Financials Unshackled | Weekly Briefing of 14th Dec 2025 (ECB Proposals and Much More)

The independent voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Before I start I wish to note that I published two in-depth thought pieces - which have attracted a significant level of interest - related to global, UK and Irish banking matters this afternoon at 16:20 BST. If you did not receive them please check in your Spam / Junk folder or email me at john.cronin@seapointinsights.com and I will send them to you. It has been a long day…

Welcome to the Financials Unshackled Weekly Briefing of 14th December 2025 - your weekly pack for critique and curation of key banking developments over the last week. It’s a relatively brisk note today in view of the aforementioned thought pieces. The final ‘Weekly Briefing’ of 2025 will be distributed on Sunday 21st December.

✂️ What’s In This Note ✂️

In-Depth: ECB proposals with particular focus on AT1s

UK: MTRO CEO Interview / Motor Finance redress scheme costs / FCA growth measures / UK Finance Business Finance Review / BoE Governor on private credit / BARC investment in United Fintech / HSBC UK branch promise / LLOY director share sales / FCA fines Nationwide £44m / JPMAM shareholding in OSB / PAG CFO share purchases / Revolut offering to buy back shares of former employees at 30% discount / Starling Bank eyeing up acquisitions

Ireland: Retail interest rates update / CBI report on a more effective and efficient regulatory and supervisory framework / housebuilding stimulus / Wellington shareholding in AIBG / Nua Homeloans CEO interview

Europe: Pierre Cipollone on the digital euro / Claudia Buch on evidence-based supervision / ECB to conduct a geopolitical risk reverse stress test

Global: SRTs in focus / Marc Rubinstein on how dispersion has returned in financials / McKinsey on CIB

🔎 The Critique 🔎

🇪🇺 ECB shocks the AT1 market

What Happened?: The ECB, on Thursday 11th December, set out its recommendations in relation to the simplification of the European prudential regulatory framework to much fanfare. Of most particular note were the first two recommendations:

The first recommendation is to reduce the number of capital stack elements. The ECB notes: “This could be achieved by merging the different capital buffers into two: a non-releasable buffer (merging the capital conservation buffer and the higher of the other systemically important institutions (O-SII) and global systemically important institutions (G-SII) buffers) and a releasable buffer (merging the countercyclical capital buffer and the systemic risk buffer). P2G would be kept separate, on top of the releasable buffer. Any reduction in the number of buffers must maintain the current allocation of macroprudential and microprudential powers and preserve the competencies of national and supranational authorities within the banking union. The calibration of all elements through clear common principles and methodologies, including a single exercise, would serve to avoid unwarranted overlaps or inconsistencies. This single exercise could be based among others on a modified EU-level stress test, reflecting European and national financial cycles and risks, as a starting point for the releasable buffer and the P2G. It should also avoid creating undue additional expectations.”.

The second recommendation is to adjust the design or role of capital instruments. Although AT1s are perpetual, they are typically called at their first call date which is one of the reasons why regulators are uncomfortable with respect to their going concern nature from a loss absorption perspective. The ECB Governing Council’s proposal is to enhance the capacity of AT1 capital “to absorb losses when a bank is operating normally, which would be Basel-compliant and maintain resilience. Alternatively, non-equity elements could be removed from the going-concern capital stack provided that Basel compliance and capital neutrality are not compromised.”.

The ECB also proposes to simplify capital rules for larger lenders and lessen the extent of its scrutiny of smaller banks.

Relevant Documents: ECB press release here, ECB press briefing slide deck here, ECB recommendations here, separate ECB report on streamlining supervision here, and a separate related ESRB report on simplification (published on 11th December) here.

Unshackled Perspectives:

The proposals on AT1 are just proposals. The ECB is a supervisor, not a legislator. As Jackie Ineke at Spring Investments notes on LinkedIn: “To really change the characteristics of AT1, or capital requirements relating to AT1, you need the European Commission, the European Parliament and the Council of the European Union to decide to act”. Nothing is imminent here and, for clarity, the ECB (Luis de Guindos) has been clear that proposed changes will not be retrospective.

