investing them in liquid securities. Although the company is still in the early stages of developing its lending capabilities, the low average account balances suggest it faces ongoing challenges in convincing customers to treat it as their primary banking provider. Trust likely remains a key barrier in that transition.”. That being said, these average balances are suppressed by the fact that Revolut’s total deposits in the UK, for instance, are capped at £50,000 as it doesn’t have a full banking licence in that market - and, as noted above, I believe the validation that a full licence will bestow on Revolut will represent a landmark moment in terms of its journey to becoming a real competitor in the banking industry across multiple jurisdictions. Recycling the deposits into loans will take time but one would be naïve to discount the firm’s ability to execute carefully and successfully in a lending product rollout context. For some further quantitative analysis and a take on the latest developments at Revolut I suggest consulting Donal MacNamee’s well-written piece in the Business Post on Thursday 25th September here.

Joining Ireland’s Zippay might make a lot of sense: Finally, on Zippay, it might make sense for Revolut to consider joining as it would facilitate users of Revolut (or its Irish IBAN accounts) sending / receiving payments more seamlessly to/from bank customers without friction - among other reasons. Moreover, I suspect that it could be the catalyst to shift perception and adoption of Revolut in Ireland from that of a convenient payments app to that of an everyday primary bank account. Indeed, it would be ironic if this defensive measure orchestrated by the incumbents to catch up with Revolut from a mobile payments capability perspective were to pave the way for Revolut to truly disrupt the Irish banking market.

📌 The Curation 📌

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ Bank taxes remain in focus:

CityAM ran a piece on Monday morning here suggesting that the fall in UK bank share prices at the start of that trading day reflected mounting concerns in relation to higher bank taxes following the Lib Dems Treasury spokesperson Daisy Cooper calling last weekend for a windfall tax on lenders to raise c.£7bn of extra funds for the fiscal coffers by the end of the decade (as reported by the BBC here on Sunday 21st September). The Telegraph reported here on Friday on comments made by the Barclays (BARC) CEO Venkat in a CNBC interview in which he warned the Chancellor against “milking the financial sector” with a new tax, arguing that “It stifles competition, stifles [economic] growth. You need to encourage it to grow, not tax it out of existence”. The industry’s strongest card in defending against any such fresh bank tax / higher bank taxes is to scaremonger about the implications for lending growth and, consequently, economic growth. Indeed, The Telegraph article picked up on previous comments made by Venkat in this vein when he noted that a windfall tax presents “facile and fallacious logic” and would result in banks extending “less credit into the UK economy”. Given the challenges the Chancellor faces in terms of lifting fiscal revenues, I remain of the view that there is a real danger that Treasury will indeed seek to impose further taxes on the sector. If Treasury does press forward in this respect, I see the most likely moves as: i) a one-off increase in the surcharge (with the £100m allowance likely to be unchanged - and potentially nudged up); and ii) an outright (structural) increase in the surcharge, perhaps with a commitment to review it annually. I also continue to believe that it is highly unlikely that the excess reserves remuneration framework will be tampered with - but the IPPR’s recent proposals could be seen as ‘cover’ for an increase in bank taxes more broadly.

2️⃣ Sector Snippets:

UK Finance issued a press release on Friday 26th September here noting that it has launched an industry pilot project to deliver the first UK live transactions of tokenised sterling deposits. The ‘Big Six’ lenders are all participating in the project.

Compliance Corylated reported on Friday 26th September here that data it received in response to a FOI request shows that the Financial Ombudsman Service (FOS) received just 1,600 complaints from claims management companies (CMCs) in the three months after it introduced a £250 per case fee for the sector - a 98% drop q/q.

In further related news on CMCs, The Guardian reported on Saturday 27th September here that the FCA is facing a showdown with CMCs over the £1m advertising campaign it has pursued in a bid to discourage motorists from using CMCs services to obtain payouts in the context of the motor finance debacle. Darren Smith, Managing Director of Cormacs Legal, a law firm that reportedly says it is handling 4 million claims, reportedly noted to the newspaper that “…the FCA appear to be prioritising the interests of big banks by pressuring victims to accept low-ball offers through their redress scheme that may not reflect the full extent of the harm they have suffered. Motorists should have a choice to engage lawyers, especially if they might get a significantly higher payout through the courts”.

