The Financials Unshackled Weekender | Issue 58 (17th Aug 2025)

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Issue 58 | ‘The Financials Unshackled Weekender (17th Aug 2025)’ - your weekly pack for critique and curation of key banking developments over the last week. Feedback, as always, is most welcome.

To unshackle your understanding of the week's banking developments please read on to explore critiques, curated insights, your calendar for the week ahead, and to finish with some light entertainment! It’s a relatively short note given newsflow has been thin given the time of year, particularly in a UK context - and I delve straight into ‘The Curation’ (which, naturally, includes some critique as well).

📌 The Curation 📌

In this section I collate select key banking developments across key regions, cutting through the noise to get to the nub of the issue in cases.

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ Secure Trust Bank reports a 36% y/y increase in 1H25 adjusted PBT

Secure Trust Bank (STB) reported interim results for the six months to 30th June 2025 on Thursday 14th August. It is not a name I track in detail but some key highlights are worth highlighting as follows:

Adjusted Profit Before Tax (PBT) +36.3% y/y to £23.3m reflecting decent loan book growth (+6.1% YTD to £3.8bn) and marginal NIM expansion (5.4% in 1H25 vs. 5.3% in 1H24), much improved operating efficiency (reduction of 460bps y/y in CIR to 49.1%) and a stable, albeit elevated, cost of risk (1.7%).

Customer deposits +8.2% YTD to £3.5bn, which has supported the early repayment of TFSME funding (helpful for NIM).

No change to the motor finance provision unsurprisingly in the wake of the Supreme Court judgment (which was welcomed by STB): “There remains continued uncertainty as to the eventual cost for impacted firms. As a result, the Group has retained its remaining provision for potential redress and operational costs.”.

The CET1 capital ratio of 12.6% was strong relative to minimum requirements and the company announced an increased interim dividend of 11.8p per share - up from 11.3p for 1H24 - in line with the stated progressive dividend policy.

STB notes, in its Outlook statement, that “…the Group remains confident in its ability to deliver against its ROAE target in the near-term, continue to grow income and deliver on cost efficiencies” and notes that it will update on its strategic plans (following its recent strategic decision to quit new lending in Vehicle Finance) in 4Q25.

2️⃣ Other Snippets from a quiet news week:

The FCA issued a cautionary notice on Monday here warning consumers to be aware that scammers are pretending to be car finance lenders and falsely claiming that people are owed compensation. The Times reported here on Monday that Nisha Arora, Director of Special Projects at the FCA, said: “We’re aware of scammers calling people and posing as car finance lenders, offering fake compensation and asking for personal details. There is no compensation scheme in place yet. If anyone receives a call like this, hang up immediately and do not share any information.” and CityAM reported here on Tuesday that lawyers’ are seeing demand for their services surge ahead of the commencement of a redress scheme. Some further excerpts from the CityAM article of particular note: i) Tim West, Partner at Ashurst, reportedly commented to the newspaper that “Outside of motor finance, there is existing group litigation concerning secret commissions where the intermediaries involved owed fiduciary duties, and so much of the Supreme Court’s reasoning will do little to reduce the risk of those claims”; and ii) a lawyer who wished to remain anonymous reportedly raised concerns in relation to the rushed nature of the redress scheme: “There’s a lot to be done in a rush” after the Court’s ruling left the door ajar for consumers to lodge claims…The FCA wants to put this scheme through in a year or so – it just that there’s a danger there. Because if you rush to do something there’s obviously political benefit. But you may all get it wrong”. Finally, on this topic, UK Finance published a brief guide that was penned by a Grant Thornton Partner and Director - here on Thursday on how firms can prepare for the upcoming redress scheme.

