Financials Unshackled: What Now for Santander UK?

Financials Unshackled Issue 31 exploring latest 'developments' in a Santander UK context, potential suitors that might pounce & why and how it all might play out

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Issue 31 of Financials Unshackled. This is an in-depth note on Santander UK following recent press reports to the effect that Santander Group might exit retail and commercial banking in the UK. I hope it is useful to some of you. I will publish further ‘Going Deep’ notes on other topics with a degree of regularity going forward - I have a long list of ideas in relation to potential topics but please feel free to email me with any suggestions at john.cronin@seapointinsights.com

What is Santander UK?

Stepping back, let’s have a quick look at what Santander UK is first.

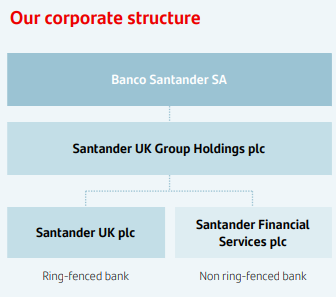

Santander UK Group Holdings plc is the UK holding company which is 100% owned by the parent, Banco Santander SA (SAN). Santander UK Group Holdings plc, in turn, owns 100% of the issued share capital in Santander UK plc (the ringfenced bank) and Santander Financial Services plc (the non-ringfenced bank) as the chart below, extracted from the Santander UK Group Holdings plc FY23 Annual Report attests to.

In this discussion I will focus on Santander UK Group Holdings plc. I appreciate the simplicity of this assumption in the context of a sale process - but there would likely be some intra-group restructuring carried out ahead of a completed transaction in any event. Anyway, the differences between what sits in the two entities in terms of net loans and deposits are not enormous and I’m not going to get ‘hung up on’ that level of precision for the purposes of this early broad discussion. Furthermore, Santander UK Group Holdings plc (hereinafter referred to as SAN UK) files quarterly accounts while Santander UK plc files just annual and half-yearly accounts so SAN UK’s latest accounts are more recent.

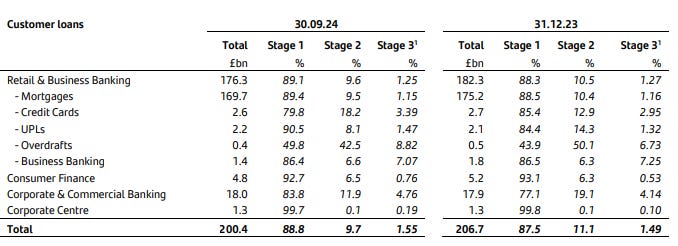

SAN UK is primarily a retail and commercial bank with the overwhelming majority of its assets and its liabilities in the UK. It is in fact heavily weighted towards UK mortgages as its 3Q24 accounts highlight. At 30th September 2024 SAN UK reported net loans of £200.4bn - comprising mortgages of £169.7bn (85%), and Corporate & Commercial Banking exposures of £18.0bn (9%) in the main (more detail in the table extracted from the 3Q24 accounts below) - and customer deposits of £185.7bn.

SAN UK reported tangible equity of £10.85bn at 30th June 2024.

SAN UK is carrying a substantial excess capital position and reported an end-3Q24 CET1 capital ratio of 15.4%, +20bbps q/q despite the £295m motor finance commission-related provision taken in the quarter. In any valuation assessment a prospective acquirer would normally recalibrate expected returns on tangible equity (RoTEs) assuming an optimised capital base (depending on expected minimum capital requirements and buffers under their ownership). Indeed, SAN could extract excess capital through an inter-company dividend ahead of the completion of any transaction.

9M24 RoTE was 8.7%, weighed down by surplus equity and (non-recurring…) provisions. Reported RoTE printed at 14.4% for FY23 and at 12.0% for FY22 (both of which were also weighed down by surplus capital).

