Financials Unshackled Specials: Nationwide In Focus - Mutually Exclusive | Issue 57

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

This special edition of Financials Unshackled follows my recent issue on UK banking M&A and zones in on Nationwide Building Society - a Big Six lender that has executed the most transformational M&A deal in the UK banking landscape in recent years, acquiring Virgin Money UK (VMUK) for £2.8bn in 2024. While the building societies space has seen its fair share of M&A through history, the group’s refreshed status - post-acquisition - as the second largest player in UK retail banking as well as its journey to becoming the UK’s first full-service mutual banking provider marks it as an outlier in the mutuals landscape - mutually exclusive if you will.

The purpose of this note is to refresh on the transformational acquisition of VMUK, to consider the integration experience thus far, and to reflect on what may lie ahead for the society. I also offer some perspectives on how financial performance (encapsulating integration progress) could be measured going forward. It is not intended to provide a financial assessment of Nationwide (which credit research analysts and investors routinely undertake) but may help familiarise some readers with a society that is now the second largest player in UK retail banking.

What is Nationwide Building Society?

Nationwide is the largest building society both in the UK and globally, with total assets of £367.9bn at the end of its 2024/25 financial year (at 31st March 2025) and 605 Nationwide-branded branches and 91 Virgin Money-branded branches.

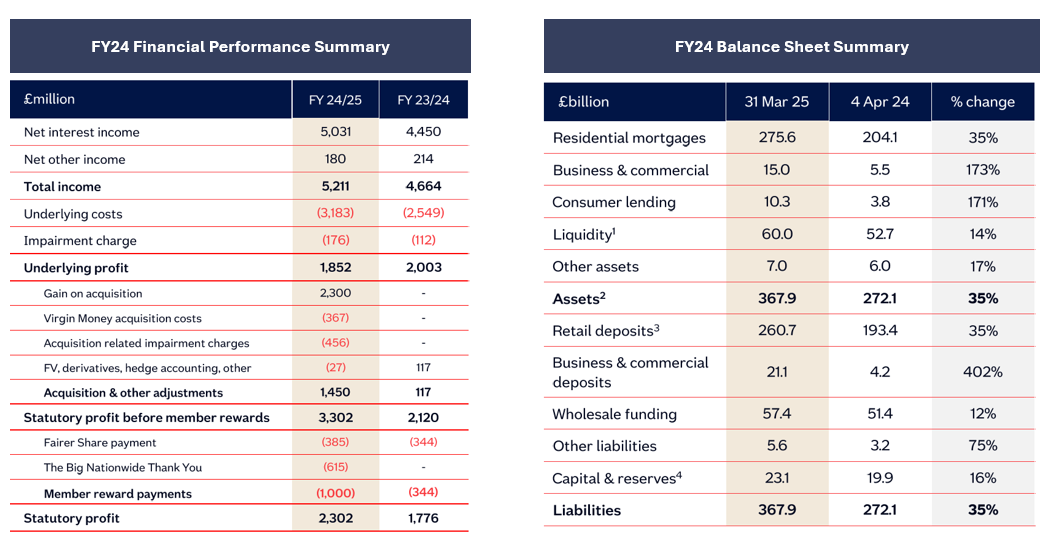

Its core business is focused on the provision of retail banking products and services - predominantly residential mortgages (owner occupier and buy-to-let), credit cards, personal loans, insurance products, current accounts, and retail savings products. Nationwide’s product range has broadened into business banking services since its acquisition of VMUK. The society reported gross residential mortgage loans of £275.9bn at end-2024/25, which represented a market share of 16.2% at that date according to company documentation. Its £7.8bn of end-2024/25 credit card balances represented a market share of 10.7% at that date, according to company documentation. Nationwide has also noted that its retail deposit balances of £260.7bn on that same date represented a 12.2% share of UK household deposit balances. Nationwide is a highly profitable machine, churning out statutory / underlying (u/l) Profit Before Member Reward Payments and Tax of £3.30bn / £1.85bn in 2024/25*.