There is a risk here that the proposals, if implemented, could serve to increase banks’ cost of capital - forcing banks to hold more CET1 capital or enhanced (read more equity-like and, therefore, higher risk and coupon) AT1 bonds as existing issues mature. This is a critical point.

The uncertainty that these proposals have caused is unhelpful and it is not entirely clear what the ECB wants. In particular, it is not clear if the ECB is proposing that overall capital requirements would remain unchanged though, as the FT picked up on here, the report does state that “any proposal to change the EU prudential framework should sustain current levels of resilience”.

Indeed, looking through one lens, it might be an overreaction to the current environment where there is, arguably, a stigma associated with not calling AT1s - as I remarked in Financials Unshackled Issue 58 on 17th August: “There is always a question mark as to whether banks will call their AT1s - though, in this yield environment, it is extremely likely (and confidence in this has strengthened following the recent introduction of a ‘tender extender’ model that allows for AT1s to be tendered a few months in advance of the expected date to capture the tight spreads available). Indeed, many issuers undoubtedly see the current yield environment as an opportune moment to lock-in low funding costs for some time - and, to the extent that yields widen in due course, the question as to whether issuers will call their instruments will become more prominent again.” - though I accept that latter comment is a point of debate.

And many regulators have already distanced themselves from the Swiss debacle - with the ECB confirming, on 20th March 2023, that in the case of a troubled EZ bank, the assumed creditor hierarchy in which shareholders bear first loss would apply: “In particular, common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier 1 be required to be written down. This approach has been consistently applied in past cases and will continue to guide the actions of the SRB and ECB banking supervision in crisis interventions.”.

However, the fundamental issue for regulators seems to be loss absorbency - with AT1 acting more like gone concern capital than going concern capital. Some strong arguments have been made in an AT1 potential phaseout context given this issue: see Satyajit Das’s piece in the FT of 3rd February here, for example.

Indeed, in a previous life many years ago (and as I noted in Financials Unshackled on 16th September 2024), I expressed a - controversial view at the time - that bank Boards and regulators have zero appetite for a bank’s capital level to approach MDA trigger levels (or, indeed, conversion or permanent write-down thresholds) and that could mean we eventually see AT1 disappear from capital stacks. The MDA trigger is the crucial line in the sand, because breaching it initiates an immediate, market-shocking action, i.e., the forced restriction of distributions, most notably the suspension of the AT1 coupon payments and ordinary dividends. The threat of this coupon suspension means that bank Boards will feel compelled to pursue a rights issue (to the extent that one is achievable) before capital levels come close to MDA thresholds, calling into question the practical loss absorbency nature of the AT1 instrument (which is why I always saw - save for in the case of banks in very serious difficulty (and Credit Suisse aside…) - the instrument as an attractive play).

📌 The Curation 📌

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ Metro Bank CEO interview:

The Sunday Times features an interview with Dan Frumkin, CEO of Metro Bank (MTRO), this weekend here, which is amusingly titled: “Metro Bank is thriving since I saved it from the doghouse”.

To state the obvious, there is never any new material non-public information imparted in these interviews. However, a few nuggets worth noting are: i) Frumkin thinks a branch estate of 120 would be viable (78 now; historically Vernon Hill had envisaged a network of 200 in size); ii) Frumkin noted that he is “debating” whether to build a “really good digital bank that sits next to physical estate”; iii) a reopening of RateSetter is under consideration: “We might dust it off again”; iv) MTRO is expecting to receive confirmation soon that it is to be reclassified as a transfer firm following the BoE PRA’s recent Policy Statement on MREL, meaning that its MREL requirements would be equal to its minimum capital requirements; and v) Frumkin commented that “We talk about the equity price at lot, but our bond prices are now above par because everybody believes in the future of Metro”.

Some perspectives:

It will be interesting to see what MTRO elects to do in terms of digital bank investment. It would be a sensible strategy in principle but could require substantial investment. There could be other workarounds in this respect too.

