Financials Unshackled Going Deep - Is BAWAG poised to disrupt Irish banking? (Edition 1, Issue 3)

The independent voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice and is for informational and educational purposes only - please scroll to the end of this publication for the full Disclaimer

Welcome to Financials Unshackled Going Deep. Today’s note examines whether BAWAG - through a potential acquisition of Permanent TSB (PTSB) - is about to disrupt Ireland’s banking market. The focus is long-term rather than dwelling on what a BAWAG/PTSB deal might mean for the market over the course of 2026 and 2027 (likely very little).

If you like your Financials Unshackled subscription here on Substack and would also like to receive a weekly perspective on - and a wrap of - key developments in the UK, Irish and European banking markets just email john.cronin@seapointinsights.com with the subject line “Y” and I’ll add you to the relevant distribution lists.

📓 Context 📓

PTSB, Ireland’s third largest domestic-centric retail bank, surprised the market on 30th October last when it announced that the Board is commencing a Formal Sale Process (FSP). The Irish State owns a 57.5% shareholding in PTSB. First round bids were reportedly due a couple of weeks ago and the widespread speculation is that BAWAG alongside a few private equity (PE) firms (Centerbridge and Lone Star have been specifically namechecked by multiple reporters) are in the mix. While Bankinter has ruled itself out, it is unclear as to whether there are any other credible trade acquirers at the table - though a Business Post article on 3rd January noted that “…there’s also now a belief that a UK bank, as yet unidentified, is looking with a degree of seriousness at PTSB”.

I have written in detail on the sale process - on Substack on 31st October 2025 (click on the image below for access), separately online here on 14th December 2025, and here on Substack on 21st December 2025 to pick out some of the more detailed notes.

📢 So, what’s the latest? 📢

BAWAG reported FY25 results for the 12 months to 31st December 2025 yesterday - and hosted an earnings call for investors and analysts which you can listen back to here. Rather than dissecting the results in and of themselves, the following are a few key take-aways in the context of a potential move for PTSB:

BAWAG reported an excess capital position of €468m at end-FY25 - that’s the surplus of CET1 capital over and above its 12.5% target ratio (with that target ratio being 227bps above its 2026 MDA trigger). BAWAG printed an end-FY25 CET1 ratio of 14.6% (pro-forma post-dividend accrual).

The standout point for me is that BAWAG has not yet decided what to do with its end-FY25 excess capital position - with CEO Anas Abuzaakouk remarking in response to a question on this point on the call that BAWAG is currently “assessing a number of market opportunities” and that management will be in a better position soon to inform the market of its intentions with respect to its excess capital “hopefully by the first quarter results, I think we’re going to be in a good position”. BAWAG’s 1Q26 results are scheduled for 21st April - with a customary pre-earnings call for analysts scheduled for 2nd April. It does not seem unreasonable in view of the reported timing of indicative offers for PTSB - and in the context of a typical sale process timeline more generally - to expect that final round bids for PTSB will be due before 21st April. Indeed, I suspect the PTSB Board expects to have a deal agreed before then.

BAWAG’s CEO went on to note, in response to a question, that its management team has believed for some time that “Ireland is one of the most robust banking markets across the European Union” - a conclusion that stimulated it to enter the market through MoCo a couple of years ago undoubtedly - and is one of seven core markets internationally (of which four are European) for BAWAG. Indeed, he noted later on the call - in response to a different question - that BAWAG sees opportunities in Ireland from a mortgages standpoint, which is PTSB’s mainstay and the largest loan book within the group lending portfolios in the case of both AIB Group (AIBG) and Bank of Ireland Group (BIRG).

PTSB’s current market capitalisation was €1.74bn at close of trading on 12th February. Abuzaakouk made it clear on the call that size is not an impediment and it was refreshing to listen to him explain BAWAG’s entirely logical and unconstrained ‘think big’ mindset (the latter being a function of how it has consistently delivered and strengthened over a long period of time, through which it has strategically developed certain scalable advantages in a multi-jurisdictional capability context in my view) in terms of inorganic opportunities, i.e., management does not see size as an obstacle and, instead, examines capital deployment opportunities with reference to: i) how much value can be created?; ii) downside risks (how much can you lose versus how much can you make?); and iii) do we have the bandwidth? (to which he made it clear that BAWAG does: “…we have a deep bench of senior leaders…and I think we have the bandwidth to be able to address larger acquisitions going forward”). Inorganic opportunities are benchmarked against share buybacks.