3️⃣Company Snippets:

Aldermore priced a £300m 10NC5 Tier 2 instrument this week (>9x oversubscribed), which marks its first external subordinated debt issuance since 2016 (useful recent credit investor presentation here, which followed a credit investor update in May which indicates Aldermore had been warming up the prospective investor base for a while). The issuance facilitates the early redemption of an existing £100m Tier 2 instrument. I only spotted the company’s LinkedIn post flagging the issuance here this weekend and I haven’t seen pricing details yet. Notably, there have been a raft of management changes at Aldermore of late (Raj Makanjee appointed CEO as this press release flags, new CFO Louise Britnell appointed in August as this press release notes) as well as cautionary comments from Aldermore’s parent FirstRand about its long-term commitment to the UK market so this external Tier 2 issuance comes at an interesting time and demonstrates evidence of capital markets access. Aldermore recently reported full year results for the 12 months to 30th June - the bank printed a RoTE of 7.7% for the year, though this was depressed owing to an increase in the historical motor finance commission provision of £61m (results release here and results report here).

Barclays (BARC) published a report on Tuesday 23rd September here on assessing nature-related financial risks of large financial portfolios, outlining pragmatic steps to drive progress.

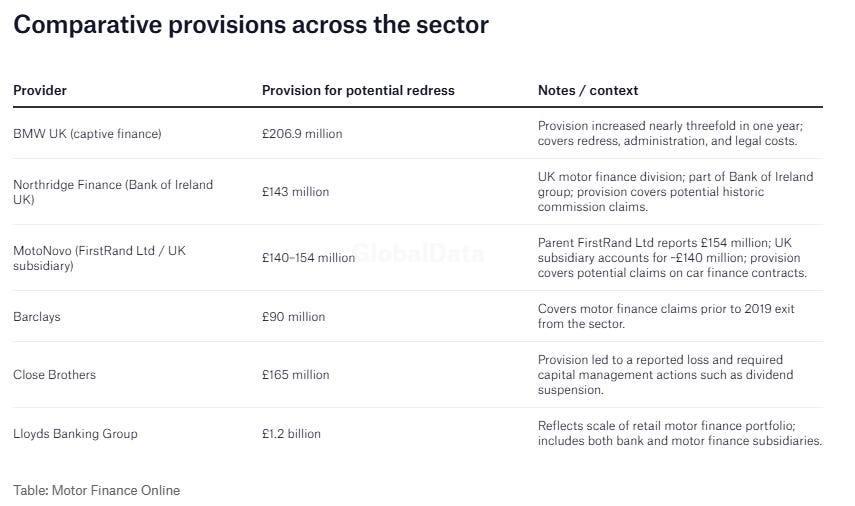

CityAM reported on Monday 22nd September here that BMW’s UK finance arm has made a provision of more than £200m in relation to the motor finance debacle and impending redress scheme. Motor Finance Online also reported on this development on Tuesday here and reminds readers that Fitch, in August, estimated that £4-7bn of the FCA’s estimate of £9-18bn in total costs could fall on non-bank lenders such as car manufacturers’ captive finance arms. The article also includes a useful table on comparative provisions across the sector, which I have extracted and presented below (note that Aldermore reported related provisions of £73m at 30th June). As investors are well aware, there is some significant topping up to do amongst the banks.

Justin Basini, the CEO & Co-Founder of the credit scoring business ClearScore commented to CityAM on Tuesday 23rd September here that a listing on the LSE would be “my signature achievement”.

Sky News reported on Thursday 25th September here that Ebury, the payments firm in which Santander has a substantial shareholding, is targeting an IPO in 2Q26 targeting a valuation of c.£2bn.

Funding Circle Holdings (FCH) issued a RNS on Wednesday 24th September here noting that it has extended its strategic partnership with TPG Angelo Gordon and Barclays (BARC) through a £300m forward flow deal.

HSBC (HSBA) issued a RNS on Friday 26th September here noting that Brendan Nelson will assume the role of Interim Group Chair with effect from 1st October. The search for a permanent Chair is ongoing and Mark Tucker, outgoing Chair, has agreed to remain as a strategic adviser to the CEO and Board while the search for a permanent successor continues.