It is no surprise to learn that MTRO expects to receive confirmation that it is to be reclassified as a transfer firm soon. Frumkin’s comment in relation to the bond prices trading above par is also an interesting remark - while this clearly reduces the likelihood that MTRO will tender for its outstanding 2029 MREL £525m 12.0% debt in 2026, we’ll have to see what happens.

More broadly, Frumkin has indeed pulled MTRO back from the brink. He was instrumental in necessarily recalibrating the strategy quickly following his appointment to the Board on 1st January 2020 - rotating to focus on higher-yielding lending segments. Indeed, management continues to deliver on its strategy to further pivot towards higher-yielding lending and other assets and to optimise deposits to achieve a lower cost of funds whilst maintaining a keen focus on cost discipline and credit risk. The key question now in my view is can the medium-term targets be achieved in a commercial lending volume growth context within acceptable risk parameters.

2️⃣ Sector Snippets:

Reuters reported on Friday morning here that two sources and two other industry figures noted to the news agency that the FCA’s proposals in relation to a motor finance redress scheme, as currently drafted, could result in total costs for lenders in the region of £18-20bn - far ahead of the FCA’s own estimate for total costs of c.£11bn. The sources and industry figures also reportedly opined that the FCA “is likely to face a costly and time-consuming legal challenge” if the proposals are not recalibrated. This news report came ahead of the closure of the consultation period on Friday evening and represents a clear warning shot to the regulator (and, arguably, Treasury). Let’s see what comes in the Spring but I suspect there will be plenty of lobbying ‘behind closed doors’ in the interim. Indeed, the Finance & Leasing Association (FLA) also issued a press release on Friday afternoon here following the submission of its consultation response, with FLA CEO Shanika Amarasekara noting: “…The most important point is simple: a redress scheme must provide redress to those who have suffered loss as a result of an unfair credit relationship. Where we differ from the FCA’s proposals, it is because the evidence shows there are fairer, more targeted and more efficient ways to achieve that outcome….”.

The FCA announced on Wednesday 10th December its new growth measures for 2026 here - with support for UK-issued stablecoins to provide faster and more convenient payments a key feature of the plans. The FCA’s letter to the Prime Minister of 9th December here is also worth a read in this respect and the following extracts highlight the nub of its approach going forward: “Growth is a cornerstone of our strategy to 2030…Rapid technological change means we must focus on outcomes, not prescriptive rules. We will further adapt our supervisory approach, with more tailoring to firms’ size and type, accepting some things will go wrong and prioritising the most egregious harms. A clearer articulation of the Government’s risk appetite with metrics would help anchor this shift and support innovation and growth.”.

UK Finance published its Business Finance Review for Q3 2025 on Thursday 11th December here. The key finding was that 3Q25 saw further y/y growth in gross lending to SMEs (to £4.2bn in 3Q, +6.4% y/y) though the pace of expansion continues to moderate (2Q lending flows were +8.3% y/y, for example) - with UK Finance observing that “surveys point to a wobble in already subdued business sentiment in the run up to the budget"…linked to concerns that businesses would again be called upon to plug a hole in the public finances”.

Eminently sensible remarks as always made by Andrew Bailey, BoE Governor at The Global Boardroom summit organised by the FT this week noting that regulation applicable to private credit firms ought to be less severe than the regulation applicable to banking institutions: “The liability side of banks is money...Banks have money as their liability. Non-banks have investment, and the two do get muddled” (as reported by CityAM here).

3️⃣ Company Snippets:

Barclays (BARC) has made an investment in United Fintech, the fintech infrastructure and ecosystem for financial institutions, asset managers & wealth managers - and now sits alongside other bank shareholders including BNPP, Citi, Danske Bank, and Standard Chartered. United Fintech press release from Wednesday 10th December here.

