Financials Unshackled Going Deep - European & UK Banks: Is There More Upside? (Edition 1, Issue 1)

The independent voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to the inaugural ‘Going Deep’ issue! As you may be aware, there are now three distinct weekly Financials Unshackled ‘In-Depth’ Briefings: one on UK banking developments and perspectives, one on Ireland (and Europe) banking developments / perspectives, and a ‘Going Deep’ note on topical items (of a broad variety) Substack. Please email me at john.cronin@seapointinisghts.com (or just reply to this post if reading on email) if you want to be added to the distribution list for the UK and Ireland (and Europe) briefings. Last Sunday’s UK and Ireland (and Europe) notes can be accessed here and here and I’ll have a new website for that content shortly. This ‘Going Deep’ note will stay on Substack.

What’s In this Note?

This note takes a broad look at current bank valuations. It is written for a wide audience of readers and sets out a quick run-through the ways in which banks are typically valued to begin with. It then considers:

Recent European and UK banks’ share price rerating

UK and Irish bank valuations in particular focus

What are the ‘push’ and ‘pull’ factors to think about in terms of the performance outlook from here?

I have always argued that the devil is in the detail. This inaugural note is intended to just set the scene for further posts over the coming months on specific elements of what is covered here. If there is anything in particular you would like me to analyse please write to me at john.cronin@seapointinsights.com. All ideas welcome!

Back to basics - how are banks valued?

Ultimately, the value of a bank is the discounted net present value (NPV) of the free cashflows that accrue to its shareholders over time. A multi-period discounted cashflow (DCF) modelling exercise is, theoretically, the most logical way to analyse what the NPV of those free cashflows will be but estimation uncertainties mean that, like in the case of a DCF modelling for any business, the assessment is highly sensitive to key assumptions - e.g., long-term growth into perpetuity the blended average discount rate over time, the fade growth rate, the terminal value assumption et al.

From a practical standpoint, investors typically assess the valuation of banks through two lens:

Price / Tangible Book Value per share (P/TBV or P/TNAV), i.e., what multiple of tangible book value investors are willing to pay given the bank’s expected returns on tangible equity (RoTE) profile. The higher the returns that a bank generates on the book value of its equity, the higher its P/TBV ratio ought to be. Clearly, sustained growth in expected returns ought to, all else being equal, conducive to a higher P/TBV multiple too.

Price / Earnings per Share (P/E), i.e., what multiple of earnings per share should a bank trade it given its expected earnings per share (eps) growth profile.

Because banks are capital-intensive and heavily regulated, P/TBV is often the primary valuation anchor, while P/E is used to assess earnings momentum and growth. The primary focus was on P/TBV ratios for much of the post-GFC period but P/E’s have made a strong comeback given the sector has been churning out decent growth of late - following what could be considered ‘a lost decade’. Both metrics are important.

Of course, there are many other factors that investors examine in their assessments - sometimes in isolation as a screening lever. For example, dividend yields and total shareholder returns (including additional capital return beyond the ordinary dividend). Everything is interrelated and there is no one perfect metric.

Performance has been very strong

Zoning in on European banks, 2025 saw the SX7P (STOXX Europe 600 Banks Index) up 68% in price terms and up 78% in terms of total return. For an unlevered equity investor, those clearly represented enormous returns. Looking at the key metrics:

Average one-year forward P/TBV ratios are in the 1.4x region with consensus expectations for RoTE in the c.15.5% territory (assuming optimised capital positions with reference to target CET1 capital ratios) over the next couple of years, indicating a cost of equity of c.11% for investing in European banks now. That is still materially higher than the historical average pre-GFC cost of equity (CoE) of c.8-9% though estimates of where this number resided do vary.

Average one-year (1Y) forward P/E ratios still hover below 9x (c.9.5x area on a 2Y forward view). That’s materially below where US banks trade. However, consensus data indicates that European banks’ eps growth is expected to be in the low double-digits over the next couple of years (earnings growth is expected to be in the high single-digits area - slightly stronger than for US banks - with eps propelled by buybacks).

Large UK banks fared even better in 2025 - with the large listed mainstream domestic banks up an average of c.75% in price terms in 2025 - but the performance of the challenger banks cohort was a bit behind this, with significant variability in the share price performance of the different challengers.

