The Financials Unshackled Weekender | Issue 59 (1st Sep 2025) - Bank Taxes in Focus and Much More

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Issue 59 | ‘The Financials Unshackled Weekender (1st Sep 2025)’ - your weekly pack for critique and curation of key banking developments. This note covers select developments from the last two weeks - a quiet period ahead of what promises to be a busy Autumn.

To unshackle your understanding of the week's banking developments please read on to explore critiques, curated insights, your calendar for the week ahead, and to finish with some light entertainment! It’s a relatively short note this time - newsflow has naturally slowed over the last week given the time of the year.

🔎 The Critique 🔎

🇬🇧 UK Unfiltered 🇬🇧: Bank taxes in focus

What Happened?: The left-leaning thinktank, the Institute for Public Policy Research (IPPR), published a report on Friday recommending that the government implement a ‘QE reserves income levy’ on commercial banks. UK bank share prices reacted adversely to the recommendation, with significant selling pressure affecting both the larger and smaller lenders. Press release here and report here.

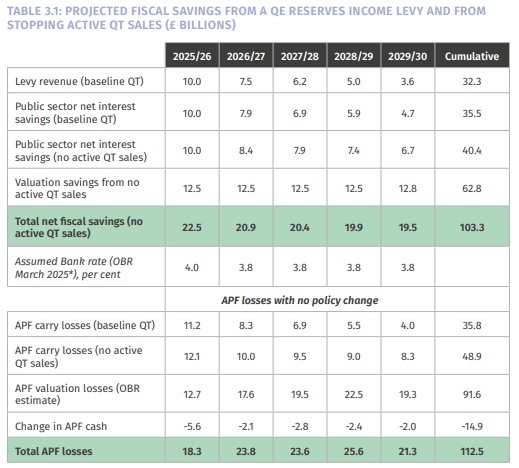

Key Detail: The report itself is focused on how to address the losses that the Bank of England (BoE) is wearing on account of its quantitative easing (QE) programme, which the author (Carsten Jung) notes “…will cost the taxpayer £22 billion a year in every year of this parliament”. The ‘QE reserves income levy’ is one of two recommendations to address the gap (the other one being that “the government should urge the Bank of England to review and better manage the fiscal implications of its policies, in particular slowing the pace of the unwinding of quantitative easing – so-called quantitative tightening – and any future quantitative easing”). Specifically, in relation to the ‘QE reserves income levy’, the IPPR notes that it could be targeted at the interest revenues that banks are generating on ‘QE-related reserves’ only and that it ought not apply to reserves that banks maintain at the BoE for liquidity and other operational purposes. The IPPR further recommends that only reserve returns in excess of 2% should be taxed in a bid to tax only the ‘windfall profits element’ of the reserves remuneration. It also proposes that banks with assets of <£25bn should be exempt from the tax. The thinktank estimates, subject to certain assumptions, that this levy would generate cumulative fiscal revenues of £32.3bn over the remaining life of the Labour-led government as the extract from the report below shows.

Unshackled Perspectives:

The IPPR is a left-leaning thinktank that is understood to be influential amongst Labour policymakers - and some see the report as tantamount to pre-Budget “kite-flying”. Indeed, this proposal is very well timed in the context of the upcoming Budget. So, the market has taken the proposals very seriously (for example, we did not see a similar reaction to Reform UK’s proposal to introduce a tiered reserves remuneration regime in June).

The Chancellor is under significant pressure to boost fiscal revenues as any casual observer of UK economic developments will be aware. The banks have historically been an easy target in this vein despite the fact that they already face much higher tax bills than companies operating in other sectors of the economy.

My view is that there is a risk of a windfall tax on banks in the Budget. However, I do not believe it is a fait accompli (I would put the probability at considerably less than 50%) and I expect that the Chancellor will tread extremely carefully in this respect given that any such move would be widely seen as deeply hypocritical in the context of Treasury’s ‘Financial Services Growth and Competitiveness Strategy’ document which was published to much fanfare just weeks ago in mid-July.

BoE Governor Andrew Bailey strongly defended the existing reserves remuneration regime in a critical speech on the topic on 21st May 2024 here. Indeed, the FT subsequently reported here in June 2024, that the Chancellor was persuaded by Bailey’s arguments: “We have no plans to do that. And actually the paying of interest on reserves is part of the transmission mechanism for monetary policy, it’s one of the ways that higher interest rates filter through to the real economy.”. Indeed, I would also add that individual banks could divert these ‘excess reserves’ into other higher-yielding liquid investment securities (for example), which would have the effect of increasing Balance Sheet risk in the case of those players - though, ultimately, it’s a zero sum game given unchanged system-wide reserve balances. While Reeves is indeed scrambling for ways in which to strengthen the fiscal coffers I believe that this is not a route that the government will take to achieve this objective.