As an aside, I noted the following in my write-up on the 3Q24 results in Financials Unshackled Issue 21 here: “I would also add that, in the absence of a desire to significantly push up wholesale funding issuance / parental funding dependence, given its LDR [of 108%], Santander UK will likely either have to start growing its UK customer deposit base [which shrunk materially by £7.9bn in 9M24] and/or run down the size of its UK loan book at a faster clip (could a portfolio sale(s) be on the cards in early 2025 perhaps?) given required FY25 TFSME repayments [£13.0bn of TFSME outstanding at 30th September] (though, with that said, the Board may be comfortable running with a higher LDR given readily available funding).”.

We will get more up-to-date financial information when SAN reports its results on Wednesday 5th February.

Recap of latest developments

By way of a quick recap, the FT reported here on Saturday 18th January that SAN is exploring a number of strategic options, one of which is exiting the UK market, according to people familiar with the matter - who also added that no deal is imminent and that the review is at an early stage. Frustrations with high costs, the onerous ringfencing regime, its independent Board (indeed, we learned that the Chairman is leaving yesterday), and the fact that it did not capture as much benefit in the UK as it did in other markets from rising interest rates are said to be behind the decision to contemplate options. The article went on to note that the “people familiar with the matter” noted that, even if SAN did elect to retreat from retail and commercial banking in the UK, it would retain its corporate and investment banking presence.

SAN issued a statement on Sunday 19th January noting that “The UK is a core market for Santander and this has not changed”.

A Reuters news report here on Sunday 19th January provided some further colour as follows: i) a source noted that SAN’s decision to review its presence in the UK is part of a regular assessment of its major businesses, which could result in a variety of outcomes; and ii) Barclays (BARC) reportedly approached SAN about a possible offer for its UK business in 2024 but the approach did not proceed due to a disagreement on price.

The Guardian reported here on Monday 20th January that the CEO of Santander UK’s corporate and commercial bank “rushed out” a memo to senior managers outlining how to respond to clients and staff in the context of the press surrounding a potential exit. The memo reportedly notes that the scripted messages that senior managers should relay are: i) SAN executives “review strategic priorities in all our markets annually. This is part of business as usual”; ii) “The UK is a core market for Santander. This has not changed. We remain focused on delivering our strategic priorities and continuing to serve our 14 million customers in the UK.”.

SAN’s Executive Chair, Ana Botin, went a step further at Davos with Reuters reporting here that Botin said “We love the UK, it is a core market and will remain a core market for Santander. Punto, that’s it” when asked if the bank would see its UK business.

A perspective on the situation

For what it’s worth my own perspectives on the developments are:

SAN is clearly reviewing its strategic options in respect of its retail and commercial banking businesses in the UK. That has not been denied. The Executive Chair can speak of her love for the UK all she likes and flag that it remains a core market - but that doesn’t shut down any options and the potential sale of the retail and commercial business has categorically not been ruled out.

Assuming the Reuters report around discussions with BARC is accurate (and there has been no rebuttal to my knowledge) then it shows that SAN was willing to entertain discussions with a potential bidder. After all, everything has a price so it’s not surprising.

SAN is clearly fed up with the cost of business in the UK, the regulatory regime, and the challenges in driving substantive net interest margin (NIM) accretion in the higher rate backdrop (HMT and FCA tapered the banks’ ability to maintain low deposit betas as rates grew - and it is a highly competitive market in any event in which deposit customers demonstrate strong proclivity to move, supported by the well-established government-sponsored Current Account Switching service (CASS)) - as reported in the FT article. The raw reality is that the group has repeatedly failed to make it work - it had universal bank ambitions but is really just a mortgage lending business in earnest.

