The Financials Unshackled Weekender | Issue 56 (10th Aug 2025) - Metro Bank in Focus and Much More

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Issue 56 | ‘The Financials Unshackled Weekender (10th Aug 2025)’ - your weekly pack for critique and curation of key banking developments over the last week. Feedback, as always, is most welcome.

To unshackle your understanding of the week's banking developments please read on to explore critiques, curated insights, your calendar for the week ahead, and to finish with some light entertainment! It’s a relatively short note this time - newsflow has naturally slowed over the last week given the time of the year.

🔎 The Critique 🔎

In this section I dissect the week’s most significant banking development(s) / theme(s) of interest across key regions as appropriate, cutting through the noise to get to the crux of the issue.

🇬🇧 UK Unfiltered 🇬🇧: Metro Bank 1H25 results point to progress

What Happened?: Metro Bank (MTRO) published 1H25 results for the six months to 30th June on Wednesday 6th August. I joined the earnings call on Wednesday morning and the analyst roundtable on Thursday morning. Results materials (RNS, slide deck, webcast link, report, and Pillar 3 Disclosures can be accessed on the company website here).

Key Detail: MTRO delivered a strong financial performance in 1H25 and management confirmed that it expects to be reclassified as a transfer firm following the BoE PRA’s recent Policy Statement on MREL. Here are some key take-aways from the update:

Underlying (u/l) PBT of £45m in 1H25, up materially h/h from just £13m in 2H24, reflected: i) strong NIM expansion (+65bps h/h to 287bps (exit NIM was 295bps), driving h/h u/l NII growth of 8%) resulting from loan mix evolution, deposits mix improvement, and liquid assets recycling; ii) flat u/l net fee and other income; iii) u/l cost reduction (-8% h/h); and iv) a modest ECL charge of just £6.3m (CoR: 14bps).

Net loans were +£250m q/q to £8.72bn at 30th June while deposits reduced further to £13.36bn (down £454m from the end-1Q25 position), which is predominantly reflective of reduced fixed term and demand account balances (NIM-supportive). However, it is notable that current account balances reduced by £109m from the end-FY24 position to £5.68bn.

MTRO finished the period with a CET1 capital ratio of 12.8%, a Tier 1 Capital ratio of 16.6% (reflecting the recent £250m AT1 issuance at a coupon of 13.875%), and a Total Capital ratio of 18.9%. Liquidity ratios were strong with the end-June LCR and NSCR sitting at 315% and 165%, respectively.

All FY25 and future guidance set out at the stage of the FY24 results was reconfirmed, including mid to upper teens RoTE by FY27.

MTRO notes that it expects to be reclassified as a transfer firm following the BoE PRA’s recent Policy Statement on MREL, meaning that its MREL requirements would be equal to its minimum capital requirements. Given this, there are no plans to raise future MREL.

The Times also reported on Wednesday here that CEO Dan Frumkin refused to comment on M&A (following the 14th June Sky News report here which noted that Pollen Street Capital had approached Metro Bank (MTRO) about a possible take-private deal in the previous fortnight) other than to say that “I see a really strong path ahead as an independent entity…At the end of the day, if we had something to say, we’d say it…The takeover code is pretty clear. Just because there is noise in the market doesn’t mean anything’s happening.”.

Unshackled Perspectives:

Management is clearly delivering on its strategy to continue to pivot towards higher-yielding lending and other assets and to optimise deposits to achieve a lower cost of funds whilst maintaining a keen focus on cost discipline and credit risk. Indeed, the bank reported a RoTE of 7% for 1H25 though this does not incorporate any AT1 coupon costs.

The news that MTRO is expecting to be reclassified as a transfer firm (MTRO is awaiting written confirmation from the PRA) is welcome - and congruent with expectations in the wake of the Policy Statement on MREL of 15th July last here, which I wrote about in Financials Unshackled Issue 54 here. However, it is not clear whether MTRO will call its existing £525m 12% MREL-eligible debt in issue in early 2026 - it depends on the economics. Furthermore, the CEO clarified that MTRO will categorically not look to redeem the notes early at par (in response to a question on the earnings call on whether management could exercise the call option set out in Clause 6 b) of the Debt Prospectus dated 16th Nov 2023 here), which may have disappointed some equity investors.