As a building society with mutual status, Nationwide is owned by, and managed for, the benefit of its members, i.e., Nationwide customers who have a Nationwide-branded current account, mortgage, or savings product.

Financial Snapshot

The below extracts from the 2024/25 results materials highlight the financial performance and position of the group - and its strong surplus capital position (with a CET1 capital ratio of 19.1% at year-end). Notably, Nationwide delivered record £2.80bn in value to its members in 2024/25, including: i) member financial benefit of £1.80bn from better pricing and incentives than the market average, primarily relating to its member deposits; ii) £385m in Nationwide Fairer Share Payments, distributed in June 2024 to 3.85 million eligible members; and iii) £615m for The Big Nationwide Thank You – a one-off £50 payment to over 12 million eligible members.

2024 saw a transformational transaction

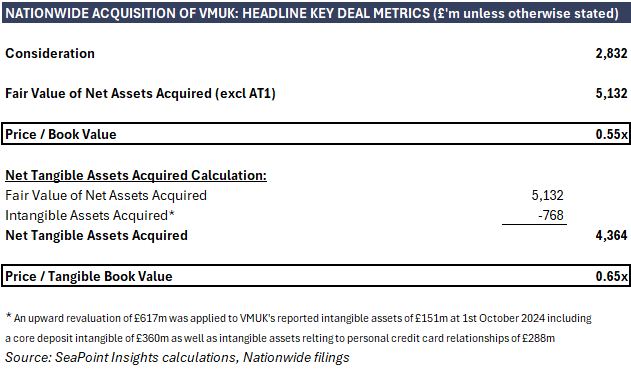

Nationwide acquired VMUK on 1st October 2024 for £2.8bn, which drove a substantial gain on acquisition of £2.3bn given Nationwide’s assessment of the fair value of assets acquired of £5.1bn (which embedded a net £410m of upward fair value adjustments to VMUK’s reported book value of £4.7bn).

Deal metrics - ‘a plum deal’ for Nationwide

Headline key deal metrics are shown in the table below:

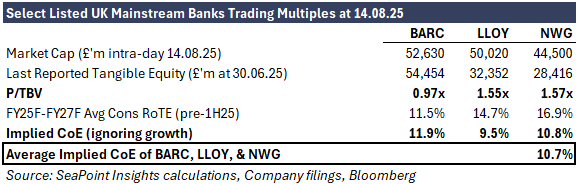

VMUK reported a RoTE of 9.1% in the six months to 31st March 2025 but had been trading at a substantial discount to tangible book value. Striking a deal to acquire a bank delivering a near-10% RoTE on a standalone basis with the added attraction of presenting Nationwide with material prospective synergies (net of integration / restructuring costs) for just 0.65x tangible book value (or 0.55x book value) was a great deal for Nationwide’s members in my view. Even if we forget the synergistic benefits, it represents an implied return on equity (ignoring growth and just running with the 9.1% RoTE) of c.14%. That compares very favourably to: i) current listed mainstream UK banks’ implied cost of equity (see table below - and, notably, NWG’s CFO remarked on the post-1H25 sell-side analysts roundtable on 30th July that management generally thinks about 11-12% as a hurdle rate) - which also ignores the material synergies that Nationwide should be capable of capturing; and ii) Santander’s recent agreed acquisition of TSB (notably, TSB reported a RoTE of 10.6% for FY24) at 1.45x TSB’s end-1Q25 tangible book value. Indeed, the deal also made much sense for VMUK’s shareholders given the deep discount at which VMUK had traded to book value for some time.