Indeed, it is not insignificant to note that Treasury sources have moved this weekend to distance the government from the IPPR’s proposals, according to this article in The Sunday Times. A Treasury spokesman reportedly noted that the Chancellor wants to reduce “red tape to boost the City’s competitiveness and has put the UK on course to be the number-one destination for financial services firms by 2035” and reportedly went on to note that “We are a pro-business government, and the chancellor has been clear that the financial services sector is at the heart of our plans to grow the economy.”.

However, the IPPR report has, more broadly, heightened anxieties in relation to some form of windfall taxes on the sector. There is a danger in my view that Treasury will indeed seek to impose further taxes on the sector. If Treasury does press forward in this respect, I see the most likely moves as: i) a one-off increase in the surcharge (with the £100m allowance likely to be unchanged); and ii) an outright (structural) increase in the surcharge, perhaps with a commitment to review it annually (which is effectively what happens anyway). In the highly unlikely event that the excess reserves remuneration framework is tampered with, I think reduced remuneration could be targeted at banks with low loans to deposits ratios (LDRs) in order to stimulate lending. However, that would largely affect just a few smaller banks (some of whom policymakers are hopeful will select London as their IPO venue) so it doesn’t solve for the fiscal revenues conundrum. Nor would it solve for the risk that those particular banks might divert much of their excess reserves’ into riskier liquid investments. For what it’s worth I also think that, even if the government were to move forward with the IPPR’s recommendation, I would expect that the assets threshold (to determine applicability) would be struck at a level substantially above £25m - however, given that I don’t expect that the IPPR’s recommendation will be adopted, this is just an academic view.

All that being said, investors will likely remain nervous until the outcome of the Budget is known (note that we don’t have a date yet) - albeit maybe at a less elevated level of anxiety - especially considering their experience of bank taxes in other countries / moves afoot in other countries to increase bank taxes (e.g., Italy, Poland, Spain).

📌 The Curation 📌

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ OSB Group 1H25 results demonstrate progress towards targets

OSB Group (OSB) reported 1H5 results for the six months to 30th June 2025 on Wednesday 20th August. In short, results were slightly ahead of consensus expectations (using the company-compiled consensus dated 5th August). Profit Before Tax (PBT) of £192m was slightly ahead of consensus for £186m - and RoTE of 13.7% printed above consensus for 13.1%. The reasons for the beat were: i) Net Interest Income (NII) of £337m versus consensus for £328m (NIM of 230bps was ahead of consensus for 224bps); ii) slightly lower administrative expenses (£131m) relative to consensus (£134m); and iii) lower financial asset impairments than consensus expected - partially offset by higher fair value losses on financial instruments than consensus had modelled. Net loans of £25.43bn also came in slightly ahead of consensus, and were +1.2% YTD. FY25 targets were retained.

However, the stock saw selling pressure in response to the update, which appeared to be for a few reasons: i) no upgrade to FY25 guidance (I wasn’t surprised by this and I think management is just playing it somewhat conservatively - albeit the CEO’s comments around “lumps and bumps that run through the back book on the journey” from a NIM perspective are relevant too); and ii) material RWA density inflation in the period (CET1 of 15.7% was 50bps softer than consensus, which was partly a function of above consensus RWAs) which brought into focus the relatively higher RWA density attached to the increased emphasis on lending outside of BTL for growth (i.e., this is somewhat structural - though that should have been clear anyway). All in all, it appears that all is on track for FY25 and that management’s confidence in attaining the FY25 targets is well-founded. I remain less convinced on OSB’s ability to attain modestly higher y/y loan growth in FY26 and on the mid-single-digit loan growth aspiration for FY27-FY29 (which management qualifies by noting it is contingent on return requirements).

2️⃣ Shawbrook in acquisition mode / FT Lex on potential IPO

Sky News reported here on Friday 22nd August that Shawbrook is in exclusive discussions to acquire ThinCats, an alternative lender to mid-sized SMEs, for a price tag understood to be in the region of £180m. ThinCats reported adjusted EBITDA of £12.6m (up from just £6.0m in the prior year period) and a loss before tax of £23.2m in the year to 30th June 2024 (accounts accessible here) with the Strategic Report noting that its expected growth in AUM “is expected to deliver sustained profit growth and an attractive return on equity”. The acquisition would be congruent with Shawbrook’s ambitions to continue to “expand our presence and impact across the specialist SME lending market” (quote extracted from Shawbrook’s 1H25 report). Additionally, on the financials, an acquisition by Shawbrook would, in my view, likely see ThinCats’ expensive debt facilities redeemed - which have been the primary underpin for the significant losses it has reported.