It was an opportune time for these messages to circulate - right before Davos when Labour is pushing a strong growth message and, seemingly, doing all that it can to foster an environment of looser regulation in the UK. In particular, adding the ringfencing regime to the discussion would have merit from SAN’s perspective. Now, of course, the FT piece (and the subsequent Reuters article) referred to above may have emerged from people just talking out of turn rather than a leak by the company or its advisers - you’ll have your own view on that. But the point is, getting these messages out serves a few purposes: i) smokes out other potential suitors on an informal basis to gauge whether or not there is sufficient appetite to potentially acquire the business (or parts thereof) within acceptable valuation parameters before deciding to launch a formal sale process; ii) acts as a further nudge (to put it mildly) for government to push regulators to loosen the rulebook as well as to ‘leave things alone’ from a deposit pricing perspective (I have recently opined that I don’t think we will see further interventions from Treasury - or, indeed the FCA in a consumer duty context - to the extent that deposit pricing remains coms right down as rates travel back down); and iii) while it would be an enormous ‘leap of faith’ to suggest that this particular ‘development’ could weigh on Supreme Court judges in the context of the impending motor finance appeal hearing (or indeed on the Supreme Court’s impending decision as to whether or not to grant Treasury permission to intervene), it potentially could have some influence at the margin I guess and there seems to be no downside (in this respect) to have these messages ‘out there’. The main points I am trying to make here are i) and ii).

With all that said, taking a more cynical view, one could argue that these messages (lambasting the UK market backdrop) are hardly conducive to bidders stumping up a big price unless it becomes a highly competitive process.

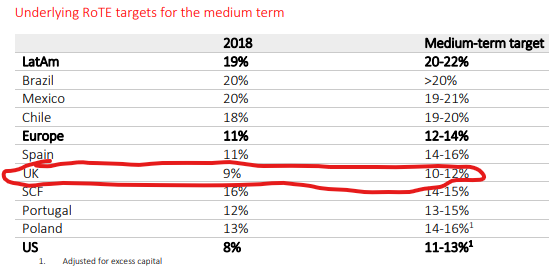

Moreover, it has been widely speculated in industry circles since pre-Covid times that SAN could cut the chord with its UK retail and (skeleton) commercial business at some point but valuation was always likely to be a challenge. UK profitability was always an issue and SAN UK has been a clear laggard in terms of returns delivery relative to other markets in which SAN operates (despite it serving to act as something of a counterbalance to emerging markets exposures). Indeed, at a digital transformation and growth-focused Investor Day in London on 3rd April 2019 (press release here), SAN noted that: “Santander UK’s priorities are increasing profitability through improving the customer experience and enhancing efficiency by simplifying, digitalising and automating the bank. We expect Santander UK to deliver an underlying RoTE of 10-12% in the medium term, after reaching 9% in 2018.”. For context the then group medium-term underlying return on tangible equity (RoTE) target was reaffirmed at 13-15% that very day and, as demonstrated in the table below (extracted from the aforementioned press release), the UK was ‘worst of the pack’ in terms of RoTE targets, dragging down the group’s returns capability. Indeed, no new growth initiatives were called out in a UK-specific context at that session.

So, will they sell?

As articulated above, it seems pretty clear to me that SAN will entertain exploratory discussions with prospective suitors at the very least. Assuming price expectations are somewhat realistic (more later in this note on this), then I suspect the most likely direction of travel is the launch of a formal sale process. Whether that culminates in a transaction in due course (or the sale of portfolios) remains to be seen. It would be a complex transaction to execute in the case of an outright acquisition of the bank (the Santander UK Group Holdings plc entity presumably). There is a significant possibility that SAN divests of portfolios on a piecemeal basis though that is cumbersome and, potentially, even more complex. In any event it is unlikely to move quickly - in my view no deal will be struck ahead of the Supreme Court appeal hearing in the context of the motor finance debacle, for instance. Indeed, processes like this can easily take more than a year.

Who are the likely suitors?

In overall terms, it appears to me that there is a rather limited prospective universe of buyers for this business (unless management elected to dispose of select loan portfolios, including some but not all of the mortgage portfolio - though I suspect that would not be the ‘base case’ plan). This section sets out my thoughts on the universe of possible suitors and is supplemented by a table in the next section that focuses on key metrics were one of the ‘likely bidders’ (in my view) to acquire SAN UK, zoning in on mortgage stock market share implications.