P.S.: Note 17 to Nationwide’s interim accounts for 2024/25 noted that “On 1 October 2024, Virgin Money UK plc and Virgin Enterprises Limited (‘VEL’) executed a Deed of Amendment and Restatement to the Trade Mark License Deed of Agreement originally dated 1 October 2014, as amended, restated and novated on 25 July 2016 and 18 June 2018. Pursuant to this Deed of Amendment and Restatement, the agreement will terminate after a four-year period, followed by a two-year cessation period, and Virgin Money UK plc has agreed to make payments to VEL totalling £250 million in addition to annual royalties during the remaining four-year term. These costs will be recognised within administrative expenses in the consolidated income statement, with the £250 million payment to be recognised in the period ended 31 March 2025 and the annual royalties recognised over the periods to which they relate. These future costs had already been articulated on page 21 of the Scheme Document of 22nd April 2024 (accessible here). Indeed, Nationwide took a charge of £275m in 2H24 to reflect in-period exit costs of £250m related to the amended Trade Mark License Deed of Agreement (TMLA) in addition to royalties. If we include this £250m as a cost of the acquisition given its size, unique nature, and immediacy post-transaction (which I appreciate is a highly debatable inclusion as the NPV of future royalty payments will be much reduced by virtue of the amended TMLA - and it is essentially just another cost of integration in any event), it would serve to nudge up the acquisition multiple of book value to 0.60x (from 0.55x) and the multiple of tangible book value to 0.71x (from 0.65x). So, in conclusion, no matter what way you look at it, the acquisition of VMUK represented a highly attractive deal for Nationwide’s members in my view.

Compelling strategic rationale

Nationwide articulated the prospective strategic benefits associated with the VMUK acquisition last year. To recap:

Increased scale in Nationwide’s core lending and deposit markets, strengthening Nationwide’s position in the UK retail banking market to the status of second largest player.

Substantial growth in Nationwide’s unsecured lending market share and origination capabilities.

Transformation of Nationwide’s pre-existing business savings proposition into a broader business banking offering to position Nationwide to become the UK’s first full-service mutual banking provider, support the growth agenda, and achieve funding diversification. Indeed, the society’s AT1 Offering Circular of 6th June noted that it is planning to introduce a new process to bring VMUK’s business banking offering to Nationwide customers and its Registration Document of 3rd July observes that “we have broadened our product range to include Virgin Money's business banking services, which we intend to offer to more customers across the Group over time”.

The transaction is also potentially constructive in a funding costs synergies context over time. Furthermore, while Nationwide management has been keen to emphasise that the business case for the deal was not reliant on the extraction of aggressive cost synergies, it seems sensible to assume that there will be savings in that respect over time as well.

Integration is progressing nicely

Any acquisition - particularly of a scale akin to VMUK - presents a multitude of risks as well as prospective strategic benefits to the acquiring entity. Integration and restructuring costs always reside front and centre from a risks standpoint. In this regard it is reassuring that Nationwide’s CEO Debbie Crosbie has deep experience in this respect including: i) leading, in the capacity as Acting CEO of Clydesdale Bank, the preparations for the demerger of Clydesdale Bank from National Australia Bank and its subsequent IPO; ii) Group Chief Operating Officer and Executive Director of CYBG when it completed its £1.7bn acquisition of Virgin Money in October 2018 (which also means she had an intimate knowledge of the business that Nationwide has acquired); and iii) delivering a successful transformation at the helm of TSB Bank.

The messages, thus far, from an integration perspective are positive. CEO Debbie Crosbie noted on the full year results call on 29th May that “integration plans are progressing well. The expenditure directly on integration activities has been lower than we expected. In September, we will move to streamline governance structures and we're actively working towards a Part VII legal transfer process next calendar year”. Crosbie also noted that integration-related costs have been lower than expected. Nationwide has been clear that a gradual approach is being taken in an integration context.

What lies ahead for the Group?