Separately, the FT Lex column opined here on Wednesday 20th August that the rise in the FTSE 350 banks index this year ought to be conducive to a strong valuation for Shawbrook in an IPO scenario - commenting that “£2bn no longer looks quite so pie-in-the-sky”. Indeed, I reported in Financials Unshackled Issue 56 here that Shawbrook churned out an impressive underlying (u/l) RoTE of 18.3% in 1H25 (assuming a CET1 ratio of 12.5%), +340bps y/y reflecting improved NIM (with the decline in the cost of liabilities outstripping the asset yield compression), further efficiency improvements (with CIR of just 40.0% in the period) and a benign credit impairment charge (CoR: 42bps). Bolt-on acquisitions, to the extent that management retains price discipline (and its track record is strong in this respect), can be constructive in terms of enhancing returns capability - indeed, the real game-changer would be to inorganically capture a current account franchise but that has, thus far, proven elusive.

3️⃣ Other Snippets from a couple of quiet weeks:

Reuters reported here on Tuesday 19th August on how the UK Supreme Court ruling in a motor finance context could fuel M&A in that segment. The article notes that Cabot Square Capital has appointed BNP Paribas to conduct a sale process for Blue Motor Finance and it is also reported that Baupost Group’s Startline could come to market in the coming months.

The FT reported here on Saturday 23rd August that Moneyfacts analysis shared with the newspaper shows that green mortgages now make up just 11% of the total available deals in the UK market, compared with 16% in August 2023. However, instead of levelling the blame for such limited green product availability squarely at the banks, this, in my view, is simply a function of the fact that the UK has one of the world’s oldest housing stocks - a problem that government needs to address. However, to explain the significant shift on a 2-year lookback, some might say, perhaps, there is less greenwashing these days as well given that the green agenda has been de-emphasised.

The Times reported here on Wednesday 27th August that Treasury is considering a plan to apply national insurance (NI) to rental income in the hope of raising £2bn. This, in my view, would be a dangerous move that would likely drive more landlords to sell and exit the market and, ultimately, serve to push rents upwards. Significant lenders to landlords such as Aldermore, OSB Group (OSB), Paragon Banking Group (PAG) and Shawbrook will undoubtedly be monitoring developments closely.

The ONS published its private rental affordability release for 2024 on Monday 18th August here - which notes that private renters on a median household income could expect to spend 36.3% of their income on an average-priced rented home in England, compared with 25.9% in Wales and 25.3% in Northen Ireland in 2024. Private rental household incomes have increased faster than rents since 2016 - and this improved tenant affordability is positive for landlords and their lenders.

CityAM reported here on Wednesday 20th August that Atom Bank’s Chair Lee Rochford has hit out at the UK’s largest credit institutions remarking that the role they are playing in driving improved customer outcomes or supporting UK economic growth is “increasingly unclear” - noting that they offer “paltry saving rates and barely increased lending”. These specific comments may be seen in some circles as somewhat harsh but I think there is a highly valid perspective in Rochford’s overarching stance. It is, in my view, disappointing that we have not seen the market become more competitive despite the wave of banking licences issued in recent years. Overly onerous and unnecessary regulations applicable to smaller institutions (e.g., MREL) and glacial progress towards levelling the playing field in a risk-weighted asset (RWA) density context are, in my view, an embarressment.

Sky News reported here on Saturday 30th August that Naguib Kheraj, the former Deputy Chairman of Standard Chartered (STAN) and Finance Director of Barclays (BARC), has been shortlisted for the HSBC (HSBA) Chair position. Kheraj appears to have strong credentials for what is a notoriously difficult to fill role.

Fitch moved on Tuesday 19th August to upgrade Metro Bank Holdings (MTRO) Lon-term Issuer Default Rating (IDR) to ‘BB-’ from ‘B+’ (Outlook: Positive) and Metro Bank’s (MTRO) Long-term IDR to ‘BB’ from ‘BB-’ (Outlook: Evolving). This is a positive development in the context of future debt issuance costs. Fitch report available here.

Bloomberg reported here on Thursday 28th August that Revolut has been considering appointing investment banking advisers with a view to potentially acquiring a US-based licenced lender to accelerate its growth ambitions in that market. This seems a sensible plan in principle, designed to avoid the elongated process that banking licence applicants can face - with Revolut’s experience in the UK a case in point.