Importantly, given the size of PTSB, Abuzaakouk noted “we are not averse to issuing shares” - though he went on to emphasise that everything has been self-funded historically. This, to me. serves to signal that BAWAG is not closing off any options but makes it clear that it has a strong aversion to diluting its shareholders. Indeed, there are lots of options and structures available to BAWAG to fund an acquisition of PTSB without having to raise fresh equity, including a potential combination of some of (not intended to be an exhaustive list):

Asset disposals (notably, BAWAG’s 2025 Investor Day slide deck stated “non-core business lines identified”) - indeed the “market opportunities” that BAWAG management refers to might also take into account possible disposals too.

SRTs (three were completed in FY25 according to the CEO on the FY25 earnings call - and he further noted that SRTs cover €9bn of BAWAG assets, highlighting BAWAG’s intensive usage as well as its capacity for much more).

Acquiring less than 100% of the equity in PTSB upfront.

Offering deferred consideration to a cohort of PTSB shareholders structured in a way that doesn’t reduce regulatory capital.

Indeed, some incremental FY26 capital build pre-acquisition, a possible preparedness to temporarily operate below its target CET1 ratio (but with a sufficient buffer to MDA) and the possibility of some negative goodwill on acquisition of PTSB (albeit I accept that expectations are that the latter is highly unlikely to manifest given where PTSB is now trading versus tangible book value) could provide a bit more firepower.

♗ What would BAWAG/PTSB mean for the Irish banking landscape? ♗

To understand what the potential impact of a BAWAG / PTSB tie-up could be for the Irish banking landscape more broadly, it is first worth zoning in on some key features of the BAWAG business model.

Disciplined culture; unwavering strategic clarity; evidenced delivery

A review of historical materials indicates that BAWAG has an incredibly disciplined and consistent culture - focused on patience and discipline, good stewardship of capital, and management and staff commitment. A few things stand out versus other banks: i) consistency of message through the years; ii) average management team tenure (senior leadership team average time at BAWAG >12 years, though down from c.14 years in FY24); and iii) significant emphasis on management and staff incentivisation (senior leadership team owns c.5% of BAWAG), with management incentives directly tied to financial and ESG targets (and appropriate adjustments to the linkage to targets in the case of the CRO and CAO) and a focus on continuing to roll out employee participation programmes (“We believe stock ownership is the best way to create alignment with shareholders and long-term strategic value creation”). The bank’s top tier management team boasts deep industry-specific experience in a general management, a finance, and a restructuring context - with a number of the Management Board members having worked at the PE firm Cerberus and GE Capital many years ago. BAWAG is very clear that it has deep bench strength as well - indeed, one wouldn’t expect any less in such a well-run business. It is also worth noting that the company’s materials are interspersed with language like “owner-operator mindset”, “long-term compounding benefits”, “We Embrace Change & Do Not Avoid Challenges”, “focus on the things you can control”, “Valuing work ethic, character, and performance”, “We believe in a flat organization”, “our best years lie ahead” et al. - which, in my view, gives you a read of the differentiated mature leadership psyche, i.e., sophisticated, confident yet grounded, and deeply long-term focused.

BAWAG projects strategic clarity - a highly consistent focus on growth (14 acquisitions complete, continued organic growth), efficiency (more below), and judicious risk management (declining NPLs; migrated to secured lending focus). The following excerpt from BAWAG’s 1H25 report sums up the strategy neatly in my view: “Our emphasis on managing costs and maintaining a conservative and disciplined risk appetite is more important than ever. The opportunity lies in maintaining our cost discipline and focusing on risk-adjusted returns while capturing the benefits of a normalized interest rate environment. The resilience of our franchise lies in our ability to deliver results across all cycles as we are built for all seasons. Our approach is consistent: focus on the things that we can control, be a disciplined commercial lender, maintain a conservative risk appetite, and only pursue sustainable and profitable growth.”. The three pillars of the strategy are closely intertwined as I see it - growth brings scale benefits which drive efficiencies, and judicious risk management facilitates continued growth and efficiency and the delivery of targeted risk-adjusted returns.