Domestic Potential Acquirers

There just a few potential ‘in-market’ acquirers who have the capacity to complete a transaction of this size - i.e., BARC, Lloyds (LLOY), HSBC (HSBA), Nationwide Building Society, and NatWest Group (NWG). While Coventry Building Society has also been touted in the media as a potential buyer I don’t think that its Board would seriously contemplate taking on a lender that is almost three times its size in terms of the loan book (for context, Coventry Building Society and Co-op Bank’s combined net loans came in just shy of £72bn at end-1H24) - not to mention the fact that management has its work cut out to ensure that the transformational Co-op Bank acquisition integrates well (despite the fact that Co-op Bank is run as a separate subsidiary). For the sake of completeness, an acquisition of SAN UK by Standard Chartered (STAN), while doable, would be entirely incongruent with the emerging markets-focused lender’s strategy.

There is strategic congruence from a BARC, LLOY, HSBA, Nationwide, and NWG perspective given lending markets overlap (and ability to fill in share gaps in certain cases). However, for LLOY, the implications for outstanding mortgage stock share would likely be a key obstacle. I think it is very unlikely that Nationwide would be prepared to do a deal given it is set to be focused intensively on integrating Virgin Money UK over the coming years.

BARC and NWG are underrepresented in certain retail (particularly) lending segments in the UK (see table below) and the acquisition of SAN UK would fill in some of those gaps.

HSBA appears more focused on orienting towards China / Asia than on building out its developed markets presence but, with that said, I wouldn’t see yesterday’s news to the effect that HSBA is downsizing its investment banking activities in Europe and the US as reflective of a reduced appetite more broadly in those jurisdictions) though I suspect that it would examine the potential acquisition with that said - indeed, management has spoken of its ambitions for the UK again in recent times. However, it would be quite transformational and would be a double-down bet on the UK as if it ever had a change of heart it would, most likely, be harder to sell the enlarged entity.

Foreign Potential Acquirers

It is possible that an overseas suitor swoops. However, it doesn’t appear especially likely in my view given the inability of these suitors to capture meaningful synergies (as things currently stand at least). Who could pounce?

Some have mentioned J.P.Morgan (JPM) to me in this context given the bank is developing a retail lending proposition in the UK, i.e., Chase UK. I respectfully disagree. I believe that the whole ethos underpinning Chase in the UK and Europe is to play the digital banks at their own game - a blueprint in the UK that can be rolled out across multiple jurisdictions if successful (indeed, The Wall Street Journal reported here on 14th January that JPM plans to launch Chase in Germany, another large population centre, in late 2025 or early 2026). A traditional neobank as it were with the strategic and financial muscle to make it work with a long-term view. Acquiring a traditional heavily ‘bricks and mortar’-focused institution (SAN UK had 444 branches in the UK at end-2023) with its own legacy systems would be entirely inconsistent with the strategy that JPM is pursuing more broadly with Chase in my view.

Other overseas banks who are present in the UK retail lending market like Sabadell (TSB), BBVA (Atom Bank shareholding), Marcus (Goldman Sachs), Handelsbanken, State Bank of India are highly unlikely to have an interest in my view. Sabadell has tried to sell TSB in recent years and BBVA is considered likely to divest of TSB should its pursuit of Sabadell succeed, Goldman has reversed gear on its foray into retail, it would be a massively transformational acquisition from Handelsbanken’s perspective which hardly seems likely (its market cap is c.£17bn), and, while State Bank of India would have the capacity it seems (market cap >£55bn), an acquisition of this scale would appear to be inconsistent with the pace of international expansion envisaged by its management team (an interesting read on this topic can be found in a Business Standard article from 25th November last here).