Starling Bank issued a press release here on Tuesday 19th August noting that it has agreed to acquire Ember, a tax and bookkeeping software business that will be integrated with its app and online bank - providing a one-stop-shop financial management solution for small businesses. The price was undisclosed. It seems a sensible bolt-on acquisition in the context of Starling’s business banking proposition.

4️⃣ Shareholding Changes of Note:

Barclays (BARC): Sasha Wiggins (Chief Executive of Private Bank and Wealth Management) sold 330,000 shares at a price of 368.5p per share on 28th August netting her gross proceeds of c.£1.22m.

Barclays (BARC): Craig Bright (Group Co-Chief Operating Officer and Barclays Execution Services Co-Chief Executive Officer) sold 18,920 shares at a price of 372.2p per share on 19th August netting him gross proceeds of c.£70k.

Barclays (BARC): BARC announced two transactions on 19th August. Venkat, Group CEO, transferred 1,382,804 shares to a joint brokerage account held with P. Venkatakrishnan, his PCA, on 15th August. The price was not disclosed. Separately, Anna Cross, Group Finance Director, disposed of 753,438 shares at 373.2p per share on 15th August, netting her gross proceeds of £2.8m.

Lloyds Banking Group (LLOY): Chris Vogelzang, a PDMR, acquired 50,000 Shares on 22nd August at a price of 84p per share for a gross outlay of £42k.

NatWest Group (NWG): Emma Crystal (CEO, Coutts and Wealth Businesses) sold 30,000 shares in NWG at a price of 554.2p per share on 26th August, netting her gross proceeds of just over £166k.

OSB Group (OSB): JPM AM now 5.25% (previously disclosed shareholding: 5.22%) following a transaction on 14th August.

Paragon Banking Group (PAG): JPM AM now 5.64% (previously disclosed shareholding: 5.72%) following a transaction on 21st August.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ CBI banking statistics point to continued favourable lending and deposit market conditions:

The Central Bank of Ireland (CBI) published its Money and Banking Statistics for July 2025 here on Friday 29th August.

Key points to flag:

Loan Volumes: Mortgages for house purchases were +€472m in July 2025, continuing the positive trend observed since May 2024. Annual growth in lending to households to end-July was just under €4.5bn, +4.3% y/y. Net lending to non-financial corporates (NFCs) was -€390m in July following positive flow of +€274m in June (the data ebb and flow quite a bit) - annual growth to end-July was +€158m, +0.5% y/y.

Deposits: Household deposits were +€1.3bn in July to €167.1bn - with the growth mostly attributable to overnight deposits (good for liability margins). Annual growth in household deposits to end-July was €11.1bn (€5.8bn term, €4.8bn overnight), +7.1% y/y. NFC deposits were +€281m in July - with the increase entirely attributable to increased overnight deposits, partially offset by some negative flow from term (good for liability margins but the data ebb and flow quite a bit). Annual growth in NFC deposits to end-July was -€1.4bn (+€1.1bn term, -€2.4bn overnight).

All in all the data is broadly as expected and points to continued strongly positive conditions in both a loan growth and a deposit funding build context for the banking industry.

2️⃣ Mortgage approvals at record levels in July

Banking & Payments Federation Ireland (BPFI) published its Mortgage Approvals Report for July 2025 here on Friday 29th August. Mortgage approvals by value reached €1.77bn in July, which is +13.7% m/m and +10.0% y/y (volumes were +12.0% m/m and +2.9% y/y) - and is the highest level on record. First-time buyers accounted for 62.4% of approvals by value. This data is very positive in a loan growth outlook for the main players in the Irish mortgage market, i.e., AIB Group (AIBG), Bank of Ireland Group (BIRG), and PTSB.

3️⃣ A perspective on neobanks:

Kealan Lennon, Founder & CEO of CleverCards, penned a piece in The Irish Times on Monday 25th August here on how neobanks are driving strong innovation in financial services in Ireland. It is a well-written piece and makes lots of valid points in relation to how fintechs / neobanks have met “surging demand from Irish customers and businesses for faster, more accessible and more innovative financial services”. Lennon sets out a balanced perspective on the mainstream banks - not lacking in talent and working hard to digitise but notes that they are “hobbled by legacy systems, higher cost bases and regulatory inertia, have been slow to adapt”. However, on Lennon’s question, as to “whether traditional banks can meaningfully compete with this new wave of digital-first challengers”, the mainstream banks are currently spitting out record profitability and, undeniably, dominate mainstream lending markets - while their digital counterparts are largely struggling to become the primary banking provider to their deposit customers, the average value of their deposits per customer is typically a fraction of the average value of mainstream banks’ deposits per customer, and most are struggling to grow their loan books significantly (and make most of their banking profits by just parking their deposits at central banks and in investment securities portfolios). That said, it is undeniable that banks face disruption risk in a longer-term context and I am reminded of Bill Gates’ classic observation in 1996: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.”. The banks can help themselves by continuing to digitise and partner with fintechs to enhance the customer experience and it is my view that the business banking propositions need more work than the retail banking propositions.