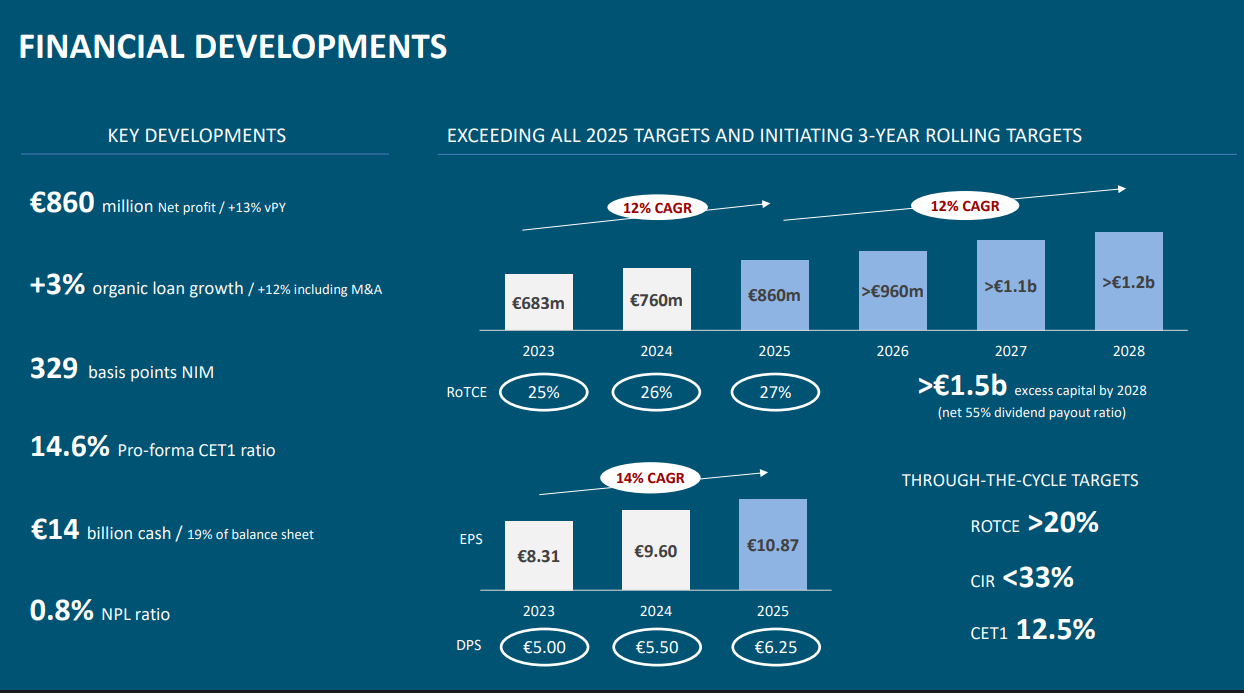

Consistent execution of the strategy has seen BAWAG’s share price soar by almost 300% since its IPO in October 2017, which represents massive outperformance versus both the EuroStoxx Banks Index (SX7E) and the Stoxx 600 Banks Index (SX7P) over that period. BAWAG presents enviable financial metrics, printing a RoTCE (returns on tangible common equity, which is the same as what I routinely refer to as RoTE) of 26.9% for FY25 and reassuring through-the-cycle (TTC) targets as the extract from the FY25 results slide deck below shows.

Indeed, management was very clear on the FY25 results call that its TTC RoTCE target of >20% is a conservative floor relative to what the bank will achieve in some years in benign credit environments - FY25 was testament to that, with RoTCE coming in closer to 30% than 20% despite a significant uptick in operating costs in early-FY25, which has since reversed.

It is undeniable that the Irish bank management teams have done a lot of things well - cultures have been tightened up considerably and large-scale financial scandals seem to be in the rear view mirror, underwriting policies are very conservative, NPEs have been reduced substantially, politicians are kept ‘on side’, there is a strong focus on costs, capital is carefully conserved, and financial performance (returns) is stellar. However, the purpose of this note is to understand the points of weakness relative to a BAWAG in the event that BAWAG acquires PTSB and thereby develops a more meaningful presence in the market.