Commitment to mutuality

Nationwide remains clearly committed to its mutual status, evidenced by the return of a record amount of £2.8bn in value to its members in the last financial year, including £1.8bn of member financial benefit (continued provision of competitive interest rates for its members) and a further £1bn through the Nationwide Fairer Share Payment and The Big Nationwide Thank You. Nationwide notes that the average member pay rate for retail deposits was 291bps in the last financial year, which was 72bps higher than market average deposit rates and the CFO Muir Mathieson noted on the 2024/25 earnings call that the passthrough of interest rate changes to depositors as base rates reduce should be broadly similar to the passthrough on the way up.

Other commitments that are congruent with Nationwide’s mutual status are explored under the next heading below but it is also important to note that the mutual model has its critics given that building societies put many key decisions to a non-binding (advisory) vote at their AGMs. This means that even a significant number of members vote against a proposal, the board is not legally obliged to change course - which critics see as a loophole. This flared up recently in a Nationwide context given the recent (voluntary) AGM proposal to push up the CEO’s maximum potential remuneration to almost £7m p.a. (Directors’ Remuneration Policy document here) - in the end the opprobrium proved to be something of ‘a storm in a teacup’ with the vast majority of voting members (c.95%) supporting the proposals, presumably recognising that you generally tend to get what you pay for in life.

Continued evolution of societal-friendly business model

In an interrelated vein to its commitment to mutuality, Nationwide is a progressive business, continuing to invest in its member and broader customer banking proposition whilst maintaining strong cost discipline. There are many examples of this in the last financial year:

The extension of its Branch Promise - Nationwide notes that its branch network is fundamental to its customer support (notably, 35% of new current account openings took place in a branch in the first half of the 2024/25 financial year), underpinned by its Branch Promise which has now been extended to include VMUK. This is a differentiated approach in the context of large-scale retail banking players.

Investment in digital services - with further augmentation of its personal banking apps one example of this.

Modernisation of its savings and payment systems and process automation.

Investment in GenAI tools.

Investment in VMUK’s customer service and systems capability.

These commitments point to the stability and continued enhancement of the customer service proposition (indeed, its strength is reflected in Nationwide’s premier brand rankings and its customer experience score) and are constructive in a continued growth and financial performance context. Furthermore, management has noted that a key element of its plans for VMUK is to drive improvements in its customer service proposition - with some notable progress already achieved in this vein. Indeed, it would be unwise to rule out further M&A entirely too but I suspect the appetite to transact would be tempered by the ongoing VMUK integration process - at least until the Part VII transfer has completed, perhaps.

It is also worth noting that Nationwide is committed to a social impact strategy, to intermediate science-based targets in a climate context, to diversity, and to continuing to donate 1% of pre-tax profits to charitable activities.

Integration progression

A strategic review in relation to long-term integration is advanced and more details and next steps will be communicated when it completes later this year (notably, Nationwide is scheduled to publish its interim results on 20th November, so perhaps we will get an update then). Everything we have learned to date suggests that confidence in management’s execution capability is warranted. Nonetheless it will be important to monitor progression in this respect.

Performance delivery

Nationwide management is clearly growth-focused. Record growth in both lending and deposits was achieved in the 2024/25 financial year and the society has seen growth in personal current account volumes, with standout performance observed in the recent CASS switching data. It is also notable that Nationwide stated at the stage of its 2024/25 financial year results release on 29th May last that its stock of business current accounts has grown by 5% since the acquisition of VMUK.

Management expressed optimism about the financial outlook on the full year earnings call whilst noting that competition is expected to strengthen, driving some margin pressure. From a costs standpoint, management’s objective is to contain business-as-usual cost growth “within the bounds of inflation”. Credit performance is stable and the annualised u/l cost of risk (CoR) was just 11bps in the second half of 2024/25.