Sky News reported on Monday 22nd September here that Curve, the digital wallet provider that has been reported to be in advanced discussions in relation to a potential sale of the business to Lloyds Banking Group (LLOY) for a price tag thought to be in the £120m territory, has convened an EGM for early October to seek the removal of Lord Fink (Chair) and Shachar Bialick (Founder & CEO) from the Board following a demand from shareholder IDC Ventures. Mark Kleinman wrote in CityAM on Wednesday here opining that the investor row is a curveball for the LLOY deal.

Sky News reported on Friday 26th September here that NatWest Group (NWG) has appointed James Holian as Chief Customer and Operations Officer. Holian will take on many of the responsibilities of NWG’s former COO Jen Tippin, who is leaving the company.

Reuters reported on Friday 26th September here that a US judge dismissed two lawsuits seeking to hold Standard Chartered (STAN) liable for having allegedly provided indirect support to groups that conducted 12 attacks in Israel and Iraq between 2010 and 2019.

Fintech Futures picked up on Starling’s appointment of Jaideep Bhagat as Regional President of its fledgling North American business here on Monday 22nd September as well as its plans to “invest upwards of $50 million into our North American footprint”. A key focus for Bhagat will be on the expansion of Starling’s BaaS platform, Engine. CityAM reported on Starling’s brand overhaul on Wednesday 24th September here and I was pleased to contribute my perspectives on Engine within the article: “It is important to remember that Starling was borne out of the frustration with legacy banks’ deployment of outdated technology and the founding team was determined to build the bank’s own tech stack in-house. So, in a way, the orientation of emphasis towards Engine – which has been happening for a while – essentially reflects the bank going back to its old roots, seeking to leverage its core competence as it were.”.

Tide, the business management platform, issued a press release on Monday 22nd September here noting that it has raised $120m in a further funding round led by TPG that values the business at $1.5bn. Augmentum Fintech (AUGM) issued a RNS on the development on 23rd September here and the news was also covered by Bloomberg here. It’s also worth reading the thoughts of Ben Martin at The Times on the development here.

Interesting to read a press release issued on Wednesday 24th September by Triver, a digital business founded in 2023 which gives small businesses credit decisions within minutes, here which notes that it has secured up to £114m in fresh debt and equity funding. Sky News broke the story on Tuesday 23rd September here.

4️⃣Shareholding Changes of Note:

Close Brothers Group (CBG) RNS of Friday 26th September: FMR now 5.08% (previously disclosed shareholding: N/A) following a transaction on 24th September.

Close Brothers Group (CBG) RNS of Monday 22nd September: Aberdeen now 8.45% (previously disclosed shareholding: 8.50%) following a transaction on 19th September.

Lloyds Banking Group (LLOY) RNS of Monday 22nd September: Chirantan Barua (CEO, Insurance, Pensions & Investments) sold 80,804 shares at a price of 81.9p per share on 22nd September for gross proceeds of c.£66k.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ Sector Snippets:

Banking & Payments Federation Ireland (BPFI) reported on Friday 26th September here that the value of mortgage approvals in August was +4.1% y/y - with the y/y growth in the size of the average mortgage (partly reflecting higher housing prices presumably) outstripping the 2.5% y/y decline in the volume of mortgages approved. While mortgage approvals have been soaring in recent times (good for banks’ loan growth but at the end of the day it’s the liability margins that really matter) we are likely to see a slowdown given the fall-off in housing completions expected in 2026. Over to Government…any update on the new Housing Czar I wonder? Full BPFI report here. Separately, the BPFI has made a submission to the Ireland for Finance Strategy 2026-2030 here, which calls again for regulatory simplification.

The Central Bank of Ireland (CBI) published mortgage arrears and repossessions statistics for 2Q25 on Friday 26th September here. In short, arrears continue to come down - with just 3.5% of permanent dwelling homes (PDH) (or owner occupier (OO)) in arrears over 90 days, the lowest proportion of accounts in arrears since 2009. Moreover, the regulator has done a stellar job at orchestrating the movement of these NPEs to the unregulated non-bank lending space with a startling statistic being that, while non-banks accounted for just 15% of the total number of PDH accounts outstanding at 30th June, they accounted for 94% of PDH accounts in arrears over 10 years (and 41% of accounts in arrears of <90 days).

