Financials Unshackled | Weekly Briefing of 9th Nov 2025 (UK Political & Regulatory Tailwinds - and much more)

The independent voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to the Financials Unshackled Weekly Briefing of 9th November 2025 - your weekly pack for critique and curation of key banking developments over the last week.

✂️ What’s In This Note ✂️

In-Depth: UK political and regulatory tailwinds? Covers FCA motor finance consultation extension, bank taxes, and BoE push for banks to draw down on their capital stack without fear of a supervisory response.

UK: Lloyds’ AI updates / seminar highlights substantive progress; Metro Bank publishes upbeat 3Q25 trading update; OSB Group 3Q25 trading update reads well; Other Snippets; Shareholding Changes

Ireland: AIB Group rounds off Irish banks’ 3Q season with a strong update; Bank of Ireland Group issues senior unsecured at a keen coupon; Perspectives on PTSB sale process; IG launches new commission-free investing product; BPFI reports strong growth in personal loans in 2Q; Shareholding Changes

Europe: ECB cautious on synthetic risk transfers; Other regulatory matters of note; S&P Global Ratings presentation on European Banks

Global: Private credit in the spotlight

To unshackle your understanding of the week’s banking developments please read on to explore critiques, curated insights, and your calendar for the week ahead.

🔎 The Critique 🔎

In this section I dissect the week’s most significant banking development(s) / theme(s) of interest across key regions as appropriate, cutting through the noise to get to the crux of the issue.

🇬🇧 UK Banks: Political and regulatory tailwinds? 🇬🇧

What Happened?

Three major (likely) favourable developments this week from a UK banking sector perspective - which, more symbolically in my view, reflect an emerging more constructive political and regulatory backdrop:

The FCA announced on Wednesday morning here that the consultation period for its motor finance scheme has been extended to 17:00 on Friday 12th December (from Tuesday 18th November).

The FT reported later on Wednesday here that a number of people close to the Chancellor’s thinking in relation to upcoming 26th November Budget measures have indicated that Reeves is “not minded to” increase the tax burden for banks - with raising taxes on banks said to be “a long way down” the Chancellor’s list.

Bloomberg also reported on Wednesday morning that Sarah Breeden, Deputy Governor for Financial Stability at the BoE, noted at a conference in Spain on Tuesday that she wants to change “the approach to the [capital] buffers that the banks have” in a bid to free up more capital for lending purposes.

Unshackled Perspectives:

Prelude:

The week started off with an op-ed in the FT penned by Patrick Jenkins here in which he staunchly defended the banking sector - arguing that no further taxes should be imposed as well as casting bankers in a highly favourable light arguing that those who still harbour distrust of banks “…trace a link back from today’s broken public services to the years of austerity that followed the 2008 crisis”. I’m a strong believer in the need for a well-capitalised profitable banking sector to ensure the proper functioning of the financial system et al. and I agree with most of Jenkins’ points. However, I believe there is another side to the argument as well. At one level it is hardly outrageous to push banks to pay higher taxes in good times - after all, they have the privilege of what is effectively a substantial government-granted subsidy to enable them print substantive profits in the first place, i.e., the banking licence (though it is notable that there is more openness in the UK to issuing licences than in other more closed jurisdictions where it could reasonably be argued in my view that the regulator, in a bid to maintain significant control, vociferously protects the entrenched strength of domestic incumbents). Nor do I fully subscribe to the view that distrust in bankers is essentially misplaced - while the current crop of UK bank executives certainly seem to me to be a highly responsible and ethical bunch, it seems naive to, more broadly, suggest that all bankers can be trusted after all the scandals we have seen over the years.

FCA extension to redress scheme consultation:

The FCA attributed its decision to extend the motor finance redress scheme consultation to the fact that analysis of the extensive market wide data (procured by lenders and some consumer and dealer representatives as part of the consultation process) will take time. This appears to me to be a sensible decision. Notably, the FCA observes that “As well as feedback on the methodology for calculating redress, issues raised so far include the time period for the scheme; the rate of compensatory interest; how independent mechanisms will ensure confidence (including the role of the Financial Ombudsman Service and ideas for alternative approaches); how smaller firms or those with a low number of agreements eligible for redress can operate the scheme in a cost-effective way; how to prevent fraud; and what the relationship between motor manufacturers and their captive lenders means for commercial ties, particularly in relation to lending for the purchase of new cars.”. The FCA’s proposed definition regarding what constitutes a high commission rate (i.e., commissions that are 35% or more of the total cost of credit and 10% or more of the loan amount) is notably absent from this ‘list’ though I suspect this too is under consideration.