Zoning in on UK and Irish banks specifically

Let’s keep things simple and take a snapshot view of current market valuations.

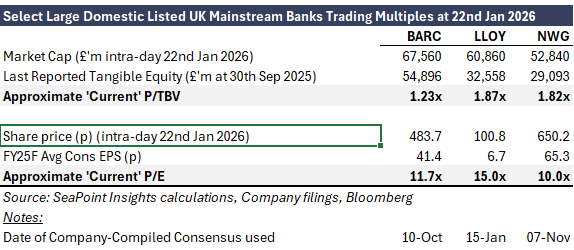

Firstly, large cap UK domestic bank valuations:

Large UK banks are trading at much richer multiples of book value and eps than they were a few short years ago. Indeed, the implied CoE for investing in these names -using the above P/TBV multiples married with average consensus FY25F-27F RoTEs (11.8% for Barclays (BARC), 15.3% for Lloyds Banking Group (LLOY), and 16.9% for NatWest Group (NWG)) and ignoring growth - we get to c.9% (BARC comes out highest at 9.6% while LLOY is lowest at 8.2%).

However, this is not a precise science and the following factors need to be considered: i) most importantly, the market appears to be expecting further upgrades through the FY25 results season; ii) somewhat related to i), we are in an earnings upgrade cycle more broadly (consensus has been consistently moving upwards over the last year, for example); and iii) consensus is, by its very nature, always a bit stale anyway (a human analyst cannot continually update estimates in real time it goes without saying). So, it could be strongly argued that the true cost of equity is indeed closer to the European banks’ c.11% number - especially when one considers other factors like potential near-term capital efficiency actions following the FPC’s clarity in December (UK banks CET1 targets may come down an inch and there is scope to operate more efficiently relative to the pre-existing targets anyway) and as more clarity emerges in the context of the ultimate costs of the motor finance debacle (relevant to LLOY specifically). Similarly, one could strongly argue that the above P/E multiples are significantly inflated, i.e., if the consensus EPS estimates - and expected EPS growth estimates for FY26F and beyond - are too light. It is my view that consensus earnings are too bearish (though that should not be interpreted as a valuation view).

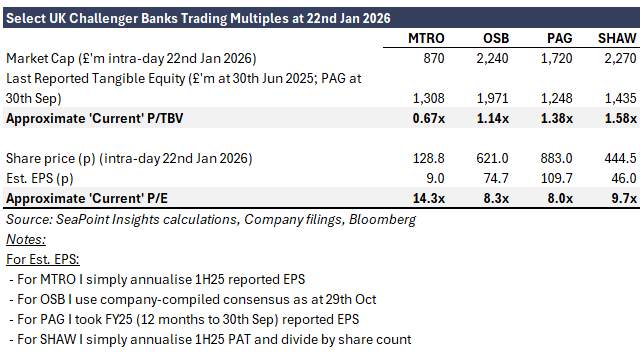

And a few of the UK challengers:

You’ll see I make some pretty simplistic estimates. Rather than get into the weeds on the numbers (EPS, etc.), given this is a contextual post, the above is sufficient to highlight the point that these challengers (as a collective) clearly trade at a material discount to their large bank counterparts (as a collective) - both from a P/TBV and a P/E perspective (note that Metro Bank’s ‘trough earnings’ (and my simplified EPS estimate calculation methodology) serve to inflate its ‘current’ P/E multiple and this would be lower if we were to consider a blended average of current EPS estimates for the next few years).

By the same token, CoE appears materially higher. If we take medium-term target returns for the specialist challengers, OSB Group (OSB), Paragon Banking Group (PAG), and Shawbrook (SHAW) we are getting implied CoEs in the 12.5-13.0% range. I won’t write a treatise on this today but one thing to bear in mind in relation to these specialist challengers is their tendency to fare better when base rates are a bit lower (relative funding cost disadvantages lessen, ability to maintain decent asset spreads increases). As I wrote on PAG on 8th December here: “Sticking with NIM, and stepping back, it strikes me that the downward guided trajectory is an adjustment process that will settle when base rates settle - i.e., more reliance on expensive variable rate deposits during the transition (with scope to increase the proportional reliance on wholesale funding with that said - especially given easy access deposit market behaviour) and a return to a more traditional funding structure when rates stabilise.”.