To me, BAWAG’s culture and strategic clarity would denote competitive advantage in the Irish banking market. Starting with some qualitative points:

From a management stability perspective, we see significant rotation at a senior management level in some of the Irish banks (though not so much at CEO and CFO level it must be said).

Furthermore, having worked in the industry for many years and observed the industry mechanics for many more years as a sell-side analyst, I observe at times what I see as an excessive focus on politics over performance amongst top Irish banking executives - that contrasts deeply with the BAWAG culture as I see it, which is not to underestimate BAWAG management’s political savvy. For example, I can’t imagine we would ever see BAWAG’s existing management team optionally pour shareholder equity into a lending segment that cannot produce anything close to its hurdle RoTCE (of >20% in BAWAG’s case), i.e., it is not the sort of management team that will take shareholder value-destructive actions unless there is a very clear longer-term turnaround plan that it is transparent about.

Furthermore, while it is a relief at one level to observe the cautious underwriting approach taken by Irish bank executives (which is not simply a function of macroprudential rules to be clear), the ‘conservatism for conservatism’s sake’ that we see Irish bankers proclaim as a ‘badge of honour’ (e.g., irrational deep aversion to loan losses) appears to stand in contrast to BAWAG’s clinical and more sophisticated risk-adjusted returns focus - and the hoarding of capital for no obvious purpose that we see is unlikely to be observed at BAWAG* (which has struck its CET1 target ratio of 12.5% - an appropriate, but not excessive, distance from MDA, for example). Last, but by no means least, is efficiency and this topic is worth exploring in some depth.

* BAWAG is sitting on a significant excess capital position as I write but management has been clear that this is a temporary dynamic as it is actively exploring “market opportunities”

BAWAG runs an efficient ship

Top tier Cost/Income ratio target

BAWAG reported operating costs of £799m in FY25 and has guided that costs will be down by >5% in FY26 (indeed we saw two consecutive quarters of material cost shrinkage in 3Q/4Q25). Its Cost/Income ratio (CIR) was 36.1%< +260bps y/y (i.e., jaws narrowed - with income +36% y/y and opex +47% y/y) but that must be considered in the context of acquisition integration costs. As noted earlier, BAWAG’s target TTC is <33%, which is ‘best-in-class’ in a European banking context - and meaningfully better than Irish banks and UK banks’ target CIR ratios. Notably, AIB Group (AIBG) and Bank of Ireland Group (BIRG) reported an underlying CIR of 40% and 46% respectively for FY24.

How BAWAG thinks about cost management

BAWAG is very clear about its cost focus - which is the second pillar of its interrelated three-pronged strategy of growth, efficiency, and risk management (as noted above). Company materials consistently emphasise BAWAG management’s relentless focus on cost containment, which its leadership sees as a competitive advantage. The CEO Letter within the FY24 Annual Report captures BAWAG’s modus operandi in this respect: “The continuous improvement mindset we have embraced, and the strategic M&A executed, have been the catalysts underpinning the transformation of our franchise from a traditional banking model to a digital bank with a high-touch and high-quality advisory-focused branch network. We believe the future is one where customers expect friction to be removed from daily banking, where financial products and services are provided at the time and place of their choosing, and where banking access is 24/7 across a multi-channel commercial banking platform.”.