S&U (SUS) issued an upbeat trading update for the period from its AGM Statement on 18th June to 31st July on Tuesday 12th August. Advantage Finance has seen advances recover to exceed budget at £70.6m at end-1H25 (i.e., end-July) while Aspen, the bridging business, saw is advances reach £108.6m at end-1H25, +15% y/y. The statement further nots that the recent revival in growth in both businesses is expected to generate funding requirements exceeding its current funding facilities of £280m (note that end-1H25 borrowings were £185m) within the next two years and that this matter is “being addressed in a timely way”. Elsewhere, the statement includes lots of positive commentary in relation to the Chancellor’s recent Mansion House speech, the Supreme Court judgment, and the FCA’s “practical position”.

Sky News reported on Friday here that Affinity Partners, which was founded by Jared Kushner in 2021, is set to acquire an 8% shareholding in OakNorth Bank - with a deal expected to be signed in the coming weeks. Transaction terms are unclear and the article reminds readers that OakNorth was valued at $2.8bn in its most recent funding round in 2019. The FT also reported on the story here.

The FT reported on Friday here that Permira and Warburg Pincus have appointed Evercore to advise on a sale process for the wealth management firm Evelyn Partners. The article notes that the vendors are targeting NatWest Group (NWG) and RBC specifically - with much emphasis placed on NWG’s potential interest. The Times also subsequently reported on this story here - noting that Raymond James and the Ontario Teachers’ Pension Plan are also seen as potential bidders. Indeed, there could be pretty wide interest in the business in my view though I am inclined to also agree that, of the UK banks, NWG is the most likely to bite at this point - even if that means paying a significantly higher multiple than its core business (provided it can get comfortable that, with synergies and growth delivery, any such acquisition will deliver net benefit for shareholders over time - indeed, recent multiple expansion helps as well).

I published a reasonably detailed note on Nationwide Building Society, the UK’s second largest player in UK retail banking, on Thursday 14th August. You can access it here if you missed it.

3️⃣ Shareholding Changes of Note:

Barclays (BARC) announced on Wednesday 13th August that Tristram Roberts (Group Human Resources Director) disposed of 500,000 shares in BARC at a price of 373.9p per share on Tuesday 12th August for gross proceeds of just under £1.9m.

NatWest Group (NWG) announced on Thursday 14th August that Jen Tippin (Group COO) sold 14,300 shares in NWG at a price of 540.8p per share on Wednesday 13th August, netting her gross proceeds of just over £75k.

Secure Trust Bank announced on Wednesday 13th August that Ennismore’s shareholding in the bank reduced further to 2.66% (previously disclosed shareholding: 4.69%) following a transaction on 12th August.

Vanquis Banking Group (VANQ) announced on Tuesday 12th August that Redwood’s shareholding in the bank reduced to 16.87% (previously disclosed shareholding: 17.29%) following a transaction on 7th August.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ CBI Retail Interest Rate Statistics for June 2025:

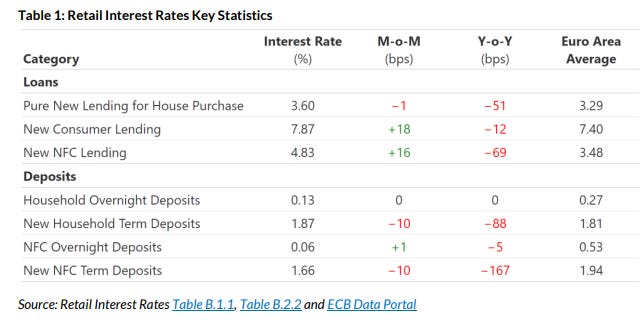

The Central Bank of Ireland (CBI) published its Retail Interest Rates update for June 2025 on Wednesday 13th August and an excerpt from the release, neatly summarising key movements, is shown below.