In the case of Metro Bank (MTRO) management has guided to a mid-to-upper teens RoTE target by FY27 without issuing fresh equity but the bank is trading at just 0.67x tangible book, which many will see as an indication that the market doesn’t buy into the target - yet at least.

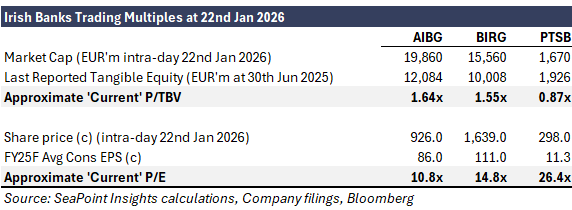

And the Irish banks:

AIB Group (AIBG) and Bank of Ireland Group (BIRG) are not as richly valued as the large cap UK domestic banks from a P/TBV perspective (though the disparity is not enormous) but are broadly ‘in the pack’ from a ‘current’ P/E standpoint (though motor finance provisioning suppresses BIRG’s headline FY25 EPS and therefore inflates P/E). The Irish banks are outearning the UK large cap domestic banks from a RoTE perspective but are not getting credited for that in their valuations, i.e., the cost of equity for investing in these names is higher (by more than meets the eye from screening consensus data in fact as I will show in a future post). Why? There are a few things to think about like CET1 capital ratio targets, historical surplus capital levels, and deferred tax assets most particularly but this merits a full post in its own right. Furthermore, the same points can be made for the consensus estimates used - i.e., they are constantly getting revised up. It is my view that consensus earnings for AIBG and BIRG are too bearish, especially on NII (though please don’t interpret that as a valuation view).

One point to note now is that I have seen some market participants strip out the DTAs when reflecting on P/TBV multiples. While I understand the logic (i.e., there is a risk that usability will become constrained), I think the following points are important:

The DTAs have been incredibly valuable and it is notable that the consensus view on EPS (and, therefore, P/E multiples) typically uses post-tax profits whereas an addback of the Irish tax charge (or the vast bulk of it) gets you to a much better proxy of internal capital generation - and AIBG and PTSB’s ROI DTAs in particular shield those two banks from ROI tax charges for many more years (to the extent not restricted or repealed).

It is possible that DTAs could come under the microscope politically but I think it’s rather unlikely. I wrote in the Business Post here in September that “…my research indicates that any move to restrict DTA usability could have a highly significant impact on certain multinationals operating in Ireland”.

If doing that in a valuation assessment, you should add back the NPV of what you think the DTAs are worth today.

Note that PTSB is in a sale process, which has seen its share price soar in recent months - which partly underpins the rich current P/E multiples relative to AIBG and BIRG though the most important factor here is ‘trough earnings’ (though that should not be interpreted as a valuation view).

Can the strong performance continue?: Framing the discussion

Two linked considerations

There are two interrelated drivers that will determine whether the upward momentum in bank share prices continues as I see it:

Valuation rerating (multiple expansion): Will investors’ required return on equity (CoE) fall further and/or will risk perceptions and growth expectations improve (not mutually exclusive!), thereby justifying higher P/TBV and P/E multiples.

Earnings growth and capital returns: Will further earnings growth and distributions to shareholders continue to support share price accretion?

Rather than seek to answer the question, I set out some ‘pull’ and ‘push’ factors below.

First, some observations:

Observation #1: Cost of equity is still above historical levels

As noted above, pre-GFC CoE typically resided in the c.8-9% territory for European and UK banks. Therefore, if one runs with an estimated c.11% CoE for European and UK banks (as a proxy) it could be argued that there is room for CoE to fall significantly further, especially if risk perceptions continue to improve.

Observation #2: Banks’ P/E multiples are far below other sectors

Sentiments are positive as we head into earnings season. Continued delivery and ratcheting up of management guidance and consensus expectations for growth is typically constructive for multiple expansion - but every case is different. While we appear to still be in an upgrade cycle, a key question is for how long can this upward momentum continue - when will it stabilise and/or inflect? Shock events can quickly change things. However, the crucial point from a potential multiple expansion perspective is that banks still trade very poorly relative to the average P/E multiple at which other sectors trade - and investors can therefore advance solid arguments as to why sectoral derisking and earnings delivery / growth prowess means that the discount at which banks trade should continue to shrink.