Following the FCA announcement, Jill Treanor at The Sunday Times reports this weekend here that motor finance firms are apparently pressing for the scheme to exclude the 2007 through early 2014 period on the grounds that the FCA requires secondary legislation to give it the power to enforce compensation for that timeframe given it did not assume responsibility for regulating consumer credit until 1st April 2014 (see here) - though the FCA has reportedly denied it would need new legislation to enact its scheme for that period.

Public pressure remains relentless in the wake of the FCA’s extension announcement - with: i) Lloyds Banking Group (LLOY) CEO Charlie Nunn raising his concerns about investability and sentiment towards the UK at the House of Lords Financial Services Regulation Committee on Wednesday (watch here): “Having a scheme like this, that can take away more than 20 years of profitability from the sector, is a really difficult issue for both global companies looking to invest in the UK – and for that matter my investors looking to invest in financial services”; and ii) FirstRand noting on Thursday that the proposed redress scheme is significantly beyond its expectations of what can be considered proportionate or reasonable - adding that “The group continues to engage with the FCA and will consider all options and reserve all legal rights should the final scheme represent an unfair and or disproportionate outcome for lenders” (as reported by Bloomberg here) - a clear warning that a judicial review challenge is in mind.

I remain of the view that we will see a significant softening of the redress parameters. In theory, a regulator would work through all of the arguments, consider their merits/demerits, and arrive at a sensible judgment on balance. Indeed, the regulator will surely diligently undertake this exercise but the reality is that stand-off situations like this are often akin to a game of poker in terms of the ultimate outcome - where the regulator may want to cede as little as possible to stave off a potential judicial review (while retaining a good degree of open-mindedness in relation to powerful persuasive arguments that force it to rethink some of its earlier positions) and that’s where this is likely to end up in my view, i.e., a softening that will be enough to cause the lenders to drop any threats of a judicial review. Depending on the extent of the softening, there is always the risk that there is a subsequent legal challenge (in the other direction) to particular parameters of the scheme on the part of motor finance customers - but this is unlikely to cause the lender executives to lose too much sleep in the wake of the August Supreme Cout judgment.

Bank taxes:

The market took the soundings reported in the FT piece on Wednesday seriously, with a material appreciation in UK bank share prices observed in response to the article. While there will be some residual nervousness - given the article appeared three weeks out from the Budget, the comments seemed pretty definitive and it does look like the balance of probabilities suggests that no increase in bank taxes (including the idea of an excess reserves tax) is on the agenda for the 26th November Budget. Indeed, as I have previously written, the fact that the FCA motor finance consultation shall remain open beyond the Budget is, in my view, also not unhelpful to the lenders in this vein. Finally, I also suspect that Reeves harbours some concerns to the effect that the Leeds Reforms may prove to be something of a damp squib in the end despite the hullabaloo surrounding them at the time. CityAM reported on Monday here that Simon Ainsworth, Banking Analyst at Moody’s, told the newspaper that the package was “not really going to be moving the dial to a material extent for UK banks” - and I suspect that point has been made by various banking executives to Reeves too. If so, then Reeves is likely to be more inclined to let the lenders off the hook when it comes to tax increases.

On a separate note, for the sake of the BTL lenders, let’s hope that the Chancellor does not follow the Resolution Foundation’s recommendation that landlords should pay National Insurance at a basic rate of 20% with a higher rate of 28% applicable to property earnings above £50,270 p.a. Indeed, Adam Corlett of the Resolution Foundation argues here on Thursday that “The end goal should be that rental income faces the same top rate of 47 per cent, higher rate of 42 per cent and basic rate of 28 per cent as income from work (though the 8 point jump in the lower rate, from 20 to 28 per cent, could warrant a phasing-in at least).”.

Capital buffers removal:

On Breeden’s drive to change the approach that banks have to their capital buffers, it is the self-imposed management buffers that are in focus. Breeden argued that lenders should feel able to draw down on their capital stack without fear of a supervisory response, such as a dividend blocker. This could theoretically free up to 50-100bps of CET1 capital - and possibly more in some cases - on my estimates. However, one needs to reflect on Breeden’s comments more broadly in my view: “How can we think about changing the approach to the buffers that the banks have got? It’s not just simplifying. It’s changing the structure so that it can properly be used.”. These comments suggest to me that there is a very strong push to reduce the capital burden more broadly on banks and I suspect that a potential major restructuring of the CCyB approach particularly is in very sharp focus. Lenders keenly await the outcome of the BoE FPC’s Capital Framework Review at 07:00 BST on Tuesday 2nd December. Many questions have been fielded on recent earnings calls in relation to bank management team’s expectations and potential implications for their target CET1 capital ratios / ratio ranges. Executives have been understandably coy but it is my suspicion that major UK banks are hoping for a minimum one percentage point reduction in target CET1 ratios on the back of the outcome of this FPC Review. Let’s see - but, to the extent that’s where it ends up, it would be highly meaningful for: i) RoTE augmentation; and ii) surplus CET1 crystallisation to be deployed towards lending / M&A / shareholder distributions.