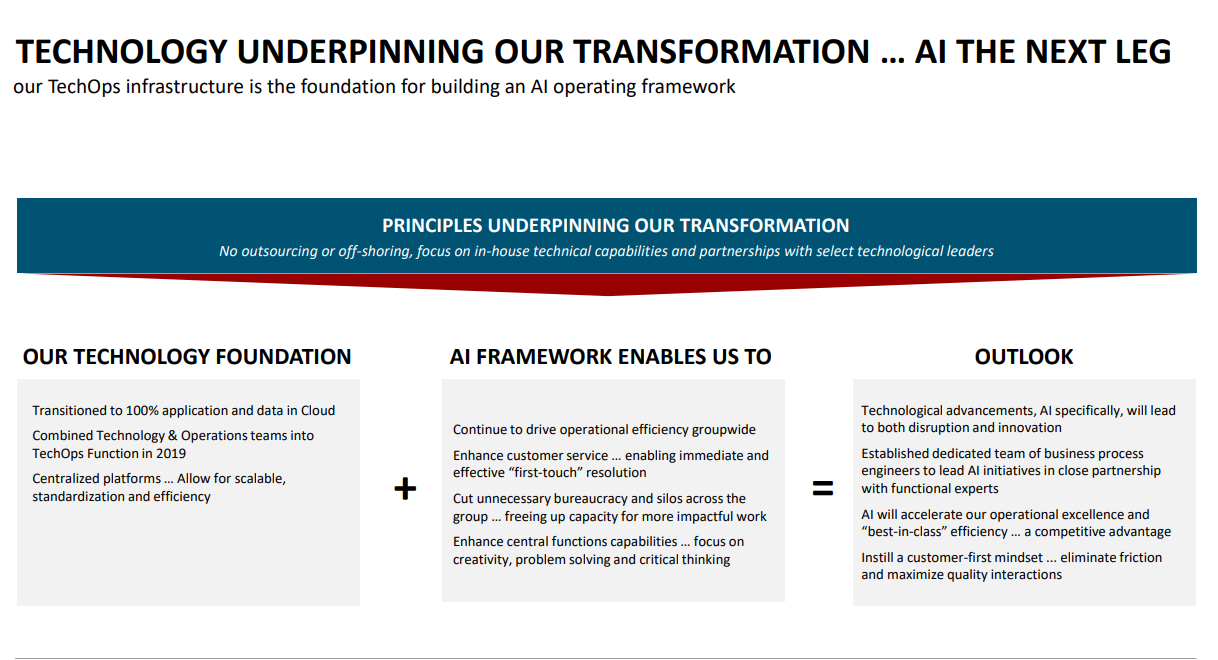

Furthermore, BAWAG management clearly communicates its investment in Technology & Operations (TechOps) and the following extract from the aforementioned CEO Letter is worth reading in this respect: “Our TechOps focus is based on the principles of simplification, pragmatism, accountability, and efficiency in how we work. We believe that the plumbing of the Bank – which captures a bank’s technology stack, applications, workflows, and governance – is as important as any area but can at times take a back seat to more front-end focused projects and initiatives. We have spent years investing in simplifying our technology stack, building up internal technical capabilities, and creating simplified end-to-end digital customer journeys.” - as is the following excerpt form the Strategy section of the FY24 Annual Report: “We are convinced that despite the tailwind from rising interest rates, banks must continue to transform their business models and cost structure to be much simpler and more efficient. We embarked on this transformation over a decade ago and are well positioned for the years ahead. First, we focused on building a strong technological foundation. We recognize that at their core, banks are technology companies, and moving data is a key business process for banks. Hence, we initially focused on our data infrastructure and on building internal technological capabilities. On the data infrastructure side, we combined financial, risk, and regulatory reporting in a central Group data warehouse, enabling the organization to work off the same baseline, accelerate reporting, and decommission highly manual, bespoke reports. At the same time, we insourced software engineering, built a central, standardized cloud infrastructure, and invested in technical in-house capabilities across the entire technology stack.”.

Moreover, BAWAG sees AI as ‘the next leg’ and a lever to “accelerate our operational excellence and “best-in-class” efficiency” - as the extract from the FY25 results slide deck shows below. The CEO was interesting to listen to on the FY25 earnings call where he gave more colour on how BAWAG thinks about tech and AI - pointing out that TechOps is a constant feature of the strategy unlike other banks that announce fixed period ‘transformation programmes’, giving one a sense that it is just enshrined in the DNA of the management team from Day 1. It was also interesting to hear the CEO remark with candour that, despite BAWAG’s existing remarkable efficiency, more redesign work needs to be done in relation to certain business processes (the development of 'Natural Intelligence’) before AI can be fully implemented. I would not mistake that for lack of preparedness on a relative basis and this comment, in my view, exemplifies how this management team go about everything clinically, carefully, methodically, and thoroughly.