‘Pull factors’ (not exhaustive):

As I see it, there are some critical ‘pull factors’ to consider in terms of bank earnings and returns performance moving forward (I will write about these in far more depth in another post soon):

Base rate environment / hedge contributions - expected r* rates conducive to sustained healthy margins and structural hedge income tailwinds constructive for NII expansion.

Stable and growing economies (some growing economies across Europe but something of a mixed bag in an individual country context; UK and Irish economic growth expectations are above the European average) with easing inflation and contained unemployment.

Bank lending and deposits growth growing - with bank lending growth picking up from below historical average levels.

Efficiency opportunities owing to investments in Digital & Data (AI particularly).

Continued strong credit quality (a function of relatively stable economic backdrops as well as more sophisticated and conservative underwriting and risk management).

Less scandals and associated litigation and conduct fines - becoming more a thing of the past.

Stability of capital requirements regime (and easing in certain jurisdictions, e.g., the UK) and a sense we are at ‘peak regulation’ (emerging sense that there may be some positive spillover effects from expected US regulatory capital easing measures).

Continued commitment to dividends and buybacks.

Potential for M&A to augment returns.

‘Push factors’ (not exhaustive):

In the opposite direction, there are some ‘push factors’ which could see negative revisions to expected earnings and returns performance:

Macroeconomic / sovereign debt shocks - for example, a global slowdown owing to geopolitical - or indeed other - factors (though thankfully we no longer appear at the possible brink of a trade war!!), politicians driving up bank taxes, etc.

Broader market forces - for example, a market correction. There is a lot of discussion in the markets as regards whether we are in an ‘AI bubble’ but two points here: i) banks are cheaply valued relative to other sectors as noted above, so, it could be argued that there is less potential downside; ii) European and UK stock markets are arguably not as exposed to tech or AI enablers as the US (though broader contagion factors can be significant); and iii) demand prospects for semiconductors and electrification appear strong for the medium-term.

Rising competition - for example, from: i) ‘givebacks’ given many banks are outearning their returns targets (as banks compete more aggressively on pricing); and ii) new entrants - neobanks most particularly. Two points I want to make here are: i) return targets have been climbing and it seems more likely to me (in broad terms) that, in markets where loan growth is healthy at least, management teams will seek to maximise shareholder returns rather than sacrifice margin for share; and ii) generally speaking, neobanks have not captured much share in core deposits and lending markets thus far at least and I am relaxed about their impact in the medium-term as I have discussed at length in previous posts.

Investment spend - while I flagged AI-related efficiencies as a potential plus point above, investment spend requirements could ratchet up significantly over the coming years on the other hand.

Credit losses - for example, in the case of banks with substantial private credit exposures. While private markets have settled since the Tricolor Holdings and First Brands Group fallouts in October, this remains a risk for the more exposed banks.

Digital currencies encroachment: Stablecoins and other cryptocurrencies appear to represent far less risk to European and UK bank deposits relative to US banks at this juncture given differing regulatory regimes. CBDCs could take a slice of the revenue pie for sure - as well as tack on some costs - but central banks appear extremely keen to protect the financial health of the banks in the design of CBDCs. Separately, the development of tokenised deposits (see the UK most particularly) may provide a structural mitigant, enabling banks to preserve deposit funding, payments and settlement roles as new forms of digital money proliferate.

For internationally active banks, widening differences in regulatory perimeters (e.g., US vs. Europe) could serve as a headwind.

On a final note, I have taken the care not to express a valuation view in this document but hopefully set out a framework for how one could think about it.

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.

I should add of course the jury is out on how asset quality evolves as loan book grows in the case of MTRO and the fact that no specific CoR guidance has been imparted probably doesn't help (though you can effectively backward engineer). But so far so good it has to be said. Overall it doesn't get much analyst attention given size and can be overlooked a lot in my experience. Let's see how it plays out!

On PTSB I hear you - they must have felt there would be enough bidders to get sufficient value for jam tomorrow. Of course the State was keen to sell too... Interesting to see that Bankinter officially ruled themselves out today.

Also, did write a long comment on PTSB but lost it. Basically, still don't understand the formal sales process at this stage in the bank's journey. Returns will surely improve (like, a lot) and it's hard to see any acquirer paying a price that is better for shareholders than just holding on as the bank's earnings get better. There is/was big scope for buybacks and other capital returns at the current share price, too.

Still doesn't make sense to me, at all.