Closing remark:

The executives at the large UK banks have played a blinder. The approach to provisioning in a motor finance redress scheme context and the relentless public warnings in relation to the damage this compensation scheme could inflict on the UK’s investability - led by LLOY but with others (especially FirstRand) playing their role likely to be exerting pressure. On taxes, there has been a concerted effort across the industry - with UK Finance playing a critical role - to highlight the large tax burden that lenders already face and to highlight other challenges faced by the lenders - all of which seems to have been grasped by the Chancellor. Indeed, in a broader regulatory burden context, the sector’s voice has been heard with some changes already achieved - as well as further important milestones ahead (e.g., the Capital Framework Review, ringfencing). It is for sure a changed political and regulatory backdrop.

📌 The Curation 📌

In this section I collate select key banking developments across key regions, cutting through the noise to get to the nub of the issue in cases.

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ Lloyds’ AI updates / seminar highlights substantive progress

Lloyds Banking Group (LLOY) assaulted the market this week with a wave of press releases on its AI initiatives as well as a fascinating investor seminar on Thursday on its Digital & AI capabilities. See here to read about: i) its latest Consumer Digital Index which highlights how 56% of UK adults have used AI for financial management purposes in the last 12 months; ii) the launch of LLOY’s first large-scale multi-feature AI-powered financial assistant through its mobile app; and iii) the group’s classification as “Outstanding” (Top 20 world digital bank in a study that benchmarks over 300 retail banks globally for digital excellence) in Euromoney’s Global Digital Banking Report this week.

The presentation, webcast replay, and transcript of the Digital & AI investor seminar (run by CEO Charlie Nunn and COO Ron van Kemenade) can be accessed here and I would encourage anyone with an interest in this subject to listen back. Nunn appears to me to be a highly mature real leader who displays deep strategic perspective and focus, confidence in the direction of travel, decisiveness, and humility in equal measure. Van Kemenade arguably displays more flair which is not to take in any way from his obvious deep strategic focus and clear command of the digital brief. The two make for a very strong combination (with some parallels between how the LLOY CEO & CFO make for a highly effective combination I would argue - though for different reasons).

I reported a few months ago on Group COO Ron van Kemenade’s leaked remarks on an internal call to the effect that the bank’s service towards its customers has “degraded” over the past weeks and months which is a function of “…probably ten to 15 years of underinvestment”, which he apparently likened to a house falling into disrepair. No mention of this at the session but it was, implicitly, cleverly dealt with at the outset with van Kemenade commenting that there was a lot of work to do in mid-2023 and with both executives acknowledging LLOY’s substantive progress in the context of legacy challenges - whilst acknowledging that there is more to do more widely. Indeed, I can imagine van Kemenade making those aforementioned comments in a bid to push people along as I suspect his ambitions can be hard to please at times - surely a good thing from a shareholder perspective.

In overall terms it was a slick presentation and highlighted LLOY’s emerging competitive advantages relative to peer UK banks. Topics discussed in an AI context included embedding AI with the mobile app (driving improved onboarding speed and improved customer engagement - with additional services and innovative propositions in focus) and the use of GenAI to reimagine customer propositions (e.g., scaling financial advice services without adding headcount). LLOY’s work on the UK Finance GB Tokenised Deposits initiative (which it acknowledges is both offensive and defensive in a digital currencies / stablecoins context) was also discussed in significant depth.

In short, my own perspectives were: i) LLOY is ‘ahead of the game’ in an AI development context relative to UK peer banks; and ii) this is likely to lead to opportunities for revenue enhancement (disintermediation, personalisation / product customisation, cross-selling) and efficiency capture which could be highly material in time (fundamentally this will spring from higher quality customer relationships and rich data access). It didn’t come up on Thursday but I would also add that enhanced product customisation and risk profiling ought to be conducive to a below-market impairment rate across the lending segments. All that being said, one should not underestimate the ability of LLOY’s well-resourced large bank peers to catch up / demonstrate strong innovation in this vein too. We’ll learn more at the Strategy Update in the early new year and it will be interesting to see if Nunn opens up more at that stage about the potential internationalisation opportunity - where LLOY seeks to leverage its technological capabilities and data build to export best practices / core competences to other markets. But, without getting overexcited, the message is clear - the gameplan is one step at a time, moving decisively forward.