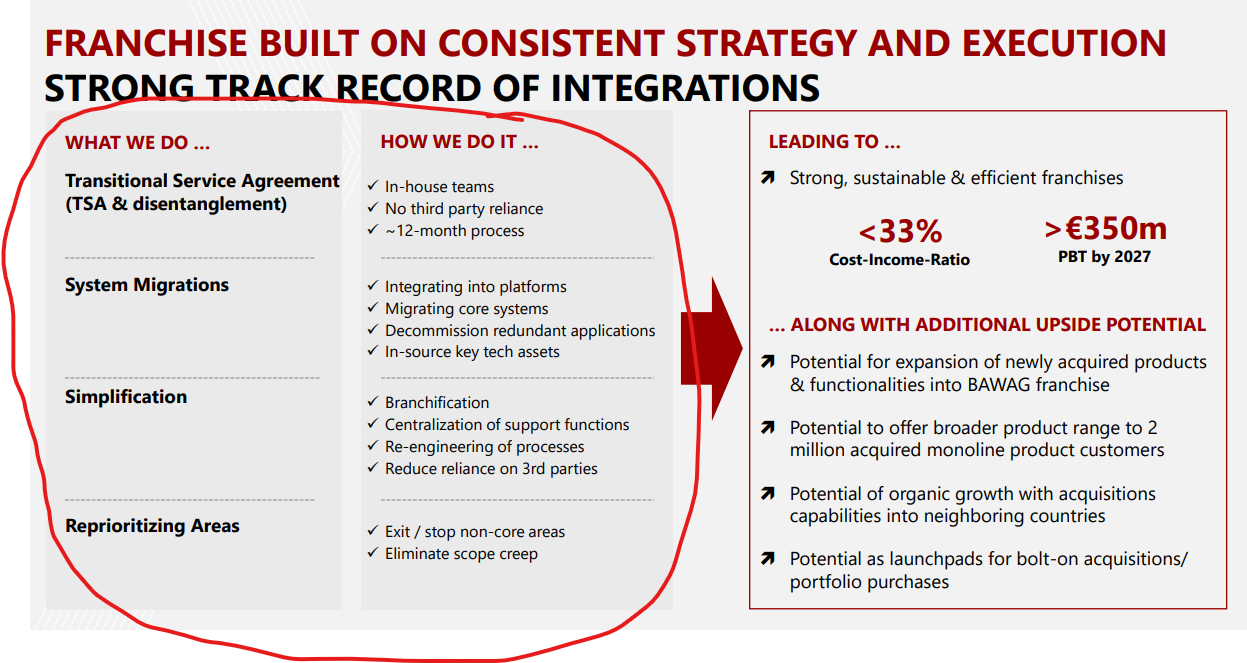

BAWAG focuses on in-house solutions

BAWAG prioritises in-house technology capabilities and places minimal reliance on third-party software and solutions. The company has insourced software engineering, has built a central standardised cloud infrastructure in-house, and has invested in technical in-house capabilities across the entire tech stack. This seems to tick all three strategic boxes as I see it - scalability to facilitate growth, cost containment, and risk minimisation (e.g., third party reliance) and contrasts with the approach taken by most banks. Indeed, BAWAG’s investor deck from March 2025 notes, in relation to integrations, that it doesn’t place reliance on third parties through its efficient Transitional Service Agreement (TSA) disentanglement process and that systems acquired are integrated into BAWAG’s platforms with core systems migrated (a point that is reinforced in the 3Q25 Credit Update slide deck in the context of KNAB and Barclays Consumer Bank Europe integration progress). That is likely how BAWAG will think about PTSB, i.e., ruthless cost extraction should it acquire the business - and the below extract from the March 2025 Investor Day deck is worth reflecting on in this vein.

Cross-comparing BAWAG with select Irish / UK banks

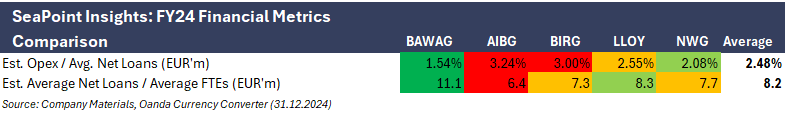

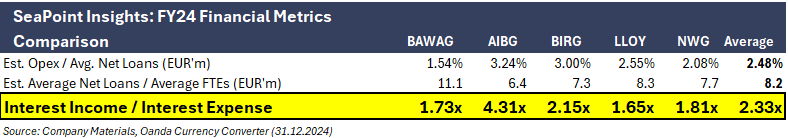

While BAWAG’s low CIR evidences the effective cost management strategy, it’s important to look a little deeper - and focus on some pure efficiency metrics. While there are no perfect measures, I have run some basic calculations which I show below. Note that I use FY24 numbers for consistency purposes, which slightly flatters BAWAG (given its costs grew faster than income in FY25) though the difference is not meaningful in the context of deriving any conclusions from the data.