Mortgage rates fell just 1bp m/m but are down 51bps y/y (and front book mortgage rates are now 7th highest in the eurozone - up from 8th highest in May but down from 5th highest in April and I expect some more material trimming in the coming months). It was also interesting to note the reduction in household and non-financial corporate (NFC) term deposit rates in the month, both of which were -10bps m/m. New household term deposit rates are above the euro area average (1.87% versus 1.81%) while new NFC term deposit rates are below the euro area average but it is important to remember that the relevance of this from a banking sector net interest margin (NIM) perspective is extremely limited for two key reasons: i) the percentage of deposit stock attributable to term deposits in the Irish market is very low compared to other jurisdictions (over 90% of the listed banks’ deposit funding is represented by current accounts and demand accounts, i.e., overnight product); and ii) deposit churn (or flow to term) has been minimal (talking about deposit beta as rates come down is absolutely and utterly pointless in my view - just look at the absolute quantities of flow to term) and is clearly slowing. On my calculations, AIB Group (AIBG) and Bank of Ireland Group (BIRG) paid in the region of just c.25bps of their entire stock of deposits in 1H25.

On a related but separate note, Martina Hennesy of Doddl.ie featured in the Irish Independent on Tuesday here criticising Irish banks’ high variable mortgage rate pricing. I have some sympathy with the banks here - and in a deposit pricing context as well, despite my regular highlighting of the point given its centrality to the high returns story. Ultimately, it is for customers to move. Options are there - certainly in a mortgage product context and, with some effort, in a deposit product context to a significant extent at least. On the latter, while competition is very thin, customers do not need to park as much of their savings in overnight product as they do - which has been the main reason why the banks have maintained very low deposit funding costs.

2️⃣ Sinn Fein raises its ire with DTAs

The Irish Independent reported on Friday here that Sinn Fein Finance Spokesman Pearse Doherty has raised his ire with the benefits accruing to the listed banks owing to their large stock of deferred tax assets (DTAs) which are mostly capable of offset against Irish profits. As an aside, these are a key source of capital generation so it’s important to reflect on these as the benefits of the DTAs are not captured in a standard P/TBV vs. RoTE assessment. AIBG / BIRG / PTSB reported DTAs relating to unutilised Irish tax losses specifically of €1,862m / €500m / €319m at 30th June. Indeed, the Sinn Féin manifesto ahead of the 2024 General Election proposed to limit the use of DTAs to 50% of the banks’ tax liability in any given year - though it did not attract much debate in the public discourse. So, Doherty is having another pop ahead of the Budget, it seems - remarking that: “There is something rotten at the core of our economy when banks can extract €5bn in profits and pay essentially no tax” and that the government needs to “stop facilitating the banks to avoid paying taxes on profits”. While it is not an invalid perspective (which I’m sure most reasonable people who don’t have a vested interest in the outcome here would agree with, irrespective of their politics), it was unsurprising to read in the article that the sector defended itself - with BIRG reportedly commenting that “There is no justification for the singling out of individual companies for the removal of long-established tax assets that apply to every other company”. While that is true (though it was interesting that the sector’s defence came from the bank with the least proportional benefit to extract over the coming years), many readers will know that this didn’t stop the UK legislating to limit utilisation profits in any given year. Let’s see where it all ends up. My guess is that, if politicians are inclined to do anything, they will find a way of protecting PTSB - including some kind of utilisation limit that would be above that bank’s expected overall tax bill for the coming years.

3️⃣ Other Snippets from a quiet news week:

I wrote in the Business Post here on Friday on how large Irish listed banks’ (AIB Group (AIBG) and Bank of Ireland Group (BIRG)) reluctance and hesitation to distribute excess capital with sufficient frequency and in sufficient quantities is likely, in my view, to be one of the factors that underpin the materially lower multiples of tangible value at which they have been trading relative to their mainstream UK counterparts, Lloyds Banking Group (LLOY) and NatWest Group (NWG). I argue that this excess conservatism must stop and that Irish bank boards need to adjust to market realities. I also question the strategic rationale underpinning AIBG’s Climate Capital activities: “Its climate capital unit, which specialises in lending to large-scale renewable energy and infrastructure projects, has consistently generated a significantly lower return on lending than its other divisions – and it is an enormous consumer of capital, as AIB’s historical risk-weighted asset disclosures demonstrate [see page 27 of the FY21 results slide deck here for those historical risk-weighted asset density disclosures I refer to]. Moreover, most of the lending is overseas where AIB’s expertise is unlikely to denote deep strategic advantage. Ultimately, this raises questions about the true ambition behind the strategy, as it is currently not delivering from a shareholder value perspective.”.