As a final aside, it was interesting to hear Nunn characterise and van Kemenade characterise LLOY as the largest fintech in the UK. Is the ultimate game plan to transition LLOY to be as much a technology company as it is a bank - playing into that push that we have seen amongst some of the neobanks to solicit a quasi-tech company valuation? Though one suspects that would just be the eventual natural outcome to the deeply considered strategy the Board is pursuing in someone like Nunn’s mind - not an end, or a first order objective, in and of itself. Is this capability what will determine who the winners and losers are in a banking sector context on a long-term view? Surely so. This ‘industrial evolution’ as I have termed it in the past is something many have been thinking deeply about for many years given digitalisation / data analytics / LLMs / Revolut / etc. but more in a philosophical context - though it does feel like we are beginning to emerge slowly towards the cusp of what will be something of a shakeout within the world of banking on a 5/7/10Y forward-looking view. Different markets will undoubtedly evolve at different paces given local regulatory frameworks and politics et al. but ‘change it is a coming’. I digress…

2️⃣ Metro Bank publishes upbeat 3Q25 trading update

Metro Bank (MTRO) published a 3Q25 trading update for the three months to 30th September on Wednesday. In short the messages were positive: i) continued growth in underlying and statutory profitability, with all guidance for FY25 and beyond reaffirmed; ii) 12% q/q growth in target lending segments (Corporate, Commercial and SME, and Specialist Mortgages) as the asset rotation strategy continues (notably net loans were +1% q/q to £8.82bn, reflecting target lending segments growth and non-core lending run-off); iii) deposits -1% q/q to £13.21bn driving more Balance Sheet efficiency (LTD +2pps q/q to 67%) and better margin; iv) exit NIM of 3.03%, within FY25 guidance range of 3.00-3.25% though that’s still a tough target given 1H25 NIM print of 2.87% (with 2Q25 exit NIM of 2.95%) and the substantive reduction already achieved in cost of deposits (though the exit CoD of 0.95%, which has continued to glide downwards, will be constructive in 4Q - which is down from 1.16% average CoD for 1H25 and 2Q25 exit CoD of 1.02%); v) strong credit quality and prudently provisioned; and vi) MTRO reaffirms that it expects to be classified as a transfer firm under the BoE’s new policy, removing the need for MREL going forward - noting that it “continues to review its liability structure on an economic basis in the context of its ongoing regulatory and liquidity needs”.

All in all this has to be seen, in my view, as a positive update. It was unlikely that anyone had expected any more detail / updates in the context of the outstanding MREL debt - or any final confirmation to the effect that MTRO will be a transfer firm (we’ll presumably get that on 1st January - or maybe shortly before then). Some may have expected a slightly better 3Q exit NIM but it is notable that FY25 guidance has been maintained. Finally, one point that did catch my eye was the slightly lower credit approved pipeline of £750m at end-3Q (versus £800m at end-2Q) - it is important not to overanalyse a single datapoint (especially given seasonal factors, perhaps - and a relatively small q/q delta in any event) but, given the importance of growth in target lending segments to the delivery of MTRO’s target returns, it will be important to see continued strong net lending expansion delivery. This is the most critical challenge within the plan as I see it.

3️⃣ OSB Group 3Q25 trading update reads well

OSB Group (OSB) published a 3Q25 trading update for the three months to 30th September on Thursday. In short, it was a positive update with the following key notables: i) net loans +£157m q/q to £25.6bn (i.e., +0.62% q/q or +2.5% y/y) and that also reflects the sale of £130m of second charge loans in September, which suppressed the growth (originations of £3.4bn in 9M25 were +19% y/y, for instance - with OSB noting that it is “delivering on its plan to evolve its loan book mix”); ii) retail deposits +£669m q/q to £25.3bn (i.e., +2.72% q/q or +10.9% y/y) - note that TFSME repayments were £656m in 3Q; iii) OSB notes that the cost of funds remained elevated in the 3Q in the run-up to large market-wide TFSME repayments; iv) 3M+ arrears were back down to 1.7% at end-3Q (from 1.8% at end-2Q); and v) the CET1 Capital ratio came in at 15.8%, +c.10bps q/q.

A few observations:

It’s hard to know if OSB’s comment about an elevated cost of funds in 3Q is an attempt to issue a note of caution in relation to NIM evolution but it might be. Sell-side analysts will probably have a better read than I based on their ongoing engagement with IR on their models but if I were a stakeholder it’s a question I would be asking. At 1H25, the company noted that “Net interest income and net interest margin reduced compared to the prior period primarily reflecting more costly spreads to SONIA as the savings book continued to recycle, partially offset by more resilient back book performance and an emerging benefit from higher yielding sub-segments” (NIM was -7bps y/y to 230bps for 1H25), i.e., they married a negative comment with a positive one which they didn’t do in the 3Q update (though they may not have felt compelled to in what are typically short quarterly updates). The fact that they called out the pressure - especially given it was “expected” - leads me to be a bit nervous that management might be expecting NIM to be a touch below 225bps for FY25 (guidance is for c.225bps which gives some bandwidth here - and maybe management just thinks consensus of 226bps is just a few bps too much).