It was widely reported in the media this week that HSBC UK (HSBA) is following in Nationwide’s lead to extend a ‘Branch Promise’ - noting that no branches in the UK will be shut until 2027. Sally Williams, Head of the branch network at HSBC UK noted that “We are investing heavily into our physical network so that we can continue to service our customers, including those with more complex needs who value in-person interaction for those moments that matter” (as reported by CityAM). Indeed, bank branches are having something of a revival in the UK and further ashore with banks using them as hubs, wealth advice centres - and, potentially in my view, locations for customer demos in relation to how to engage with and get value from agents on banking apps.

Lloyds Banking Group (LLOY) announced on Tuesday 9th December that Jayne Opperman (CEO, Consumer Lending) disposed of 688,578 shares in LLOY at a price of 95.3p per share on that same day - for gross proceeds of >£650k.

The FCA announced on Friday that it has fined Nationwide Building Society £44m for failings in anti-financial crime systems and controls between October 2016 and July 2021 (press release here and Final Notice here). While the findings are damning: “Between 1 October 2016 and 1 July 2021 (“the Relevant Period”) there were deficiencies in Nationwide’s AML systems and controls which had a material impact on its ability to monitor effectively its customer relationships”, it is important to note that the failings did not happen under the stewardship of the current leadership team - and Nationwide’s response was both humble and reassuring from a customer standpoint: “Nationwide identified these issues, which relate to controls in place before July 2021, through its own reviews, and voluntarily brought them to the attention of the FCA. The Society cooperated fully with the FCA investigation, and we are sorry that our controls during the period fell below the high standards we expect. Since 2021, Nationwide has invested significantly in all aspects of its economic crime control framework in order to ensure our systems are robust. We do not believe that these controls issues caused financial loss to any of our customers and remain committed to preventing economic crime and protecting our customers and the wider UK economy from fraud.”.

OSB Group (OSB) announced on Tuesday 9th December that JPMAM’s shareholding in OSB reduced to 5.22% (previously disclosed shareholding: 5.27%) following a transaction on Friday 5th December. OSB issued a further RNS on Friday 12th December noting that JPM’s shareholding in OSB increased again to 5.26% on Thursday 11th December.

Paragon Banking Group (PAG) announced on Tuesday 9th December that Richard Woodman (CFO) acquired, via a SIPP, 15,000 shares in PAG at an average price of 808.3p per share on that same day - for an outlay of >£120k.

The FT reported here on Tuesday 9th December that Revolut has offered to buy back the shares of former employees at a 30% discount to its latest fundraising valuation of $75bn.

The FT reported here on Thursday 11th December that Starling Bank is “exploring plans to buy another UK lender” and is said to be “actively looking at several acquisition options that would allow it to expand its lending capacity and deploy deposits into areas that could generate higher returns, such as corporate lending” - with potential for a large-scale acquisition in this context. Why would Starling be thinking of a sizeable transaction in this segment? Put simply, it is struggling to lend. I wrote the following in Financials Unshackled Issue 48 on 29th May last for those who want more context:

Stepping back, an examination of Starling Bank’s balance sheet raises serious question marks in relation to the strategic direction of travel. Despite all the hype a few years ago when a solid case was made for an organically scalable UK credit institution, leveraging a low cost deposit franchise and a keen cost base (which I admittedly subscribed to as well), Starling’s deposits stood at just £12.1bn at 31st March 2025 – representing a growth rate of 10.0% y/y but: i) is off a very low base relatively speaking; and ii) was likely bolstered by the fact that Starling increased rates paid on its current accounts in the year. As an aside, higher funding costs drove a 22bps NIM reduction in the year to 412bps – despite a material uplift in asset yields.

