Financials Unshackled Going Deep - Is A New Paradigm for Bank Returns Emerging? - Lloyds in Focus (Edition 1, Issue 2)

The independent voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice and is for informational and educational purposes only - please scroll to the end of this publication for the full Disclaimer

Welcome to Financials Unshackled ‘Going Deep’. There are now three distinct weekly Financials Unshackled ‘In-Depth’ Briefings: one on UK banking developments and perspectives, one on Ireland (and Europe) banking developments / perspectives, and a ‘Going Deep’ note on topical items (of a broad variety) Substack. Please email me at john.cronin@seapointinisghts.com (or just reply to this post if reading on email) if you want to be added to the distribution list for the UK and Ireland (and Europe) briefings. Last Sunday’s UK and Ireland (and Europe) notes can be accessed here and here and I’ll have a new website for that content shortly. This ‘Going Deep’ note will stay on Substack.

What’s In this Note?

The focus of this note is on how a new wave of initiatives is necessary to ensure that medium-return expectations for UK banks are sustainable in the long-term - and acknowledging that ‘the invisible hand’ can serve to cap returns to the extent that a significant number of players in a sector are consistently delivering attractive numbers. Lloyds Banking Group (LLOY) is a particular focus in this post following its FY25 results update today and the Digital & AI initiatives it is pursuing - with more detail to follow at its strategy refresh in July.

Lloyds in focus

Lloyds Banking Group (LLOY) kicked off the FY25 UK bank earnings season today

LLOY was first out of the traps this morning, publishing its Preliminary Results for FY25. The market has responded favourably to a: i) 1.9% pre-provision operating profit beat (versus company-compiled consensus of 15th Jan 2026); ii) improved guidance for FY26; iii) news that the company will consider excess capital distribution every six months going forward instead of just once per annum (though this had been largely expected); and iv) perhaps, most importantly, the sentiments conveyed by management on the earnings call in relation to the evolving returns profile - particularly owing to Digital & AI initiatives (though, purposefully at this point, without much quantitative detail).

FY26 return on tangible equity guidance was upgraded

LLOY upgraded its target FY26 RoTE to >16% from >15%. While this was not particularly surprising (pre-results consensus was already at 16.1% - and that embeds a £254m remediation charge in FY26 too), the confidence expressed on the earnings call in relation to the returns trajectory from here (with much focus on its confidence in generating both revenue and cost efficiencies to drive down CIR over time, albeit without quantitative detail at this juncture) points to an emerging higher returns profile into the medium to longer-term. Indeed, consensus FY28 RoTE prior to the results was already at 18.0% and while that might nudge up marginally over the coming days, one senses that the next strategic update in July will seek to reinforce management’s conviction in a structurally sustainable high-teens plus returns profile for the longer-term - that might well mean upside to the FY28 consensus for 18.0% I suspect (while maintaining a healthy level of conservatism within guidance) but, more importantly, that those kind of (or better) returns can be achieved beyond the 2020’s.

LLOY is effectively playing catch-up with NatWest Group (NWG) at one level

LLOY and NWG are two peer listed banks that are often compared given their UK-centric focus. NWG, as a very well-run business at multiple levels and, particularly, in a cost efficiency context versus peers, has laid down the gauntlet in terms of returns generation in recent years - churning out a RoTE>17% in FY23 and FY24 for example, with consensus expectations (based on NWG’s latest company-compiled consensus of 22nd January) for RoTE of 18.5% in FY25 and to remain above 18% through FY26-28*. HSBC UK, as a subsidiary of the parent internationally-focused group, receives less attention but it also reports chunky returns - in the order of 20.2% for FY24, for example. Other large domestic-focused players’ returns profiles lag NWG’s considerably.

** While the purpose of this note is not to get into a disaggregation of the differences between LLOY and NWG, it is worth remarking that remediation costs, underlying operating cost efficiency, risk-weighted assets density, liquidity profiles, and interest expense variations appear notable.

What supports the expected (consensus view) RoTE expansion for LLOY?

Without getting into an elaborate dissection, three factors in particular are noteworthy.

Firstly, the expected significant structural drop-off in remediation costs following LLOY’s booking of an £800m provision in 3Q25 related to the FCA’s intended motor finance redress scheme.

Secondly, LLOY’s structural hedge income tailwind is building. Structural hedging income increased by £1.3bn in FY25 (to £5.5bn) and, importantly, is expected to grow by c.£1.5bn in FY26 and c.£1.0bn in FY27 “with earnings growth from the structural hedge expected to continue thereafter” - a stronger proportional uplift than for peer banks for FY26. Furthermore, it is notable that LLOY extended the weighted average life of its hedge further in 4Q25 (to c.3.75 years from c.3.5 years at end-3Q25), which implies an income tailwind that has longevity, suggesting that, as things currently stand, the growth and proportionality of its income attributable to structural hedging will eclipse that of select key peers.