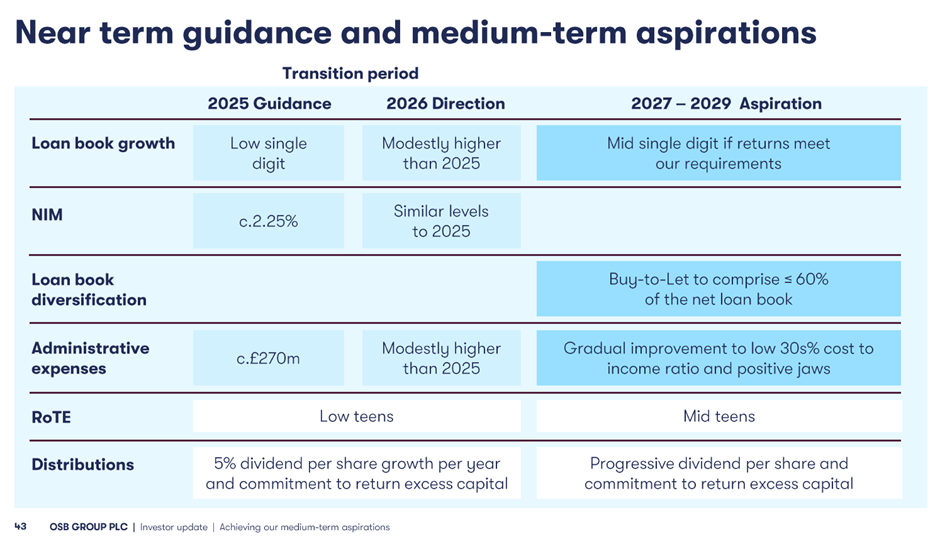

Putting the 3Q trading update aside, OSB is inevitably, in my view, going to see a significant structural uptick in CoR in due course (only 44% of 1H25 originations were BTL; 15% were Commercial, 16% were Bridging, 5% were Residential Development). If the housing market freezes at some point they could get caught on bridging (and Residential Development potentially too). Consensus loan loss ratio expectations look too low to me (FY25F: 5bps, FY26F: 9bps, FY27F: 10bps) and surely incapable of extrapolating into perpetuity in any valuation assessment (it looks like analysts are just extrapolating recent run rate experience / backsolving to RoTE guidance given no firm steer from management on this line item and I’d doubt there is any great science or detailed analysis underpinning these assessments). Also, OSB’s ECL Coverage ratio of 0.49% at end-1H25 is very low relative to the wider UK banking universe (even in the context of collateralised books) – that’s Stage 1 coverage of 0.07%, Stage 2 coverage of 0.76%, and Stage 3 + POCI coverage of 7.14%. PAG also reports low 0.47% ECL coverage but it’s a lower risk business model in my view and has exhibited structurally lower CoR than OSB historically even prior to the recent evolution of OSB’s loan book into higher-risk lending segments - and PAG’s coverage is stronger at a Stage 1, a Stage 2, and a Stage 3 level (that’s Stage 1 coverage of 0.11%, Stage 2 coverage of 0.87%, Stage 3 coverage of 15.39%). Indeed, OSB’s CoR was 33bps/23bps/16bps in FY14/15/16, for example - when it was a lower risk business than what it is becoming. It should surely get back to and over those levels given new lending forays. And going back to the 13th March Investor Update Presentation it is very interesting (and careful I would say) that they don’t guide on CoR as the extract from Slide 43 of that Investor Update deck shows:

4️⃣ Other Snippets:

The Guardian published an exclusive interview with David Bailey, Executive Director of Prudential Policy at the BoE’s PRA here this afternoon. A few key take-aways with views in parentheses: i) UK banks still showing a “vibrant” commitment to climate goals despite the recent demise of the NZBA (one might ask how long will that last…); ii) the BoE is still monitoring climate risks and is leaving the door open to more climate stress tests for the banks (I suspect politics will dissuade the BoE from doing so and that the PRA is likely to focus on other - arguably more pressing - ‘battles’ / matters in a near-term context); iii) Bailey caveats this in any event, noting “We do, of course, have to put climate risk into proportion alongside all the other risks. We can’t focus just on one risk … But we’ve got to focus on climate risk. It’s important. And we continue to maintain the momentum of our work in that space.” (I don’t need to spell out for you what I think this really means…); and iv) Bailey notes that the Strong and Simple framework was one of the biggest changes to regulation in 30 years and would help smaller banks “compete and grow, and provide the really important services they do to households and businesses right across the UK” (better still if there were a clear path to IRB accreditation to enable smaller lenders compete on a more even keel; I would also add that the application of MREL rules to challenger banks was always a nonsense as I said many times in the past and it is flabbergasting that it took until 2025 for the BoE to reverse gear and unsurprising that it did so in a convoluted way that ‘saves face’). On the whole, while it mightn’t seem so on reading the above, I am very respectful of the seemingly balanced and proportionate approach that the PRA takes to regulating the industry generally (as regular readers will be well aware) though I clearly have certain points of view as well.