The Business Post reported yesterday here that AIB Group (AIBG) is preparing to issue an apology to thousands of tracker customers in the coming weeks having received complaints over the pace at which it is passing through ECB rate reductions. The articles notes that the overall costs associated with the interest refunds that are reportedly planned is expected to be at least €5m.

4️⃣ Shareholding Changes of Note:

AIB Group (AIBG) announced on Wednesday 13th August that Wellington’s shareholding in the bank reduced to 4.02% (previously disclosed shareholding: 4.06%) following a transaction on 12th August. AIBG subsequently announced on Thursday 14th August that Wellington’s shareholding in the bank increased again to 4.04% following a transaction on 13th August.

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ Tight AT1 spreads in focus

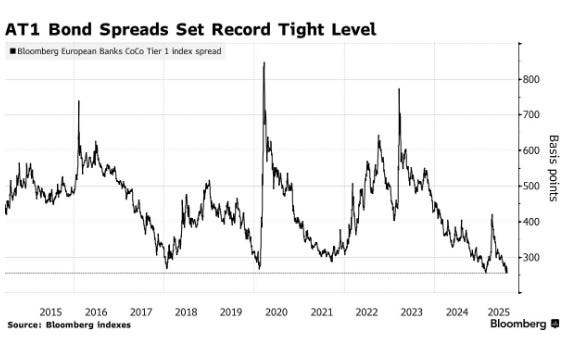

Two interesting articles on Bloomberg on AT1 spreads caught my attention this week. Firstly, Bloomberg reported on Monday here that veteran AT1 investors have begun to adjust their tactics - passing some deals and holding back cash to take advantage of market corrections - as the market becomes swamped with new buyers in an environment of “yield scarcity” to paraphrase Jeremie Boudinet at Credit Mutuel Asset Management, who is quoted in the piece. A second article on Bloomberg on Tuesday here zoned further elaborated on this topic, noting that the Bloomberg’s European Banks CoCo Tier 1 Index spread is at its lowest level ever (at just 255.2bps) since the instruments were created in 2014. Here is the chart, extracted from the referenced Bloomberg article:

The reduction in spreads is multi-faceted but, in my view, partly reflects the search for yield (where AT1s have stood out for a long time against other bank bonds), the strong financial health of European lenders, the regulatory clarity following the Credit Suisse debacle, and the likelihood that bank boards and regulators would be highly resistant to seeing regulated banks’ capital levels dip towards MDA levels (let alone conversion / permanent writedown levels). There is always a question mark as to whether banks will call their AT1s - though, in this yield environment, it is extremely likely (and confidence in this has strengthened following the recent introduction of a ‘tender extender’ model that allows for AT1s to be tendered a few months in advance of the expected date to capture the tight spreads available). Indeed, many issuers undoubtedly see the current yield environment as an opportune moment to lock-in low funding costs for some time - and, to the extent that yields widen in due course, the question as to whether issuers will call their instruments will become more prominent again.

I would also add that the movement in implied cost of equity does not appear to have moved in parallel with AT1 spreads. This is not unusual - both don’t move in lockstep - and there is no one perfect measure to gauge this as implied CoE can be measured in many ways. But some will see this as an indication that cost of equity for the sector could continue to contract from here.