2️⃣ Company Snippets:

AIB Group (AIBG) issued a RNS on Thursday 25th September noting that INEDs Ann O’Brien and Raj Singh will retire as Directors with effect from 31st December. Both were appointed to the Board in 2019 following their nomination by the Minister for Finance under the Relationship Framework Agreement then in force. Separately, an article in the Irish Independent on Thursday here notes that Haven (AIBG) is reducing its ‘green’ 4Y fixed rate mortgage prices by 25bps to 3.20%.

The Irish Times reported on Thursday 25th September here that Bank of Ireland Group (BIRG) has made it into the winners quadrant in the Autonomous 8th annual edition of its ranking of technology in retail banks. This surprises me as, out of all the Irish retail banking apps, BIRG’s is the least user-friendly according to my own experience and that of everyone I speak to. Not to mention the outages…

PTSB announced mortgage and deposit rate changes on Thursday 25th September here. Mortgage rates for 2Y, 3Y, 5Y, and 7Y fixed products at 80-90% LTV will reduce by 15-20bps (i.e., PTSB is targeting growth in first-time buyer volumes) while term deposit rates on: i) 6M and 1Y product will reduce by 25bps; and ii) 3Y and 5Y product will increased by 40bps and 50bps respectively. One cannot help but feel that the overarching motivation behind these changes is NIM neutrality - with the reduced 6M and 1Y term deposit rate reductions potentially offsetting the asset yield compression associated with the highly specific mortgage rate reductions. As far as the higher rates on 3Y and 5Y term deposit rates go, the volume of savings sitting in these accounts is negligible in my understanding so the changes are highly unlikely to have a notable impact.

3️⃣ Shareholding Changes of Note:

AIB Group (AIBG) RNS of Friday 26th September: FIL now 3.08% (previously disclosed shareholding: 3.06%) following a transaction on 24th September (there was a prior announcement on Tuesday 23rd September noting that FIL’s shareholding has reduced from 3.08% to 3.06% following a transaction on 19th September).

🇪🇺 Europe Unbound - My Top Pick 🇪🇺

1️⃣ Just a few quick snippets this week:

Some European banks are demonstrating innovative initiative, joining forces to develop a euro-based stablecoin as an alternative to a market that is dominated by dollar-based stablecoins - Bloomberg reported on Thursday 25th September here that Banca Sella, CaixaBank, Danske, DekaBank, ING, KBC, Raiffeisen, SEB, and UniCredit are planning to launch the stablecoin in 2Q26. Bloomberg subsequently reported on Friday 25th September here that ECB Governing Council Member Francois Villeroy de Galhau remarked that European banks risk falling behind the US in the development of stablecoins. However, it seems to me that there is a significant push amongst European policymakers to expedite the development of the digital euro (earmarked for 2029) in preference supporting the development of stablecoins as this speech made by Pierre Cipollone, Member of the Executive Board of the ECB, on Friday conveys - with Cipollone wrapping up noting that “The findings of the digital euro innovation platform demonstrate that innovation in the retail space does not depend only on stablecoins – it can flourish using central bank money. In fact, the digital euro would reduce the risk that stablecoins pose to banks. With the digital euro allowing banks to offer consumers access to convenient, widely accepted and innovative payment services, consumer and merchants would have fewer incentives to turn elsewhere.” - further reinforced by comments made by Cipollone in this interview on Thursday where he notes: “Dollar-denominated stablecoins, which account for 99% of the market, could make European households and firms even more dependent on private, non-European [payment] systems. Widespread use of stablecoins would pose risks to euro area sovereignty, financial stability and monetary policy. It’s worth considering that buying stablecoins in dollars in all likelihood means transferring deposits from European banks to US banks. It may seem like a remote risk, but in just over a year, the market has doubled, and analysts are predicting that by 2028 the supply of stablecoins could be close to the current level of GDP in Italy. The digital euro makes sure consumers have a stable and sovereign option, which will allow them to make payments anywhere in Europe for all use cases. European firms can also act as a foundation on which they can build modern, innovative and secure payment services. If Europeans have access to an efficient means of payment in the form of the digital euro, they might be less inclined to resort to stablecoins.”. For further materials on the digital euro project I suggest reading the transcript of a speech made by Burkhard Bulz, Bundesbank Executive Board Member, on Friday here.