It was encouraging to hear the CEO remark that he expects that MTRO will be discussing capital return come the FY26 results, which stands to reason to the extent that financial performance continues to progress in line with management’s expectations / targets.

While there may have been some disappointment at the CEO’s comments in relation to potential M&A (the stock sold off significantly last week), it seemed to me that the market became much too excited at the prospects for a bid / a process back in June (I didn’t write this at the time in a bid to avoid implicitly opining on stock valuations but now that ‘some heat has evaporated’ I want to make this point). A Sky News report in relation to a third party approach does not mean a takeover is highly likely and it was notable that the MTRO Board has not felt compelled to issue a Rule 2.4 announcement - as Frumkin reportedly said to The Times: “…if we had something to say, we’d say it….”. That said, I see MTRO as a desirable asset in the eyes of various third parties given its brand strength and low cost current account franchise - and a sale at some point seems the most likely preferred exit play for the main shareholder. One to watch.

📌 The Curation 📌

In this section I collate select key banking developments across key regions, cutting through the noise to get to the nub of the issue in cases.

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ A good week for UK banks in the wake of the Supreme Court judgment

I wrote briefly about the UK Supreme Court judgment and subsequent FCA announcements of Friday 1st August in Financials Unshackled Issue 55 here. The affected banks saw a strong share price performance last week following the judgment - with Close Brothers Group (CBG) the standout top performer, seeing its share price rise 38% in the week. In terms of latest news on the motor finance debacle, the FT reported here on Friday on a letter issued to the FCA by Lord Michael Forsyth of the House of Lords’ Financial Regulation Committee on Friday here in which the Committee challenges aspects of the FCA’s decisions in relation to a redress scheme for consumers, including: i) noting that a six-year limitation period may be more appropriate than a redress scheme covering motor finance agreements dating back to 2007; ii) asking what modelling the FCA has undertaken on the indicative cost of a redress scheme with a timeframe consistent with the six-year limitation period for complaints brought in the courts; and iii) asking what modelling the FCA has undertaken to ascertain the administrative costs that a redress scheme covering agreements dating back to 2007 would impose on firms. He also requests that the FCA appear before the Committee in September to respond to its concerns.

These concerns from a Committee which acts as an important check on the powers of financial regulators are not to be dismissed in my view. While the Committee cannot directly force a regulator to change a rule or a policy, its public reports and recommendations can culminate in significant political pressure. To the extent that the FCA were to adopt a more restrictive limitation period, it would undoubtedly be welcomed by the lenders. That being said, my own view is that the FCA will robustly defend its position in respect of its decisions and I don’t expect any reversals here - with the FT reporting last Tuesday here that the FCA Chief Nikhil Rathi commented to the newspaper that lenders must stop “haggling” over the decision to include agreements dating back to 2007 in the upcoming redress scheme.

2️⃣ Upbeat interim results update from Shawbrook

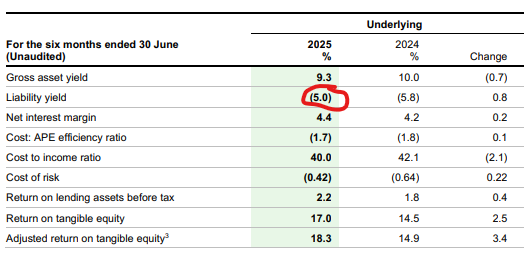

Shawbrook reported a very strong financial performance for 1H25 (the six months to 30th June) on Thursday 7th August - this followed a pre-close trading update on 18th July here. Adjusted underlying (u/l) RoTE came in at 18.3% (assuming a CET1 ratio of 12.5%), +340bps y/y reflecting improved net interest margin (with the decline in the cost of liabilities outstripping the asset yield compression), further efficiency improvements (with CIR of just 40.0% in the period) and a benign credit impairment charge (CoR: 42bps). Net loan growth was strong in the period, +4.1% h/h to £15.8bn - and +6.9% h/h if you strip out the impact of structured asset sales), deposits were +5.6% h/h to £16.7bn and the CET1 capital ratio printed at 13.1% (leverage ratio: 8.1%).