4️⃣ Other Snippets from a couple of quiet weeks:

The Business Post reported here on Friday 29th August that AIB Group (AIBG) is planning to start writing to tens of thousands of tracker mortgages to apologise for a delay in the pace at which it has passed through ECB rate reductions. This appears to be a communication issue in relation to different approaches taken to effecting rate changes in the AIB and acquired Ulster Bank portfolios and is not comparable to the scandals of yesteryear under different stewardship. The newspaper previously reported that the overall costs associated with the interest refunds are expected to be at least €5m - not helpful, but marginal in the context of FY26 consensus operating costs of >€2bn.

The row between Bank of Ireland Group (BIRG) and the Financial Services Union (FSU) in relation to return to work practices continues to rumble on and was covered extensively on the media over the last couple of weeks. Requiring hybrid-eligible staff to attend the office eight days every month (from 1st September) does not appear unreasonable to me but the issue is that the FSU is arguing that effecting this change is “…contrary to written agreements between the FSU and the bank”. It feels to me like BIRG’s effort to railroad through the changes in a short timeframe was ill-judged - especially in the wake of capacity issues reported by the Business Post on Saturday here.

5️⃣ Shareholding Changes of Note:

AIB Group (AIBG): BlackRock now 9.82% (previously disclosed shareholding: 9.48%) following a transaction on 26th August.

AIB Group (AIBG): Wellington now 4.02% (previously disclosed shareholding: 4.04%) following a transaction on 20th August.

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ ECB on CCyB:

It was a hard but worthwhile slog reading the ECB’s article (from Monday 18th August) on the early activation of the countercyclical capital buffer (CCyB) within its latest Macroprudential Bulletin here. In short, the ECB is highly supportive of the early activation of the CCyB, i.e., reducing it in times of stress - noting that it “fosters banking sector resilience by ensuring the availability of sufficient capital that can be released in the event of shocks (including non-financial ones)”.

2️⃣ European banks bad loans

It’s worth checking out a Bloomberg piece on the resilience of European banks’ asset quality from Tuesday 19th August here. In short, consensus expectations for loan loss provision charges have been too high - with persistently low unemployment, reduced commercial real estate (CRE) exposures, and years of deleveraging (the higher risk loans) since the Global Financial Crisis (GFC) the main contributory factors. Indeed, an interesting and constructive discussion came up on the NatWest Group (NWG) 2Q25 earnings call on this very point - where historical broad through-the-cycle (TTC) cost of risk (CoR) guidance / direction was debated.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ AI in Banking

It’s well worth checking out a report published by Deloitte US on the importance of AI in banking which you can access here. It contains several examples of use cases, ranging from ways in which banks can leverage AI to drive front office revenue growth to how they can generate back office operating efficiencies.

📆 The Calendar 📆

Look out for these in the week ahead:

🇬🇧 Mon 1st Sep (09:30 BST): Bank of England (BoE) Money and Credit Statistics and Effective Interest Rate Statistics - Jul 2025

🇪🇺 Wed 3rd Sep (09:00 BST): European Central Bank (ECB) Euro Area Bank Interest Rate Statistics - Jul 2025

🇮🇪 Wed 3rd Sep (11:00 BST): Central Bank of Ireland (CBI) Monthly Card Payment Statistics - Jul 2025

🍺 The Closer 🍺

I wrote in a Business Post article of 16th June last here that Monzo appears to me to be pursuing aggressive growth across multiple markets simultaneously, rather than proving out its model in one. It seems to be just firing for growth everywhere - leading some to wonder is there a strategy at all. The latest is that the bank is now planning to enter the UK mobile phone services market, most likely as a mobile virtual network operator (MVNO), to cross sell other services to its banking customers (as reported by the FT here). Seems to be they would be better off focusing on building customer trust than trying to build a customer supermarket. While the visionaries may have their day, as I wrote in Financials Unshackled Issue 49 here, Monzo is a household name but that’s not translating into sizeable lending opportunities thus far. Forgive my traditional instincts but I just want my bank to be a bank.

Have a great week! 🍨

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.