Bloomberg reported on Tuesday 23rd September here that Martin Kocher, Head of the Austrian Central Bank and ECB Governing Council Member, has added his voice to the chorus of those calling for regulatory simplification: “…it would be important to review the existing regulations and, for example, phase out unnecessary reporting and documentation requirements…Today, we still see too many national differences in capital availability, regulatory frameworks…These differences hamper the transmission of monetary-policy impulses.”.

Bloomberg reported on Tuesday 23rd September here that the European Banking Authority (EBA) is planning to improve the efficiency of regulations and give more discretion to regulators, according to EBA Vice Chairperson Helmut Ettl.

Bloomberg reported on Tuesday 23rd September here that a number of German senior bankers have urged the government to deregulate in order to stimulate investment in the country.

The EBA’s Risk Dashboard for Q2 2025 was published on Wednesday 24th September here. It notes a 20bps q/q uplift in EU/EEA banks’ RoEs to 10.7% despite a further tightening in net interest margins (NIMs) to 1.58%.

The Single Resolution Board (SRB) published operational guidance on resolvability testing for banks to enhance crisis readiness on Friday 26th September here.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ Just a few quick snippets this week:

Interesting report from Citi during the week on stablecoins here, with the authors concluding that “The evolution of digital assets – stablecoins, tokenized deposits, deposit tokens – feels in some ways like the early days of the dotcom boom. Skeptics once again proclaim that banks will be disintermediated. But we don’t believe crypto will burn down the existing system. Rather it is helping us reimagine it.”. That being said, delving into the details of the report, the authors do acknowledge that “The rise of reserve-backed stablecoins introduces the risk of deposit disintermediation, as flows of cash, deposit or securities migrate away from traditional banks into stablecoin structures”, going on to remark that “Globally, small savings and community banks are likely to be more dependent on public deposits and hence face higher risk of deposit disintermediation as opposed to large banks”.

Fascinating piece penned by Toby Nangle on FT Alphaville on Tuesday 23rd September here exploring how private credit default rates could escalate upon an uptick in PE exits. Furthermore, Daniel Davies piece on the future of credit risk models on FT Alphaville on Wednesday 24th September here is also well worth a read - the author flags the challenge that the EBA’s rules on materiality present for the ECB in a model changes approval context and Helmut Ettl’s comments (flagged in the ‘Europe Unbound’ section above) spring to mind in this respect.

Interesting article in The Financial Brand on Wednesday 24th September here on the urgent need for regulatory standards in the context of AI in banking. The article is naturally US-focused but has broader relevance.

McKinsey’s 2025 Global Payments Report was published on Friday 26th September - check it out here.

📆 The Calendar 📆

Look out for these in the week ahead:

🇬🇧 Mon 29th Sep (09:30 BST): Bank of England (BoE) Money and Credit Statistics and Effective Interest Rate Statistics - Aug 2025

🇬🇧 Tue 30th Sep (07:00 BST): Close Brothers Group (CBG) Preliminary FY25 Results (for the 12 months to 31 Jul 2025) - followed by an analyst / investor call at 09:30 BST

🇮🇪 Tue 30th Sep (11:00 BST): Central Bank of Ireland (CBI) Money and Banking Statistics - Aug 2025

🇪🇺 Wed 1st Oct (09:00 BST): European Central Bank (ECB) Euro area bank interest rate statistics - Aug 2025

🇮🇪 Wed 1st Oct (11:00 BST): Central Bank of Ireland (CBI) Card Payment Statistics - Aug 2025

🍺 The Closer 🍺

🇬🇧 Reform UK leaders Nigel Farage and Richard Tice emerged from their meeting with Bank of England Governor Andrew Bailey on Thursday feeling triumphant. Tice reported that Bailey “appreciates the interest” Reform is showing in the BoE’s balance sheet, where they are pressing for reduced bank reserve remuneration and the establishment of a national Bitcoin reserve. Music to the Governor’s ears? Hardly. The BoE’s official comment spoke volumes in its carefully-worded institutional English: “The governor had a productive meeting with Reform UK on Thursday as part of the Bank’s engagement with political representatives”. Meanwhile, the comments section of this FT piece on Thursday offered a more colourful interpretation: “I guess the meeting was friendly as it was like when people take their kids into a trading floor. The visitors have no idea of what is going on... But as they are there, it’s nice to be polite to guests etc. makes them feel important etc.”. A cordial nod and a political pat on the head, then.

Have a great week! 🍨

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.