It is of course possible that an unexpected suitor comes into the fray - for example, like a bank like Unicredit that has cross-border expansionary ambitions (albeit strategic). But where are the synergies and what would be the long-term play? Indeed, a recent poll I ran on LinkedIn here showed that just 14% of the 125 voters thought it likely that SAN UK would be acquired by an overseas bank (if a sale process is run) and my own sense is that the probability of that happening is probably closer to 5% or less. In any event, Botin and her aides will probably find out pretty soon if there is any genuine interest amongst international prospective acquirers.

Private Equity

The history of Private Equity (PE) ownership of banks in the UK is limited. Banks are already highly leveraged entities so PE struggles to bring the re-leveraging angle to bear. Additionally, PE tends to disfavour banks of anything close to this scale - and highly regulated businesses more broadly. And, maybe it’s just me, but I struggle to see significant angles for SAN UK to eke out material fresh growth opportunities in the UK market on an organic basis within an acceptable timeframe. PE has tended to pluck for specialist lenders in the main (e.g., United Trust Bank, Shawbrook, OSB Group historically) and I would be very surprised to see PE bidders in the mix for SAN UK. It’s far more likely that PE would ‘run the rule’ over specialist firms with a high implied cost of equity - like an OSB Group, for example - or a high returns specialist bank like a Shawbrook to the extent that the owners’ price expectations are not unreasonable, for example.

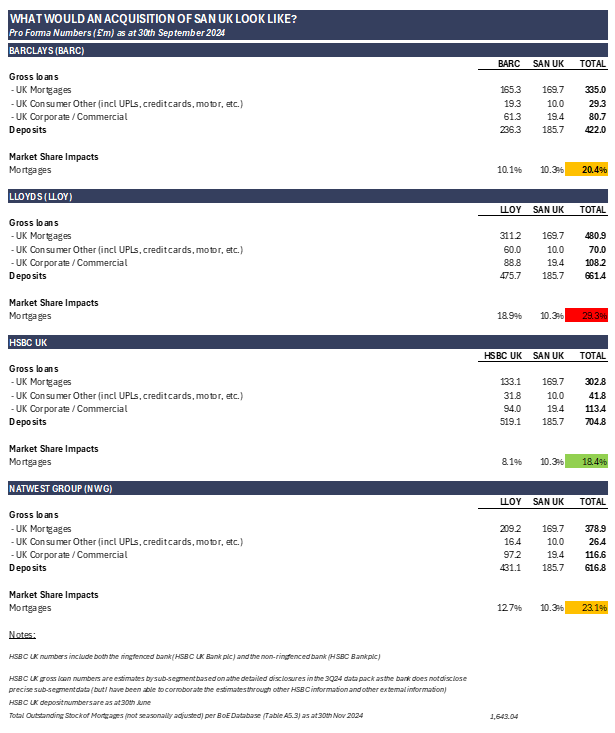

What would an acquisition mean for prospective bidders’ balance sheets?

The high-level table below (based on published company data) shows what the combined size of the loan books and the deposit books would look like were one of the most likely bidders (in my view) to acquire SAN UK. It also computes overall implied combined mortgage stock share (using latest available data) as this would be the key battleground from a competition clearance perspective for certain potential bidders.

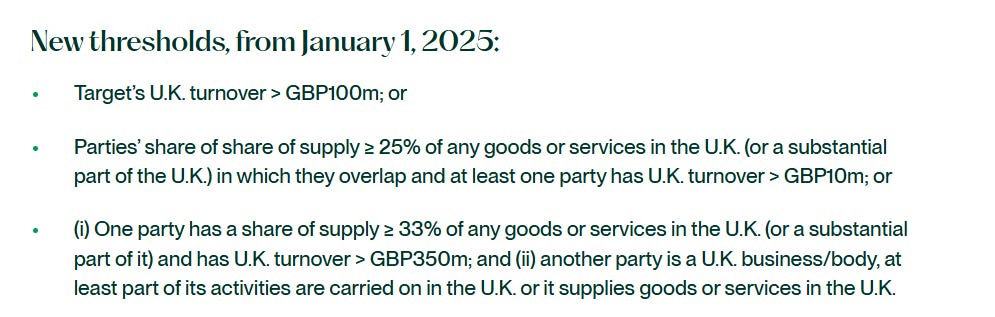

It is important to note that the UK Competition and Markets Authority (CMA) is the relevant body that reviews potential competition issues in mergers. New merger control thresholds were introduced on 1st January, as shown below (extracted from a useful note penned by the legal firm, A&O Shearman, here):