The Times reported here on Monday on how HSBC UK (HSBA) has started to make loans available to homebuyers at up to 6.5 times income for its Premier customers as banks continue to loosen mortgage rules. While this is a move up the risk curve, the reality is that it is likely to be selective within the Premier customer cohort, many of whom have substantial savings (which reduces the risk to the bank).

The FT reports today on how Lloyds Living (LLOY) has acquired c.7,500 residential properties since the division’s launch in 2021 - with the property portfolio said to be worth more than £2bn, a key element of the bank’s income diversification push. Well worth reading the story here and the associated Lex piece here.

The FT reported on Thursday here that Santander is planning to appoint an insider as the next Santander UK CEO - with Group CRO Mahesh Aditya and Head of Santander UK Retail & Business Banking Enrique Alvarez Labiano reported to be the sole shortlisted candidates. This is not surprising given the Board is presumably keen to get a trusted lieutenant to carefully manage the integration of TSB and prepare the business for its next evolution, whatever that might be. Indeed, it could be argued that the greater scale (and returns opportunity) by virtue of taking over TSB denotes improved strategic optionality.

Vanquis Banking Group (VANQ) published a 3Q25 trading update for the three months to 30th September on Wednesday. A few notables in what was a mixed bag: i) gross customer IEBs and net receivables both +8% q/q to £2.65bn and £2.51bn respectively (with FY25 guided gross IEBs upgraded from >£2.6bn to >£2.7bn - a positive but one that comes with a capital cost (see below)); ii) NIM continued its downward trajectory, -40bps q/q and -170bps y/y to 17.0% owing to a lower yield on Second Charge Mortgages and growth in zero balance transfer and promotional Credit Card products, partially offset by improved asset yields in Vehicle Finance and a lower cost of funds (with FY25 NIM guidance downgraded from >17% to >16.5%); iii) VANQ notes that an additional liability of £4.0m (on top of the existing provision of £3.0m) could arise if the FCA’s proposed motor finance redress scheme parameters are unchanged - mostly due to higher operating costs associated with customer engagement; iv) the CET1 capital ratio printed at 17.4% (pro forma Tier 1 capital ratio 20.3% reflecting the October £60m AT1 issuance), -110bps q/q, “reflecting the deployment of capital to support growth”.

5️⃣ Shareholding changes of note:

Lloyds Banking Group (LLOY): Andrew Walton (Chief Sustainability Officer and Chief Corporate Affairs Officer) disposed of 122,495 shares in LLOY at a price of 88.8p on 5th November for gross proceeds of almost £110k.

OSB Group (OSB): JPM Asset Management now 5.26% (previously disclosed shareholding: 5.25%) following a transaction on 4th November.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ AIB Group rounds off Irish banks’ 3Q season with a strong update

AIB Group (AIBG) published a 3Q25 trading update for the three months to 30th September on Tuesday and held an earnings call at 08:00 that morning. In overall terms the mood music is very positive (following the positive updates from Bank of Ireland Group (BIRG) and PTSB the previous week). Some key take-aways:

FY25 NII guidance upgraded from >€3.6bn to >€3.7bn though guidance still looks on the light side on my assessment and likely bakes in a fair degree of conservatism.

AIBG wouldn’t guide on outer year NII/NIM, unlike BIRG - that’s not unreasonable or surprising as BIRG adopts a more mechanistic structural hedging approach and has more expected swap roll benefit going forward than AIBG does - but AIBG has optionality with respect to its hedging strategies and also has more ‘in the tank’ in terms of SRT options in my view. Harder to guide on all of that in fairness.

Deposits growth YTD of €4.4bn, which is highly constructive in a NII/NIM context - and FY25 guidance upgraded to c.4% from c.3% with the CFO noting that this refreshed guidance may be slightly conservative.

Management confident in delivering c.3% FY25 loan growth guidance despite growth of just 1.4% YTD - noting good visibility here.

AIBG issued improved CoR guidance for FY25 - now guiding to lower end of 20-30bps range (from 20-30bps). Pushing through an improvement to CoR guidance at this juncture arguably differentiates AIBG from its key peer BIRG and soothes any concerns in the context of the credit quality of its international (ex-Ireland/UK) businesses, though, as I have remarked before, AIBG (and PTSB) appears to have significant excess provisions.