What’s more, Starling delivered loan growth of just 2.9% y/y – which is broadly in the range of what the large incumbents are delivering in terms of annual growth. But, in Starling’s case its net loans stand at just £4.7bn compared to £466bn over at Lloyds Banking Group (LLOY) at the same date, for example – so Starling’s loan book grew by just over £100m in the 12 months to the end of March while LLOY churned out £17.7bn of growth over that same time period. As has been well-documented, Starling took on a disproportionate share of Covid-era guaranteed business loans, which are unwinding now at a rapid clip – acting as a meaningful brake on overall growth. But underlying growth volumes are hardly material in a broader market context.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ Retail Interest Rates:

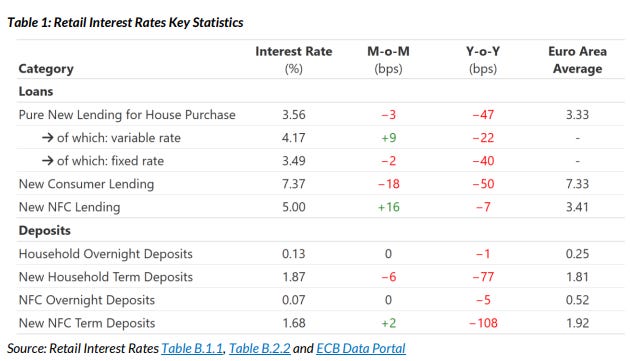

The Central Bank of Ireland (CBI) published its Retail Interest Rates update for October 2025 on Wednesday 10th December here and an excerpt from the release, neatly summarising key movements, is shown below.

As I have previously written, an important point to flesh out is that, while new household term deposit rates are above the euro area average (1.87% versus 1.81%) and new NFC term deposit rates are below the euro area average (1.68% versus 1.92%), it is important to remember that the relevance of this from a banking sector net interest margin (NIM) perspective is extremely limited for two key reasons: i) the percentage of deposit stock attributable to term deposits in the Irish market is very low compared to other jurisdictions (over 90% of the listed banks’ deposit funding is represented by current accounts and demand accounts, i.e., overnight product); and ii) deposit churn (or flow to term) has been minimal (talking about deposit beta as rates come down is pointless in my view yet management teams keep on talking about it because it suits their narrative - just look at the absolute quantities of flow to term) and has clearly slowed. What is particularly interesting about the Irish deposit market is that demand accounts earn relatively little - in stark contract to the UK, for example (for instance, the CBI release notes that the weighted average interest rate on household and NFC overnight deposits in totality was 0.13% and 0.07% respectively in October). For context, on my calculations, AIB Group (AIBG) and Bank of Ireland Group (BIRG) paid in the region of just c.25bps on their entire stock of ROI deposits in 1H25. I think this context should be provided in the release.

As a final note on this, the fact that Irish households invest very little has received a lot of media attention lately - with Joanne Hunt at The Irish Times writing on this very topic here a few hours ahead of the CBI release. Suffice to say government has done next to nothing to help the Irish consumer here - be it from a deposit movement perspective (for example, there has never been any talk of - or desire - to set up a scheme along the lines of the UK’s CASS, for example) or from an investing perspective (indeed, senior government figures are probably equally spooked about anything other than cash, bank deposits, and property if I was to hazard a guess). However, that might change if PTSB is sold.

2️⃣ Sector Snippets:

The Central Bank of Ireland (CBI), on Wednesday 10th December, published a report setting out its approach to a more effective and efficient regulatory and supervisory framework, reducing complexity and improving clarity while maintaining resilience and important protections in the system (press release here and report here), which began in January 2025. The report, while quite high-level, is a welcome publication. However, the CBI remains very clear that this is not about deregulation and is instead a bid “…to enhance the quality of regulation and supervision, making it more effective, easier to understand, more proportionate, and better aligned with risk”. In a separate (and wider), but yet a somewhat interrelated vein, it was interesting to digest the contents of the Banking & Payments Federation’s (BPFI) consultation response on the development of the priorities and policy programme for Ireland’s Presidency of the EU Council in 2026 on Friday - press release here and report here. The report reiterates the BPFI’s call for a simplification of the regulatory framework and, buried deep in the report itself, is a call for European supervisory authorities (p.11) to be tasked with achieving competitiveness and growth as part of their mandates. The BPFI called for the CBI to be ‘granted’ a secondary competitiveness mandate (like the UK’s PRA) in a seminal position paper last September - but the fact that Friday’s press release did not make any mention of this (instead it was buried in the detail of the report itself as noted above and wasn’t given prominence as far as I see it) will likely be seen by some as a recognition that this is not a runner in reality at the very least - or indeed that the BPFI may have been warned to tone it down. My view: don’t bank on it, though I would say that the probability has increased marginally since the change in Finance Minister.