While I’m not a competition lawyer, the typical ‘rule of thumb’ is that a post-transaction market share of 25% or more (stock share more important than flow share here in my understanding - though flow share would be taken into consideration too I suspect) would guarantee a Phase 1 Review. The definition of the market is what is all-important here. On deposits, none of the prospective ‘in-market acquirers’ included in the table above would command a 25% share of the outstanding stock of UK deposits on my estimates. However, in mortgages (the likely key battleground from a competition clearance standpoint as noted above) LLOY would clearly command a 29% share of the overall market. Indeed, the mortgage market could be examined by the CMA at various levels - while it is a national market (with most significant lenders serving the entire UK, a function of the heavy degree of intermediation as well as the online nature of the mortgage originations process) it is likely, in my view, that the CMA will still do granular analysis on sub-segments including residential mortgages versus buy-to-let at the very least (it’s worth having a read of the CMA’s decision on the OSB Group / Charter Court Financial Services tie-up that was published on 30th July 2019 here if you want to get a sense of how the CMA has thought about the mortgage market in the past).

The bottom line here is that it appears likely that LLOY would run into market share challenges if it were to acquire SAN UK and NWG (and, BARC, to an extent could also face a Phase 1 Review given that their post-acquisition mortgage market shares would be encroaching that 25% mark. However, two further points are: i) these issues might not be insurmountable - SAN could dispose of portfolios piecemeal or, perhaps more desirably from SAN’s perspective, a bidder could be required to earmark certain portfolios (within either its own portfolio and/or the acquired portfolio) for disposal and line up bidders for those portfolios (all of which could potentially be agreed in principle as a satisfactory remedy with the CMA I suspect); and ii) the new government has been remarkably supportive of the banking sector (and the large bank executives have been sensibly playing up to this with warm speeches at Davos and the like) and, given the recently announced shake-up at the helm of the CMA, there is an outside possibility that the new guard at the CMA could be more forthcoming in terms of waving through mergers (ok, maybe not in the case of LLOY in this particular situation) with the objective of having stronger domestic UK-committed banks in mind (despite the damning findings of the final report on the UK retail banking market of 2016 here).

What about price?

The key question for SAN is what price it can fetch for its SAN UK business

If we crudely assume that a trade acquirer would seek to capitalise the business more thinly - at, say, a CET1 capital ratio of 13% (end-3Q24 print was 15.4%) that would imply an adjusted 9M24 RoTE of 10.3% (vs. the actual 8.7% print), which is also weighed down by provision charges. Let’s call it a 12% RoTE business for simplicity for now (I’ll do more granular work on the numbers post-FY24 results).

I’m not going to seek to value SAN UK in this note but here are some benchmarks:

BARC is currently trading at c.0.80x FY24F TNAV for a FY24F RoTE of 9.5%, gliding to 11.3% for FY26F (using company-compiled consensus data as at 11th October though the consensus view on RoTE evolution is likely to have improved a bit since then).

LLOY is currently trading at c.1.14x FY24F TNAV for a FY24F RoTE of 12.6%, gliding to 14.2% for FY26F (using company-compiled consensus data as at 24th January).

NWG is currently trading at c.1.32x FY24F TNAV for a FY24F RoTE of 16.0%, gliding to 16.2% for FY26F (using company-compiled consensus data as at 21st January).