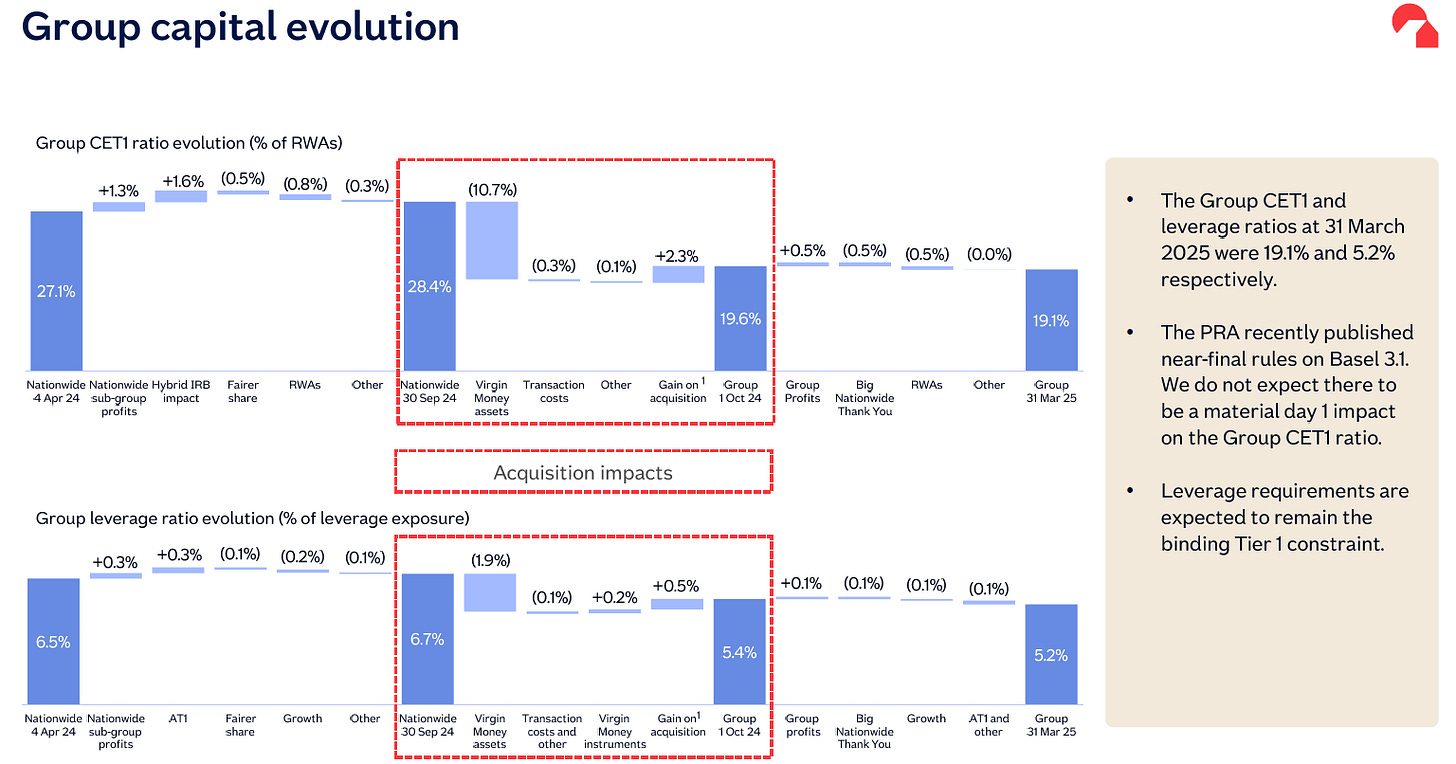

From a credit standpoint, the strong CET1 capital ratio of 19.1% at 31st March is reassuring. Indeed, the CFO reiterated on the 2024/25 earnings call that the target CET1 level formulation is heavily influenced by Nationwide’s objective to remain above MDA buffers in a severe BoE stress test. We will have to wait and see how Nationwide performs in the stress tests later this year - but, as Mathieson noted, the society is in a “very, very strong start position” given its capital strength. It is also worth noting Mathieson’s comment on the interim results earnings call on 27th November last: “…if you actually take the ACS stress test from 2022 where both the results for Virgin Money and Nationwide were published and combine them on a pro-rata basis, then you can come to a pretty safe conclusion there..”. It is also notable that, following the announcement of the VMUK acquisition, each of Moody's, S&P and Fitch affirmed the credit ratings it had assigned to Nationwide. Furthermore, it is notable that Nationwide’s hybrid IRB models have already been approved by the Prudential Regulation Authority (PRA) - with VMUK’s separate models, like many other banks’ models, pending approval.