Taking each in turn:

BAWAG screens ‘best-in-class’ by a significant margin from an Opex / Average Net Loans perspective. Standard efficiency metrics typically use Total Assets in the denominator but that, in my view, can become distorted for banks who report low loan-to-deposit ratios (take, for example, AIBG where its end-FY24 net loans of €69.9bn represented just 49.5% of its Total Assets of €141.3bn at that date). Recycling much of the deposit base into central bank balances and investment securities portfolios shouldn’t need a large complement of staff.

Again, BAWAG screens ‘best-in-class’ by a significant margin from an Average Net Loans / Average Full-Time Equivalents viewpoint (some estimation required for the latter in certain cases where a ‘clean number’ wasn’t provided), indicating a more productive employee base from a lending perspective.

So, BAWAG screens much more efficiently than a few select peer banks on these metrics - and it’s a smaller bank that spans multiple geographies (so, theoretically should, ceteris paribus, suffer from higher proportional costs), with a growth strategy that sees scaling driving further operating efficiencies - indeed, BAWAG management has been clear that it sees consolidation as conducive to scale benefits: “We believe consolidation is the catalyst for building stronger European banks that can address the challenges stemming from broken cost structures, overleveraged balance sheets, and sub-par technology.”. The above might be a very simple exercise but it highlights the large legacy costs that traditional banks are burdened with and which BAWAG management purposefully started to break from many years before its IPO - as well as evidencing that BAWAG’s ruthless focus on cost containment is delivering.

However, looking more closely it appears that BAWAG’s particular competitive advantage is in the non-staff costs domain. Its staff costs comprised 63% of its reported operating costs in FY24 - far above the select peer banks (AIBG: 45%, BIRG: 41%, LLOY: 40%, NWG: 50%). Its exceptionally keen non-staff costs level could be interpreted as highlighting the scalability of the operating platform and the core systems in my view (though it is notable that depreciation and amortisation practices can vary widely amongst banks so some caution is warranted in being overly conclusive too). That, together, with AI potentially set to eliminate many staff roles over the coming years (and who would bet against BAWAG outmanoeuvring most competitors in this respect…) as well as, I guess, the possibility of IRB accreditation at some point (90% of the loan book is on standardised models), could mean that BAWAG is primed to turn into a ‘premier returns machine’ in years to come, boasting a structurally sustainable CIR well below that 33% level.

So, what could it all mean for the Irish banking landscape?

Please note that my intention is to follow up this post with a further note ‘delving into the weeds’ of PTSB, most likely during the week following its FY25 results publication (which is scheduled for Thursday 5th March) - and fleshing out some scenarios in the context of how the bank’s RoTCE (returns on tangible common equity to use BAWAG’s preferred terminology, i.e., the same as RoTE) could evolve under new ownership.

PTSB’s returns are well below its peers - with the bank reporting a RoTE of just 2.9% for 1H25, for instance. A large part of the reason for that is its substantive cost base (CIR of 76% in 1H25, for example). That will be a core focus for any new acquirer and judging by BAWAG’s track record and management ethos, it will be more capable than most others at extracting substantial savings in this vein, assuming no political constraints. There are other efficiencies available to BAWAG - or indeed another acquirer - too, including funding cost synergies, capital efficiency actions, excess capital extraction (depending on what the PTSB Board elects to do pre-sale), IFRS 9 provision writebacks, and intangibles amortisation costs amelioration. Indeed, the PTSB Board and management team might deliver / start to deliver / continue to deliver on some of these ahead of striking an agreed sale.