While Shawbrook is reported to be pressing ahead with plans for an IPO later this year (FT report from 22nd July here and Bloomberg report from 29th July noting that it has selected its bookrunners here), there has also been much speculation regarding potential M&A activity in a Shawbrook context. In the context of Shawbrook as a potential acquirer, it is not hard to imagine what the benefits a current account franchise could bring to the table, for instance, when one considers its existing ability to churn out a NIM of 4.4% despite high average liability costs of 5.0% (see below table extracted from the 1H25 results report) - for context, MTRO reported a cost of deposits of 1.02% in 1H25. Resources: Slide deck here and Results Report here.

3️⃣ Vanquis’ transformation progressing well

Vanquis Banking Group (VANQ) published 1H25 results (for the six months to 30th June 2025) on Thursday 7th August (slide deck here, earnings call transcript here, and results document here). PBT from continuing operations of £6.2m compared with a loss of £91.9m in 2H24 (re-presented basis - see 11th July document on re-presentation here) - a function of: i) substantive cost reduction owing to transformation cost savings, lower complaint costs and the non-repeat of notable items; and ii) lower impairment charges. Revenues were broadly flat y/y - NII was up marginally on the back of higher average receivables (despite some NIM compression) while non-interest revenue was down a bit. Net receivables were £2.33bn (+8% h/h), deposits were £2.46bn (+1% h/h) and the Tier 1 Capital ratio sat at 18.1% at end-June.

All in all, the update went down well - with VANQ on track to deliver its FY25 guidance, with higher balance growth than previously expected (as the below extract from the slide deck shows).

4️⃣ Other Snippets from a quiet news week:

Latest lending updates from the Finance & Leasing Association (FLA) for June 2025 (published on Wednesday 6th August) show: i) consumer finance new business +4% y/y to £118.9bn in the 12 months to June here; ii) asset finance lending +1% y/y to £39.9bn in the 12 months to June here; and iii) second charge mortgage originations by value +25% y/y to £1.9bn in the 12 months to June here. More detail on consumer car finance volumes available here.

The Financial Ombudsman Service (FOS) published complaints data for 1Q25/26 (the three months to 30th June) on Thursday 7th August here. In short, there were 68,000 complaints in the period, -8.8% y/y. 31% of cases resolved were upheld in favour of the consumer and the most complained about product was motor hire purchase (HP).

KPMG’s annual State of the Banks (UK) report was published on Monday last - press release here and Executive Summary here. In short, the authors’ view is that “Without remedial actions, our central forecast predicts the sector’s return on equity will decline by more than a third from its 2023 peak of 15% to 10% by 2027”. It’s arguably a somewhat self-serving finding and consensus RoTEs across the listed lenders are much stronger than 10% it must be said (with logic underpinning the estimates in the form of structural hedge income for the larger lenders and the benefits of a slightly more benign rate backdrop for smaller lenders). The report also notes that high street banks have seen their share of the deposit market drop from 84% in 2019 to 80% in 2024 - with CityAM also picking up on this here.

EY has bagged the Revolut audit contract (winning out against BDO and PWC, who also reportedly tendered for the contract) - with the firm set to replace BDO as Revolut’s main auditor for FY26 - see FT report here.

This Is Money reported on Friday here that Monzo won 1 million new customers in 2Q25, which represents an acceleration in its growth following the addition of 2.4 million new customers in the 12 months to 31st March (up from 2.3 million the prior year). For some analysis of Monzo’s financials, please consult Financials Unshackled Issue 49 here.

5️⃣ Shareholding Changes of Note:

Lloyds Banking Group (LLOY) announced on Thursday 7th August that Chris Vogelzang (NED) acquired 30,500 shares in LLOY at a price of 80.06p per share on Wednesday 6th August for a gross outlay of just under £25k.