All other guidance and medium-term targets unchanged.

Management very clear that all medium-term targets will be met or beaten, very firmly holding FY26 costs guidance of <€2bn - while this is positive in terms of delivery, it raises the question (applicable to Irish banks more broadly) as to whether AIBG is underinvesting in its franchise on a longer-term view.

Finally, AIBG doesn’t incorporate in-year profits in CET1 capital. So, the end-3Q25 CET1 capital ratio of 16.6% does not reflect net capital generation of 250bps YTD. The CFO remarked early on during the earnings call that this approach is a conservative position (is based on ECB guidance according to a footnote in the 3Q update) which gives maximum flexibility with the Board and regulators when discussing distributions. My first thoughts were ‘how on earth’ does this change anything in those discussions - OK, no optical significant downward shift in the CET1 ratio upon the Board effecting a large distribution, but anyone following the company can do the basic math here, no? Indeed, a sell-side analyst asked this very question later on during the call but a detailed response was not provided. It leads me to think two things: i) is the Board just obsessed with optics (over delivery)?; and ii) does the regulator still have a very significant say (relative to custom and practice in other markets) in the decision? More generally, it worries me in the context of how swiftly AIBG will get to its target CET1 capital ratio. For what it’s worth, given organic capital generation as well as SRT optionality, I see no good reason for the bank to defer getting to c.14% by end-FY25 rather than end-FY26. This should be a very good news story for shareholders at the stage of the FY25 results.

2️⃣ Bank of Ireland Group issues senior unsecured at a keen coupon

Bank of Ireland Group (BIRG) has raised €750m from its second senior unsecured green bond issuance of the year to finance more climate action projects in renewable energy and green buildings. Investor appetite was strong, with orders >€2.6bn (so, c.3.5x oversubscribed) and participation from over 140 investors globally. The 10Y bond carries a fixed coupon of 3.625% (MS+105bps), which is the tightest spread achieved since the Group’s inaugural green issuance in 2021. I don’t have much to add here other than to say that this is a good result and reflects the strong capital position (including improved clarity in relation to the UK motor finance debacle) and financial performance / outlook for the lender.

3️⃣ Perspectives on PTSB sale process

It has been relatively quiet on the PTSB sale process front over the last week and I expect that to remain the case until the back end of the year / early new year. I remain of the view that the Board and the State want competitive tension amongst trade acquirers to drive the price up. I received some more data in relation to the State’s investments during the week and I compute that the Finance Minister will be able to say that the State got all its money back on its investments in each of AIBG, BIRG and PTSB if it sells its 57.4% shareholding in PTSB at a price of 391c or above (405c or above if transaction costs associated with the original investment are counted). However, one can see - with RWA relief, material funding cost synergies, substantive operating cost takeout, capital optimisation and excess capital capture, excess provisioning capture - how PTSB could present enormous value to the right trade acquirer and both the PTSB Board and government must be held accountable for getting the right price for this asset irrespective of sell-side analysts’ target prices or political optics about what Government can boast about (with, let’s be very clear, rising interest rates and much reduced competition the key underpins for the surge in Irish bank share prices in recent years). That’s not to say that an acquirer will pay up for its cost synergies but you get the drift. Moreover, thinking back to LLOY’s seminar this week in a way, the right strategic buyer here could see a massive opportunity to outmanoeuvre the Big Two in time, becoming more than just a challenger brand. I’ll leave it at that for now but I’ll have a lot more to say on all of this in due course.

4️⃣ IG launches new commission-free investing product

It’s worth flagging that IG has launched a new commission-free investing product in Ireland, as reported by the Business Post on Wednesday here. A further report in the Business Post this weekend here notes comments made by Michael Healy, MD for UK & Ireland at IG, to the effect that Irish retail investors are “chronically underserved” and that IG can “do better” than the existing competitor universe: “When you look at the Irish market, in particular, it is chronically underserved…The incumbent operators are providing really bad value to Irish customers. Very limited customers, very expensive pricing. And we just think, we can do better…You’ve got this challenge of some of the more nascent brands, your neobrokers. Irish customers naturally don’t trust them as much because they haven’t got the credibility and heritage that some of the stockbroking firms have, and like IG has…We’re sitting in that intersection. We can offer them both the trust and credibility of a well-established, long-tenured broker, but also the pricing and value of a more startup-type proposition.”. Informed local observers will know well that this isn’t actually an arrogant perspective (which it may read as at first glance) and that Healy is making some valid points here - particularly on fees. Indeed, it is unlikely that the £160bn sitting on deposit with Irish banks (mostly sitting in overnight product which earns a negligible return) has gone unnoticed by IG (read more on that here in The Irish Times on Friday). It has proven impossible to drive a sea shift in depositor behaviour thus far - but it will happen in time in my view. It just needs the right player offering a lower cost and quality service who employs a differentiated marketing strategy to start ‘rattling the cage’ in my view.