Thirdly (and interrelated with the above points), is a lower CIR (Cost/Income ratio) driven by a widening jaws - with consensus modelling a compound annual growth rate (CAGR) in revenues of 7.5% from FY25-FY28 and just a 2.4% costs CAGR (excl. the £800m motor finance provision taken in 3Q25). Interestingly, consensus is also modelling a 2.4% FY25-28 total costs CAGR for NWG but a revenue CAGR for the same period of 4.8%, well below LLOY - with the growth in income from LLOY’s structural hedging a key underpin for its faster expected income growth profile. While it is impossible to disaggregate within consensus costs the degree of cost growth containment that is attributable to Digital & AI initiatives relative to broader investment spend / BAU efficiency capture, a cursory glance at how consensus cost expectations have evolved over the last 12 months indicates that consensus is, understandably, not baking in much benefit from the more recently announced agentic AI and related initiatives at this stage.

Consensus expectations are for strong returns out to FY28 - growing nicely in LLOY’s case

Provided rate expectations and the economic outlook remain broadly stable from here, the medium-term returns outlook remains undeniably strong, as reflected in analyst consensus earnings and returns expectations across the sector. Momentum is favourable - and particularly for LLOY (provided there are no negative surprises from the FCA in the Spring in the context of the impending motor finance redress scheme). This assessment reflects modest loan and deposits growth, net interest income growth to varying extents attributable to structural hedging income growth and loan/deposit growth factors offsetting headwinds like refinancing margins, other income growth (and standing ready to capture some of any reallocation of deposits towards investment product), well-managed operating costs whilst maintaining sufficient investment spend, and benign asset quality - as well as assuming a continued reasonably supportive political and regulatory backdrop.

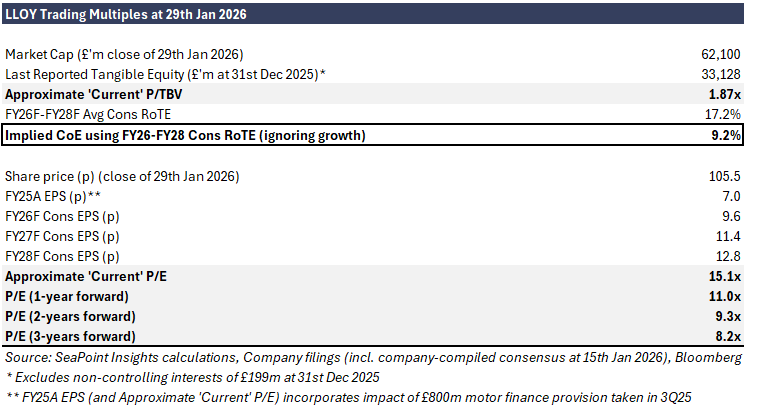

Of course there are many risks too - geopolitical shocks / a higher-than-expected rise in unemployment / a change in the PM or Chancellor all affecting the rate backdrop and the economic outlook, further remediation costs, investment spend requirements that turn out to be much higher-than-expected, etc. (I’m not setting out an exhaustive list by any means). But, all things considered, the consensus view is for a strengthening returns profile. Indeed, the market appears to have factored in this significant expected upside as well as the below simplified analysis of LLOY’s trading multiples and implied cost of equity (CoE) excl. growth attests to:

One could argue that, on these consensus numbers CoE does not have much further room to reduce. However, two key points here are: i) the market view and the consensus view on earnings / returns can differ - sometimes quite significantly; and ii) further delivery by management (from a growth, an efficiencies, a capital optimisation, a shareholder distributions, etc., etc., standpoint) can help support a reduced perception of risk and therefore a lower required return for investing (CoE) in the bank. It is also important to note that investors think further out than three years - so, the simplified (ignoring growth) CoE presented above is only one of many ways to look at what the market’s view on the required return for investing in LLOY is (and, to repeat, it is based on analyst consensus estimates, which may or may not be a fair reflection of the market’s view in those particular years).

But some of these tailwinds won’t last forever

As I have discussed in previous posts, assuming swap rates remain broadly stable, the tailwinds from structural hedging will eventually evaporate. That said, in that eventuality, the UK banks - operating in, say, a c.3.5% bank base rate environment, will still benefit from a naturally higher income profile than they do today, which is potentially conducive to consistently strong returns. That is because those who engage in structural hedging are still underearning relative to what they should be today, exemplified by the pay rate on the maturing swaps, i.e., to put it simply, some of their current income has been deferred to a future date. This is particularly evident in LLOY’s case - with the longer WAL intensifying this, meaning more income in outer years. But to keep a strong revenue growth engine alive - and to ensure a stable or declining CIR (and, therefore, to sustain a high-teens type RoTE) - banks likely need to think about other levers they can pull in the medium to longer-term.