NatWest Group (NWG) announced on Friday 8th August that Scott Marcar (Group Chief Information Officer) sold 7,759 shares in NWG at a price of 516.34p per share on Friday 8th August, netting him gross proceeds of c.£40k.

OSB Group (OSB) announced on Tuesday 5th August that JPM AM’s shareholding in the bank reduced to 5.22% (previously disclosed shareholding: 5.23%) following a transaction on 31st July.

Secure Trust Bank announced on Wednesday 6th August that Ennismore’s shareholding in the bank reduced to 4.69% (previously disclosed shareholding: 5.96%) following a transaction on4th August.

Standard Chartered (STAN) announced on Tuesday 5th August that Judy Hsu (CEO, Wealth and Retail Banking) sold 280,000 shares in STAN at a price of 1360p per share on Monday 4th August, netting her gross proceeds of c.£3.8m.

Standard Chartered (STAN) further announced on Wednesday 6th August that: i) Sunil Kaushal (Co-Head, Corporate & Investment Banking) sold 390,697 shares in STAN at an average price of 1359p per share on Monday 4th August, netting him gross proceeds of c.£5.3m; and ii) Tanuj Kapilashrami (Chief Strategy & Talent Officer) sold 125,000 shares in STAN at a price of 1367p per share on Tuesday 5th August, netting her gross proceeds of c.£1.7m.

Vanquis Banking Group (VANQ) announced on Tuesday 5th August that Schroders’ shareholding in the bank reduced to 16.47% (previously disclosed shareholding: 17.87%) following a transaction on 4th August.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ Snippets from a quiet news week:

The Irish Independent reported on Thursday here that Raisin has been highlighting - again - that Irish savers achieve some of the lowest returns in the eurozone for the last 10 years - highlighting the paltry rates offered on demand (easy access) accounts in particular. I have written extensively on this in previous issues of Financials Unshackled.

A spokesman for AIB Group (AIBG) noted to the Business Post that the lender has no plans to leave the Net Zero Banking Alliance (NZBA) following an exodus of lenders from the initiative since the election of Donald Trump as US President. This is not surprising. The AIBG Chief has picked tackling climate change as one of the key achievements he wants to deliver during his tenure at the helm. See article from Friday here.

Bank of Ireland Group (BIRG) issued a press release on Thursday here noting that it is contributing £80m as part of a consortium of international lenders backing East Anglia 3, an offshore wind farm set to become the world’s second largest when it enters operation next year. Notably, the lender is targeting €30bn in sustainability-related lending to households and businesses by 2030. It reached €15bn during 1Q25, achieving its end-2025 target ahead of schedule. Separately, the Business Post reported on Tuesday here that RBC has upped its share price target for BIRG from 1200c to 1350c following the UK Supreme Court decision and FCA announcements in a motor finance context.

In further BIRG-related news, it was reported by the Business Post on Thursday here that the Financial Services Union (FSU) has directed its members not to comply with new remote working rules which are due to come into effect on 1st September - but the bank has hit back noting that the FSU “does not have negotiating rights on this issue” and remarking that it is “very confident the majority of our people see this as a very fair approach”. The same article also noted that the FSU has also advised AIB Group (AIBG) staff not to alter their remote working practices - though the changes are not due to take effect until 1st January.

2️⃣ Shareholding Changes of Note:

Bank of Ireland Group (BIRG) announced on Friday 8th August that Emer Finnan (recently appointed NED) acquired 4,000 shares in BIRG at a price of 1265c per share on Friday 8th August for a total outlay of just over €50k.

PTSB announced on Tuesday 5th August that Wellington’s shareholding in the bank increased to 6.02% (previously disclosed shareholding: 6.00%) following a transaction on 1st August.