Interesting to read an exclusive report in the Business Post this weekend here on how the Land Development Agency (LDA) is in discussions to borrow up to €1bn from the EIB to ramp up construction of new homes - with the funds potentially financing the construction of >2,500 homes based on the average cost to the LDA. The LDA CEO John Coleman reportedly noted that discussions are expected to be finalised in the new year (“We’re in a process at the moment with the European Investment Bank where we will have a framework that we can draw down as projects go into development. So we’ll look for facilities somewhere between €500 million to €1 billion through 2026 and draw that from 2027.”). It sounds like: a) either a done deal is done in all but writing given the CEO is reportedly talking to the press on it; or b) a push to exert pressure finalise the deal without delay - far more likely to be a) in my view or maybe a blend of both to speed things up. While some will see this as crowding out the private market (and there has been more than just a grain of truth in that with respect to some other government agencies in the past in my view) I am broadly of the opinion that the LDA’s intervention is both necessary and beneficial because it targets areas where market failure is highest (i.e., where commercial developers and banks have left a gap) and helps address the well-documented housing crisis. The LDA focuses on two types of property: i) Cost Rental; and ii) Affordable Purchase. To the extent that the EIB funds will be primarily deployed towards Cost Rental (which is my assumption and understanding), it won’t, as a first order effect, increase the size of the addressable mortgage market - but the wider effects of improved supply will be of course be welcomed by the banking industry.

3️⃣ Company Snippets:

AIB Group (AIBG) announced on Thursday 11th December that Wellington’s shareholding in AIBG reduced to 3.99% (previously disclosed shareholding: 4.05%) following a transaction on Wednesday 10th December.

I enjoyed reading an interview published in The Sunday Times with Mark Watson, CEO of Nua Homeloans here. A few interesting points made: i) Nua has originated >€300m of mortgages in its first 16 months of operation, equivalent to a c.2.5% flow share; ii) Watson talks about Nua finding a niche in the lesser served areas of the mortgage market (equity release, debt consolidation, lengthier terms) and, interestingly, notes that “Everybody talks about affordability, but I don’t think that’s what borrowers really care about. The borrower wants the biggest mortgage they will be approved for. Access matters a lot.”, which some may interpret as a sign of things to come; iii) a digital app-based direct-to-consumer offering (which, in my view, is a spot where newcomers could be somewhat disruptive relative to the sleepy incumbents) is potentially in the offing though Watson adds a note of caution in the context of Nua’s current capacity as a lender through intermediaries in this respect: “Once you go direct, you are in a completely different world…But we think we’ve got some really good technology that we want to evolve over the next 12 months to see if we’re ready”; and iv) more fundamentally, Watson talks about how Nua’s funding model could evolve: “We’re kind of pioneering a mainstream prime mortgage non-bank model…I think we’ll be able to develop a broader investor base into the Irish mortgage market and obviously I think Irish consumers are the ones that will benefit from that”.

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ Just a few snippets this week:

Pierre Cipollone, Member of the ECB’s Executive Board spoke in Frankfurt on Monday 8th December on the transformation of money. It was a lengthy speech (transcript here) arguing that central banks need to take a leading role in the transformation - a view with which I concur despite what is going on in the US. It is worth reproducing Cipollonne’s remarks in relation to preserving the role of banks in financing the economy in light of the transformation that is taking place: “The digital euro has been designed to preserve the role of banks in the financing of the economy. In the euro area, banks assume a key role in this regard and thus in the transmission of monetary policy. We have no intention of disrupting this role. In fact, the digital euro will protect it. Banks will be at the centre of the digital euro distribution; they will keep the customer relationship and manage the digital euro accounts. This will allow them to retain data that are crucial for assessing the creditworthiness of their clients and thus for their role in financing the economy. And we will prepare with banks so that they are ready to distribute the digital euro. In 2027 we plan to launch a pilot offering banks an opportunity to gain first-hand experience in a simulated digital euro ecosystem. This pilot will not only provide the Eurosystem with valuable insights, but will also allow banks to provide feedback. Moreover, the digital euro will allow banks to be compensated (they will continue receiving fees), while no longer having to pay the fees charged by international card schemes (as the Eurosystem will cover scheme and settlement costs). And by offering a convenient payment solution, the digital euro will reduce the risk that the banks’ customers turn to alternatives. This will reduce the risk of deposit outflows to stablecoins, which could soon represent an alternative to banks as the source of funds for payments with cards and mobile solutions. Several safeguards have been included in the design of the digital euro to ensure it does not disintermediate banks. First, the digital euro will not be remunerated. Second, a link to their commercial bank account will allow consumers to pay amounts that exceed their digital euro holdings, thereby reducing their incentive to keep high digital euro holdings in the first place. And third, digital euro holding limits will avoid any destabilising deposit outflows.”.

Claudia Buch, Chair of the Supervisory Board of the ECB, spoke on Tuesday in Frankfurt on the topic of evidence-based supervision (transcript here). Buch highlights once again her resistance to regulatory loosening: “Some argue that relaxing banking regulation or supervision could unleash productivity and growth. I am strongly convinced that deregulation and “de-supervision” are not the right paths to take. It would only weaken resilience at a time when it is needed the most. Resilience and growth are two sides of the same coin.” and she sets out coherent arguments to support her position.

The ECB issued a press release here on Friday 12th December noting that it will conduct a geopolitical risk reverse stress test on 110 directly supervised banks in 2026. This reverse stress test will complement the 2025 EBA stress test, which assumed a common scenario for all banks and led to differences in their capital depletion. The 2026 thematic stress test will ask banks to assess how geopolitical risk could affect their business model. Simplification initiatives aside, it feels like this test has the potential to push up capital requirements in cases.

🌎 Global Unpacked - My Top Picks 🌎

1️⃣ Just a few snippets this week:

Bloomberg published a useful ‘Explainer’ piece on SRTs here on Monday 8th December - which picks up on the fact that SRTs, which have been traditionally tied to corporate loans, have been spreading into other lending segments. A further piece penned by The Editorial Board at Bloomberg on Tuesday here picks up on the risks associated with the proposed new European rules which would facilitate the sale of unfunded protection by certain large, highly rated, multiline insurance companies.

I enjoyed Marc Rubinstein’s Net Interest post on Substack this week here on how dispersion has firmly returned in the world of financials. He wraps up noting that it’s “…a stockpicker’s paradise: banks with steadier earnings and lower risk premia; payments reshaping under competitive and pricing pressure; and alternative managers facing a longer, more uncertain test. Dispersion has returned, and with it the chance to generate absolute returns by doing the work across a sector most generalists still underweight. The opportunity is there for 2026; the trick, as ever, is knowing where to look.”.

McKinsey published a report on Thursday 11th December here focused on how CIB players “need a new playbook to thrive in an environment of geopolitical and macroeconomic uncertainty; the rise of non-bank attackers, and increasing AI adoption”.

📆 The Calendar 📆

Look out for these in the week ahead:

🇮🇪 Mon 15th Dec (11:00 BST): Central Bank of Ireland (CBI) SME and Large Enterprise Credit and Deposits - Q3 2025

🇮🇪 Wed 17th Dec (11:00 BST): Central Bank of Ireland (CBI) Mortgage Arrears Statistics - Q3 2025

🇬🇧 Thu 18th Dec (12:00 BST): Bank of England (BoE) Monetary Policy Summary & Monetary Policy Committee (MPC) Meeting Minutes

🇪🇺 Thu 18th Dec (13:15 BST): European Central Bank (ECB) Governing Council Monetary Policy Decision followed by a press conference at 13:45 BST

🇮🇪 Fri 19th Dec (00:01 BST): Central Bank of Ireland (CBI) Quarterly Bulletin - 2025:4

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.