2️⃣ Other Select European Snippets

Interesting interview in the Business Post with Dominique Laboureix, Chair of the EU’s Single Resolution Board (SRB), on Monday last here. Laboureix first expresses his satisfaction with the completely new crisis framework that has been built for banks, noting that “Now we are 21 out of 27 members of the European Union. During the recent years our banking industry was able to face extremely challenging circumstances, and show resilience.”. He does raise some concerns though, namely: i) the speed with which crises can gather speed as was observed during the Silicon Valley Bank (SVB) debacle in 2023; ii) geopolitical risks, which could drive reduced banking sector profitability; iii) structural issues including climate transition and digitalisation; and iv) the growing popularity of non-banks and payment apps. It was interesting that there was no explicit mention of a digital euro (or CBDCs more broadly) or stablecoins in the piece. Laboureix went on to, effectively as I see it, issue a warning shot to Irish deposit customers of Revolut: “What Irish citizens perhaps don't know is that the deposit guarantee scheme of this bank is still in a small European country…It's not in Ireland…The potential payout of the deposits is still the same…But obviously, to have a deposit guarantee scheme in, let's say, Germany, or in, let's say, Cyprus, does not mean the same thing in terms of strength, of size, of capacity to pay out for deposits which are covered.”. But he proceeded to note that the missing link in the EU system is an EU-wide deposit insurance fund - remarking that this is something that the “market itself will make the case for”, which some might interpret as lukewarm support for EDIS at best. Laboureix wraps up the interview noting that the EU needs to consider bringing non-banks “into a sort of minimum framework” for crisis management - it feels like some regulation of the space is coming at some stage and that Laboureix’s wish will be granted at some point in the future, but, that being said, nothing moves quickly in Europe so I won’t be holding my breath.

Indeed, the ECB published a Working Paper on whether European deposits react to digitalisation on Monday 11th August here. Its key findings are: “For a sample of large banks directly supervised by the ECB, our findings indicate that an increased use of online banking services leads to a small amplification of extreme deposit outflows, but this effect is not further exacerbated by the availability of a mobile banking app. Online banking use and availability of a mobile app do not have a causal effect on deposit volatility in normal times. Finally, social media are impactful only in idiosyncratic cases.”. Nothing surprising in these findings for bankers and those who follow the industry - however, one can imagine how deposit churn volumes could ramp up substantially in a unified eurozone banking system where there was an ability for consumers to manage deposits in real time (for example, should customers be enabled, perhaps via Open Banking technology, to deploy algorithms to enabling the movement of deposits from institution to institution in real time based on best rate and other preset criteria) in a more dynamic deposit-taking marketplace or should a novel proposition be developed by a deposit-taker to entice customers to move substantial volumes of deposits to the institution in question.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ New stablecoin law in focus

An interesting article on how the GENIUS Act could revolutionise banking and payments was published in The Financial Brand on Tuesday here. In particular, the article notes that many experts see how smaller US banks and credit unions could struggle to retain deposits as major banks move towards developing their own tokenised deposits or forming consortium-style approaches to stablecoins. The article included comments from Roy Ben-Hur of Deloitte, which neatly capture that financial institutions need to get prepared for the changed landscape: “They need to be ready with an answer to a client who comes in and says, ‘I want to integrate stablecoin into my business-to-business payments, what options do you have to offer me?…If they’re not ready for that, the client can easily move those funds to another institution that may provide them with those capabilities.". The article also includes what appears to be a wise contribution from Frank Sorrentino, Chairman and CEO of ConnectOne Bank, noting that stablecoins have many practical implications and that they represent “…a big departure from the way things have been done before” but that there is a danger of overexcitement in relation to the degree to which they will penetrate society: “You’re not going to be buying a slice of pizza on the blockchain, in my opinion”.

📆 The Calendar 📆

Look out for these in the week ahead:

🇬🇧 Tue 19th Aug: Danske Mortgage Bank plc 1H25 Results

🇬🇧 Wed 20th Aug (07:00 BST): OSB Group (OSB) 1H25 Results

🍺 The Closer 🍺

The US President’s remarks on social media on what the CEO of Goldman Sachs (GS) should do with his life caught the attention of many this week: “I think that David should go out and get himself a new Economist or, maybe, he ought to just focus on being a DJ, and not bother running a major Financial Institution” - which appears to be a highly personal attack given that Goldman’s economists have been of the view that tariffs will have an adverse impact on the US economy. It will sound familiar to those who have been on the wrong side of those autocratic-leaning folk who seem to have disrespect - or even utter contempt some might say - for analyst independence or anyone who disagrees with their views. Indeed, a certain enormously valued US tech stock springs to mind. What a world we live in!

Have a great week! 🍨

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.