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ ECB Macroprudential Bulletin - key take-aways:

The ECB published its Macroprudential Bulletin on Tuesday. There are two important articles contained within it, as follows:

Abstract from ‘Heterogeneity in (capital) buffers set for systemically important banks in the European banking union’: “Unwarranted heterogeneity in O-SII buffer levels in the European banking union may have adverse consequences for financial stability and the level playing field in the banking market. Analysis of national buffer-setting yields evidence of heterogeneity which does not result from differences in the size, concentration and funding structure of the domestic banking systems. From a banking union perspective, buffer-setting by national authorities results in heterogeneity at both the upper and the lower end of the distribution of a bank’s systemic relevance. The recent enhancement of the ECB’s O-SII floor methodology is designed to mitigate unwarranted O-SII buffer heterogeneity at the lower end of the buffer range. As the ECB can impose higher macroprudential requirements but not reduce macroprudential requirements, it is not possible for the ECB methodology to address instances of unwarranted heterogeneity at the upper end.”. To me, this highlights once again some of the issues associated with national discretions.

Abstract from ‘Enhancing the ECB’s O-SII framework’: Capital buffers for other systemically important institutions (O-SIIs) are set by national authorities across the EU Member States participating in the banking union (BU). On 1 January 2025 the ECB started using an enhanced floor methodology to assess national O-SII buffer decisions. This methodology adopts a BU perspective to address “too-big-to-fail”-related risks at the BU level. The aim is to reduce the heterogeneity in O-SII buffers and achieve a more consistent treatment of the most systemically important institutions. Furthermore, the enhanced methodology recognises the progress made on the European banking union, in line with the approach taken in the G-SIB framework. It introduces a BU floor for O-SII buffers, calibrated based on a linear function mapping O-SII scores from the BU perspective to minimum buffer rates. The enhanced methodology will be fully phased in by 2028.”.

2️⃣ ECB Economic Bulletin highlights elevated uncertainties afflicting banks

The ECB published its 5th Economic Bulletin of 2025 on Friday here. Chapter 5 provides a useful refresh of latest lending / funding conditions - loan growth is was running at levels far below historical averages in May, credit standards tightened a little while loan demand grew strongly, and deposit costs continued to reduce in May.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ Stablecoins in focus

Katie Haun’s (former UIS federal prosecutor and Founder & CEO of VC firm Haun Ventures) op-ed on stablecoins in the FT on Thursday here caught my eye. Her conclusion is that, with proper guardrails (i.e., regulation - like the passage of the Genius Act in the US), stablecoins “…can reinforce dollar dominance, strengthen financial stability, and offer a faster, more resilient foundation for global money movement”. However, I feel she takes a one-sided view in relation to the over the key challenge for stablecoins, i.e., facilitating illicit activity it a greater extent than the central banking monetary system does: “Stablecoins are a poor choice for bad actors…blockchains are superior for tracing illicit funds” - a solid argument in and of itself but it fails to mention the issues in detecting illicit activity in the first place. I also tuned into The Economist Money Talks podcast on Thursday here which covered stablecoins in detail, delving into the various arguments for and against why they could pose a threat to the established financial system - with banks at particular risk of disintermediation (though with no obvious substitute for maturity transformation beyond the unregulated private credit space in part for now) - it’s well worth a listen if you have a subscription.

📆 The Calendar 📆

Look out for these in the week ahead:

🇬🇧 Tue 12th Aug (07:00 BST): S&U (SUS) 2Q25 and 1H25 Trading Update

🇮🇪 Wed 13th Aug (11:00 BST): Central Bank of Ireland (CBI) Retail Interest Rates - June 2025

🇬🇧 Tue 14th Aug (07:00 BST): Secure Trust Bank (STB) 1H25 Results

🍺 The Closer 🍺

I’m struggling to think of something humorous in what was a pretty dull week in banking but it’s worth flagging that it seems the ECB remains doubtful about the strength of banks’ digital capabilities as the following extract from its latest blog on the role of cash here attests to: “As a resilient and reliable means of payment, cash is indispensable, especially during crises. It remains functional even when electronic payment systems are disrupted by power outages, internet failures, software malfunction or other events.”. Sadly, we see these outages all too often nowadays.

Have a great week! 🍨

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.