Stepping back - are we entering a structurally sustainably higher returns paradigm? Enter AI

While medium-term growth momentum is favourable across the sector - and particularly for LLOY as explored above - the longer-term is a different question assuming the present day income tailwinds from structural hedging activities eventually taper. So, we are increasingly seeing management teams take action to position for structurally sustainable high returns - and high teens plus in the case of LLOY and NWG at least.

LLOY delivered an in-depth presentation on its Digital & AI capabilities in early November, which pointed to prospective meaningful revenue and cost efficiencies. I remarked here on 9th November that it appeared to me that: “i) LLOY is ‘ahead of the game’ in an AI development context relative to UK peer banks; and ii) this is likely to lead to opportunities for revenue enhancement (disintermediation, personalisation / product customisation, cross-selling) and efficiency capture which could be highly material in time (fundamentally this will spring from higher quality customer relationships and rich data access). It didn’t come up on Thursday but I would also add that enhanced product customisation and risk profiling ought to be conducive to a below-market impairment rate across the lending segments. All that being said, one should not underestimate the ability of LLOY’s well-resourced large bank peers to catch up / demonstrate strong innovation in this vein too.”.

Indeed, just to elaborate on that last point I made in the above reproduced quote around not underestimating competitors, NWG hosted an Investor Spotlight session on Retail Banking specifically on 25th November, which was division-specific but broader in focus - highlighting the many opportunities for Retail Banking growth, the interconnections between the Retail Banking division and the PBWM and C&I divisions and how management is seeking to drive improved cross-pollination across the group, how NWG is driving operating efficiencies and leveraging its AI investments to strengthen the customer proposition and achieve cost reduction, and divisional (and group) management’s intense focus on unit economics (much discussion on divisional and product RoEs, for instance) and future capital optimisation actions.

We got a little more today from LLOY, with management noting that its c.50 major live Gen AI use cases delivered c.£50m of value in FY25 “as we built the foundations of our capabilities” - going on to note that over £100m of incremental P&L benefit (management is clear that this is both revenue and cost-related) “as we start to scale the foundations”. One senses that this is just a bellytickle ahead of a far more detailed update on expected benefits over the coming years (including the potential internationalisation opportunity, perhaps) which will likely, in my view, support pretty chunky (yet somewhat conservative from management’s perspective I suspect) returns targets. Indeed, the CEO also spoke on the earnings call this morning about how agentic AI will allow LLOY become more efficient and can support a differentiated service proposition: “we are very ambitious on this and very confident we have the right talent”.

While one can see LLOY generate meaningful incremental benefits from things like further RWA optimisation, commercial loan growth, improved capital efficiency, etc., to me, the big picture question is whether LLOY, as it positions for the next wave through its focused Digital & AI initiatives, can: i) continue to be capable of generating a high teens plus sustainable RoTEs in a post-structural hedging income tailwinds world; and ii) more importantly (see more below), develop something of a competitive advantage relative to peers from a returns capability perspective.

Everything matters but it seems to me that the strategic success of the Digital & AI initiatives - given their wide potential influence from a revenue, an operating costs, an asset quality*, and, possibly, both a liquidity and a capital management perspective - are likely to be what can most meaningfully structurally ‘move the dial’ from a returns perspective in the longer-term (that lies within management’s control to an extent), I think. It’s early days and it seems to me that most investors are unlikely to currently ascribe material value to the revenue benefits and cost efficiencies that LLOY can procure through these efforts (understandably) - but, if management start delivering beyond today’s taster, then that can change. Of course, it’s notoriously difficult to disaggregate the benefits and management needs to rely on a degree of estimation here - but, all else being equal in terms of rate / economic conditions et al., if one can observe a structural improvement in the CIR, and therefore, returns profile (beyond what consensus is modelling today) then the market will notice.

* It didn’t come up at LLOY’s 6th November session but I would also add that ensuing enhanced product customisation and risk profiling ought to be conducive to a below-market impairment rate across the lending segments.

Last but not least, I have written recently about the dangers of assuming ever-higher sustainable returns on equity more broadly - as governments particularly in a downturn, will find ways to ‘curb the excess’. But where there is significant variability in returns amongst the players in a specific market, that becomes trickier (though not impossible when one imagines profit tiering measures). That is why LLOY’s Digital & AI initiatives (which appear to be ahead of the pack to a certain extent - albeit there is an element of ‘catch-up’ at play too in terms of the cost profile, etc.) look interesting to me and I will delve into them in considerable depth in a future post (probably after we get some more information in the July Strategic Update) to seek to explore the extent to which they could indeed procure strategic sustainable returns advantage.

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.