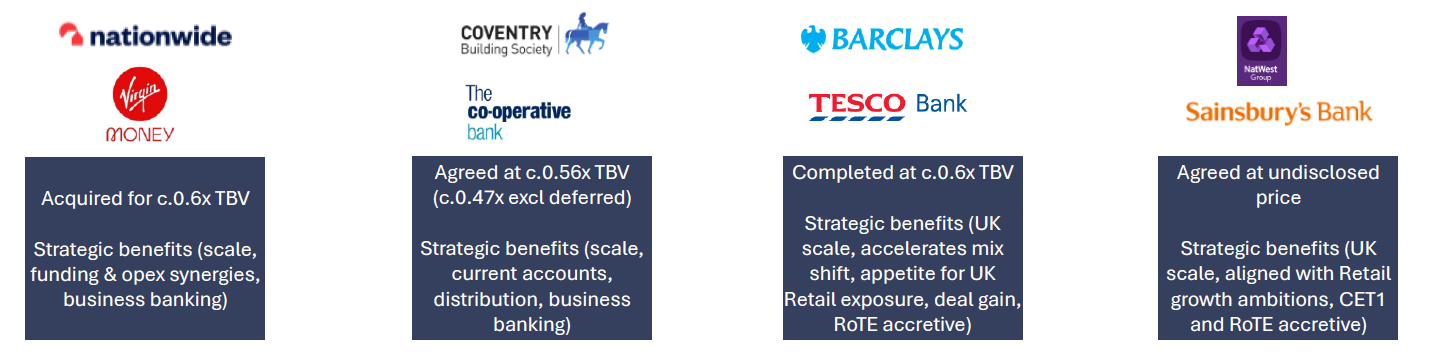

So, on average (using average consensus RoTEs over the three-year period FY24-26), the implied cost of equity (simplistically ignoring growth) for investing in these names is broadly in the region of 12.5% (BARC c.13.1%, LLOY c.11.8%, NWG c.12.4%). It’s not a precise science - I think the market has a slightly more bullish view on LLOY’s RoTE trajectory than consensus does, by way of an example. But, running with this number and applying it to SAN UK - and running with the argument that it’s a c.12% RoTE business means that SAN could theoretically get out at book value (i.e., c.1.0x TNAV). However, it is a sub-scale and monoline franchise relative to BARC, LLOY, and NWG. Indeed, given the multiples at which BARC is trading it realistically would have to strike a deal below book value in order for the transaction to be eps-accretive on a pre-synergies basis. The excerpt below from a recent presentation that I prepared illustrates the thin multiples at which a few select bank / portfolio acquisitions have been executed in the UK banking market in recent times (albeit all these businesses have different characteristics and all are different to SAN UK - so, it’s just an illustration). The point is that precedent transactions show that the domestic players only tend to acquire opportunistically at far lower multiples of book than 1x.

Furthermore, an acquisition of SAN UK would not be straightforward. Systems integration (to the extent that an acquirer wanted to integrate the business), for example, would be complicated and costly to say the least.

Counter-arguments here could be that SAN UK’s mortgage bias should be conducive to better returns under different ownership (given the typically high-RoTE nature of mortgages) and that a domestic acquirer should capture funding and cost synergies as well as strategic benefits in cases (for example, in the case of BARC it would accelerate the growth in the proportionality of the non-Investment Banking businesses).

All in all, I think it would be a stretch - as things stand today - to assume that SAN could get out at 1x TNAV. I will conduct more granular analysis on RoTE and RoTE evolution post-results but that’s my snapshot view for now assuming that acquirers look at it as a 12% RoTE business and are unprepared to pay for synergies. To the extent that price expectations are higher, it’s unlikely we will see a transaction. But, for the group, the UK has been an underperforming business for some time so it is incumbent on the SAN Board to consider whether it can drive improved group returns by reallocating capital elsewhere (or, indeed, giving it back to shareholders) - even if that means selling at below tangible book value.

Disclaimer

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.