5️⃣ BPFI reports strong growth in personal loans in 2Q

Banking & Payments Federation Ireland (BPFI) published its Personal Loans Report for Q2 2025 on Friday - press release here and report here. In short, lending was +17.6% (in value terms) y/y to €754m in the quarter. BPFI CEO Brian Hayes said: “Our latest figures indicate a sustained increase in demand for personal lending in Q2 2025, achieving the highest quarterly loan activity levels on record across all categories”. This is positive in the context of Irish banks’ lending growth ambitions.

6️⃣ Shareholding changes of note:

Bank of Ireland Group (BIRG): Wellington now 2.98% (previously disclosed shareholding: 3.00%) following a transaction on 30th October.

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ ECB cautious on synthetic risk transfers

Bloomberg reported on Monday here that the ECB is concerned about lenders’ over-reliance on lenders’ synthetic risk transfers - with the article noting that >90% of all significant risk transfer (SRT) transactions overseen by the ECB in 2023 relate to synthetic transfers. The article states that the ECB will, in a forthcoming opinion, argue that moving credit risks off Balance Sheet using synthetic risk transfers could expose banks to refinancing risks in times of market stress (as synthetic risk transfers usually have shorter maturities than the loans they insure). It doesn’t sound like any imminent regulatory changes are on the horizon but banks will be nervous - indeed, this might accelerate planned activity (though these deals take time to prepare with that said and the market can presumably only absorb so much).

2️⃣ Other regulatory matters of note

Bloomberg reported here on Thursday on the EC’s latest consultation (see here) which contemplates a 3-year delay to the implementation of the Fundamental Review of the Trading Book (FRTB) capital rules for European banks to level the playing field with other countries - they are due to be introduced at the beginning of 2027 as things currently stand while the adoption timetable in the US is unclear.

Well worth reading the transcript of Isabel Schnabel’s speech here on the evolution of the eurosystem Balance Sheet at the ECB Conference on Money Markets 2025 on Thursday (associated slides here).

3️⃣ S&P Global Ratings presentation on European Banks

I attended an interesting webinar hosted by S&P Global Ratings on the current state of European banks (broadly positive) on Tuesday, which also featured an informative discussion on AI. Miriam Fernandez – Director, AI Research & Adoption Lead, Analytical Innovation - noted that agentic specialisation and automated agents are the next key steps in the context of AI usage in banking, with a proliferation expected in the deployment of multimodal LAMs (large action models). Similar to the LLOY presentation on Thursday (covered above) S&P Global Ratings’ view, based on a study it has undertaken, is that, within three to five years, banks that embrace AI and scale efficiently could generate a competitive advantage and achieve efficiency gains in the order of 10-25%. Slide deck here.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ Private credit in the spotlight

Lots of coverage of the private credit / NBFI space again this week. However, the key standout for me was the UBS Chair Colm Kelleher’s warning in a speech at the HKMA’s Global Financial Leaders’ Investment Summit on Tuesday to the effect that insurers shopping for credit ratings on their private credit assets are creating a “looming systemic risk” to global finance, likening it to the ‘ratings arbitrage’ we saw during the GFC - which was very well covered by the FT on Tuesday here. While private credit firms have defended their lending practices - and there can be a risk of over-extrapolating the familiar / drawing too many comparisons with other crises where they are not necessarily warranted - it is difficult to disagree with Kelleher’s view. Indeed, anyone with a FT subscription really should read this FT Alphaville piece from Thursday, which notes that a small agency Egan-Jones ranks as number two globally in the context of plain vanilla corporate ratings (according to NRSRO filings), i.e., ahead of the likes of Moody’s and Fitch. What’s more, Egan-Jones’ analysts issue an average of 244 ratings per analyst (compared with ana average of 35 across S&P, Moody’s and Fitch). The FT Alphaville article satirically notes “But all this means is that Egan-Jones analysts work harder, right? How much harder? It’s difficult to say.”. Interesting times indeed…

📆 The Calendar 📆

Look out for these in the week ahead:

🇮🇪 Wed 12th Nov (11:00 BST): Central Bank of Ireland (CBI) Retail Interest Rates - Sep 2025

🇬🇧 Thu 13th Nov (07:00 BST): Shawbrook (SHAW) 3Q25 Tarding Update (for the three months to 30th Sep 2025)

🇪🇺 Thu 13th & Fri 14th Nov: European Central Bank (ECB) Sixth Forum on Banking Supervision

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.