If BAWAG acquires PTSB it will have work to do. While BAWAG is efficient and well-versed at integration (with TSA disentanglement typically no more than a 12-month process, for example) it will still take time to effect the necessary migrations. However, the scale of cost reduction that BAWAG is likely eyeing up here is surely enormous. While I’m not going to get into the weeds here (and will save it for another post), one can quickly calculate how there could be line of sight, under a new owner’s stewardship, on double-digit returns for PTSB. In any event, BAWAG management has been clear that a key criteria for any acquisition is that the acquired entity is capable of generating a TTC RoTCE of >20% (the hurdle rate) - with the CEO noting on yesterday’s earnings call that prior deals have performed strongly and have outperformed that hurdle. This means that it will be disciplined from a deal pricing perspective and will be conscious of any external factors beyond its control that could serve to constrain its returns capability - which I touched on in previous posts.

In the first instance, I suspect BAWAG, were it to acquire PTSB, would spend the first 12 to 24 months getting ‘its house in order’ rather than flexing its muscles in a competitive context. As well as macroeconomic factors, BAWAG has likely been attracted to the Irish market given the degree of concentration and customer inertia. This denotes pricing power - and I have written extensively on the point that over 90% of the listed banks’ ROI deposit funding is represented by current accounts and demand accounts, i.e., overnight product that earns negligible rates. In the absence of meaningful customer behaviour change over the next couple of years, BAWAG is unlikely to self-destruct by paying rates that are materially above market to a broad cohort of customers. However, a bank like this is going to do one thing over time in my view - and that is encroach from a share perspective across local funding and lending markets. That doesn’t mean domination but it does mean more competition. To the extent that BAWAG, at a group level, delivers even more efficiencies and a CIR that sits structurally and sustainably beneath the 33% level, then it can potentially afford to gradually become a price leader (selectively at times presumably) in a bid to drive share growth, and therefore, more scale efficiencies - within acceptable risk-adjusted returns parameters (the blending of the three pillars of its strategy essentially). Not to mention how its tech stack and AI investment could be conducive to a superior customer proposition in due course. This is why, on a longer-term view, the large incumbent banks are, in my view, likely to be nervous about what BAWAG’s presence would mean for their long-term sustainable returns profiles. That said, the good times will surely continue to roll for the time being. As a final note, the likes of Bankinter, Monzo, and Revolut will also be likely watching carefully - in particular, BAWAG appears to me to present itself as a digital bank that can beat the neobanks at their own game, with a slick low-cost operating model itself that, importantly, has earned the trust of customers.

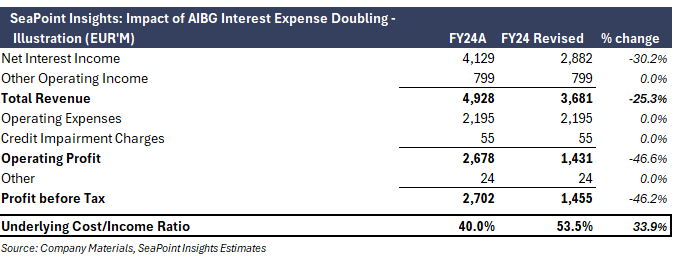

On a final note, it is also worth highlighting that the above simple efficiency metrics I present actually underrepresent BAWAG’s cost advantage relative to the Irish banks (AIBG particularly) when one considers the benefits of the ultra-low cost ROI deposits. If we add a row to the above table (see below) you can see the multiple of Interest Income to Interest Expense for each of the banks for FY24. This is an outlier in the case of AIBG. While BIRG also enjoys ultra-low deposit costs in Ireland its multiple of Interest Income to Interest Expense is far lower than for AIBG because: i) it has a much higher loans-to-deposits ratio (80% at end-FY24 versus AIBG’s 64%); ii) its deposit mix - in particular, its greater reliance on UK deposits, which carry a more normalised cost; iii) much higher interest expenses associated with economic hedges.

Say, for the purposes of illustration only, we were to double AIBG’s FY24 interest expense charge to bring its Interest Income / Interest Expense multiple broadly in line with that of BIRG (which is still notably materially above BAWAG/LLOY/NWG’s equivalent ratio), it would mean that AIBG’s reported FY24 PBT would have been 47% lower (see below) and its u/l CIR would have been 53.5% rather than 40.0%. This illustrates how much of reported efficiency is funding structure-driven rather than purely structural cost superiority. Conversely, were BAWAG benefiting from the same ultra-low cost deposit mix as the Irish banks, its reported CIR advantage would likely be even more pronounced.

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.