Finally, again in a credit context, the CFO signposted on the full year earnings call that management would review its outstanding liabilities across the VMUK capital stack to see if there are economic ways in which the capital stack could be simplified and aligned. Notably, Nationwide has recently taken early action (despite having been granted grandfathering forbearance until December 2028) to tidy up elements of the VMUK capital and funding stacks - in the context of LMEs with respect to certain VMUK externally issued capital and MREL instruments.

Appendix 1

Perspectives on financial progress measurement

So, how can stakeholders to measure Nationwide’s financial performance? Needless to say, there are very specific measures that fixed income research analysts and investors take into account at a group, a subsidiary, and an individual financial instrument level - but, for those who are not actively analysing / investing in Nationwide credit instruments, here are a few key points of note in this vein:

RoTE worth examining but suffers from limitations

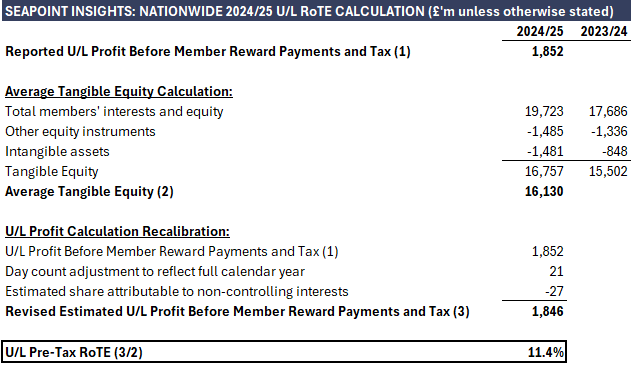

As a former regulated research analyst, I am naturally drawn to comparing returns on tangible equity (RoTE) across credit institutions. Nationwide does not place a major emphasis on return on equity in its documentation although it is notable a 20% weighting is ascribed to ‘Group return on equity employed’ (based on a theoretical internally-determined minimum capital level, which appears to embed a buffer above minimum regulatory capital requirements) within the scorecard applied to determine Executive Directors’ performance pay awards - though the society does not publish this calculation. On my own calculations for 2024/25, Nationwide delivered an u/l pre-tax RoTE of c.11.4%*. While this would fall to <10% upon the assumption of a normalised tax charge and bank levy (with some clawback for AT1 tax credits), the reality is that the headline ratio is substantially suppressed owing to the large surplus capital position (average 2024/25 CET1 capital ratio of 23.1%) so the RoTE ratio itself is not comparable to listed peer banks.

Underlying (U/L) Profit Before Tax (PBT) development

A 20% weighting is also attached to Group u/l PBT within the scorecard applied to determine Executive Directors’ performance pay awards**. PBT evolution is clearly a meaningful indicator of financial performance.

Member Financial Benefit procurement

Nationwide remains clearly committed to its mutual status, evidenced by the return of a record amount of £2.8bn in value to its members in the last financial year. Continued delivery in this respect is a key indicator of financial performance.

* SeaPoint Insights independent recalculation of Nationwide 2024/25 RoTE, using Nationwide results materials:

** Notably, other metrics that feature within the scorecard applied to determine Executive Directors’ performance pay awards are: i) Financial Research Survey satisfaction (20% weighting); ii) Risk and compliance (20% weighting); and iii) Transformation (20%). More information can be found on page 109 of the FY24 Annual Report here.

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.